Washington Partnership Agreement for LLC

Description

How to fill out Partnership Agreement For LLC?

Are you presently in a situation where you require documentation for various business or personal purposes nearly every day.

There are numerous legal document templates accessible online, yet discovering trustworthy versions can be challenging.

US Legal Forms offers thousands of form templates, including the Washington Partnership Agreement for LLC, which can be printed to satisfy federal and state regulations.

Select your preferred pricing plan, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all of the document templates you have purchased in the My documents menu. You can download an additional copy of the Washington Partnership Agreement for LLC at any time if needed. Just select the desired form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Washington Partnership Agreement for LLC template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

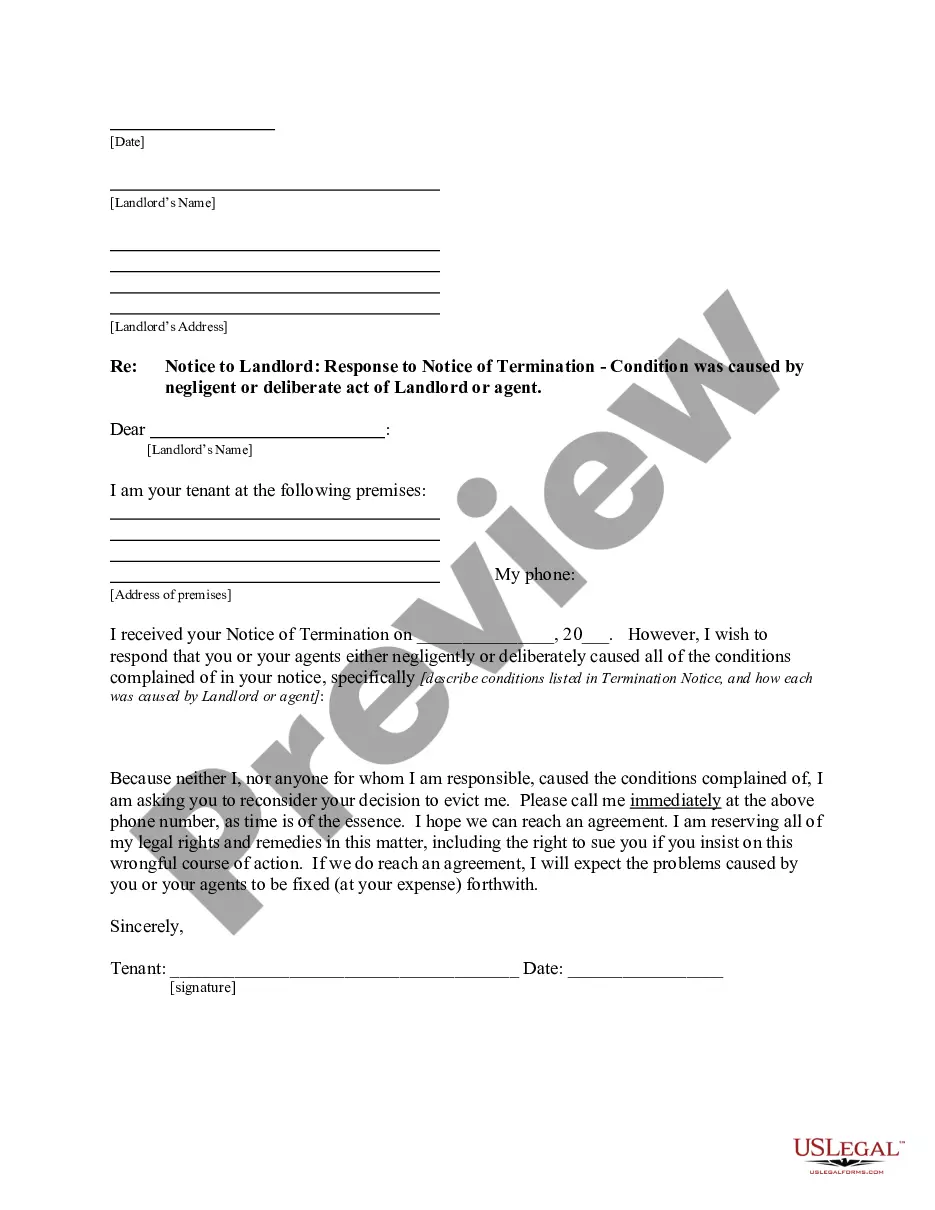

- Utilize the Review button to inspect the form.

- Examine the description to confirm that you have selected the correct form.

- If the form isn't what you are looking for, use the Search section to locate the form that meets your needs and requirements.

- When you find the right form, simply click Purchase now.

Form popularity

FAQ

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Steps to Create a Washington General PartnershipDetermine if you should start a general partnership.Choose a business name.File a DBA name (if needed)Draft and sign partnership agreement.Obtain licenses, permits, and clearances.Get an Employer Identification Number (EIN)Get Washington state tax identification numbers.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

A Washington LLC operating agreement is a legal document that is used by managing members/owners of companies to negotiate and form the policies and procedures of their company. The State of Washington does not require that any company file this document.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Washington does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

A Limited Liability Company is a legal entity all its own, while a partnership is owned by two or more people who share legal responsibility of the business entity. In a partnership, the business does not possess a legal identity outside of the business owners.

An LLC partnership agreement (also called an LLC Operating Agreement) lays the ground rules for operating a Limited Liability Company and protects the legal rights of its owners (called members). It's written by the LLC's members and describes the plans and provisions for the company.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.