Washington Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

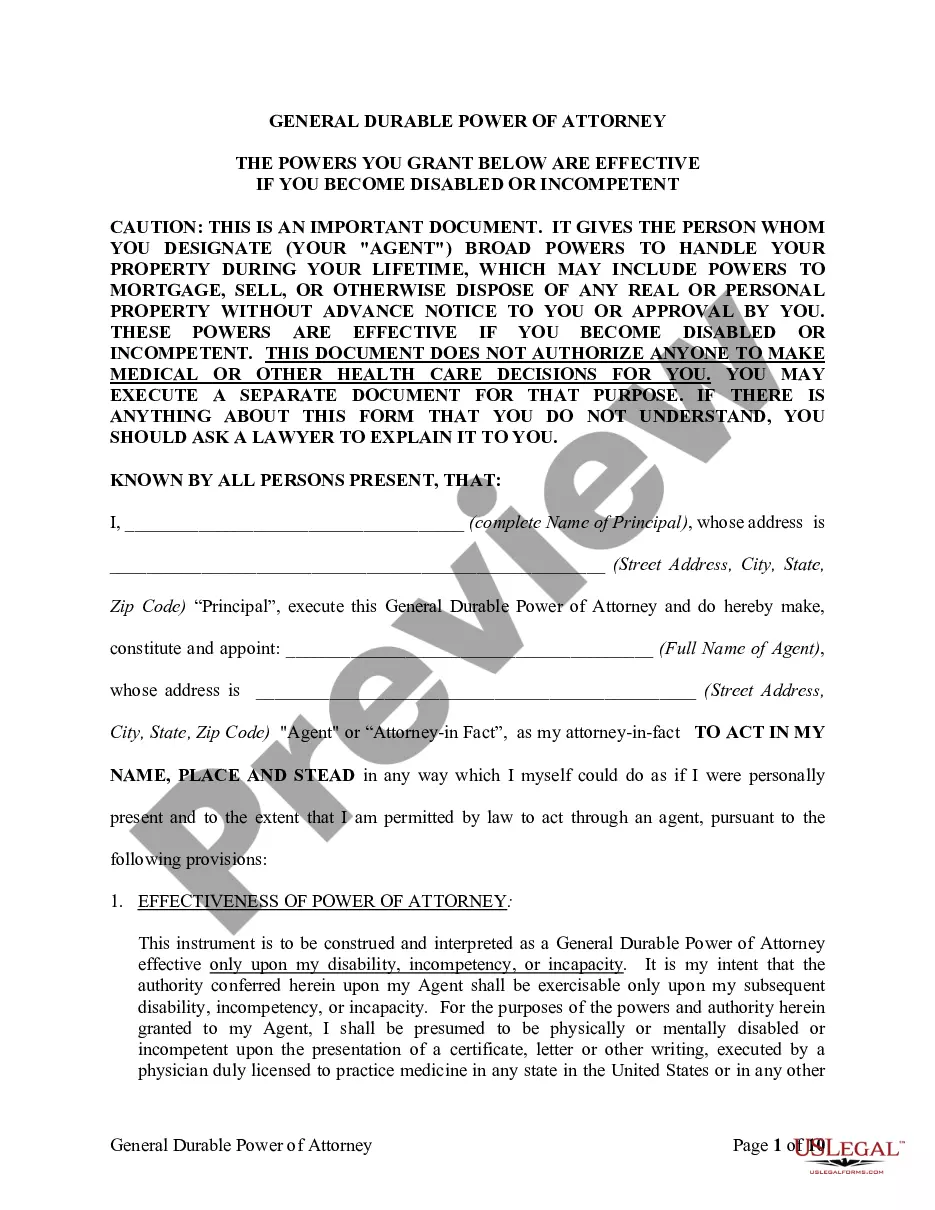

How to fill out Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

It is feasible to dedicate numerous hours online searching for the sanctioned document template that satisfies the local and national requirements you desire.

US Legal Forms offers thousands of legal documents that have been examined by experts.

You can download or print the Washington Consultant Agreement for Services Related to Finances and Financial Reporting of Company with Confidentiality Clauses from their services.

If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- Next, you can complete, modify, print, or sign the Washington Consultant Agreement for Services Related to Finances and Financial Reporting of Company with Confidentiality Clauses.

- Every legal document template you download is yours permanently.

- To get another copy of any obtained form, visit the My documents tab and click the corresponding button.

- If you utilize the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/town of your choice.

- Review the form outline to ensure you have selected the right form.

Form popularity

FAQ

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

State Laws on Confidentiality AgreementsConfidentiality agreements are considered restrictive covenants because they restrict or limit the freedom of an individual. fefffeff In the case of the NDA, the restrictions might hinder someone from going into business, finding work, or making money.

Also known as an NDA or Confidentiality Agreement, this agreement is a legally binding contract where a party agrees to keep confidential information that's received private. For example, if you hire a partner and share a trade secret with him or her; you can ask that your secret remain confidential.

Service Provider's PromisesUnless authorized in writing by Client, Service Provider will keep all Confidential Information and will not copy, reproduce, or make notes of, divulge to anyone or any entity outside Client, or use any of the Confidential Information for Service Provider's or another's benefit or purpose.

Consultants offer guidance and actionable solutions to problems the organization may be having. Consulting firms tend to have specific focuses, and companies pay them to lend their expertise on problems that can't be handled internally. Consulting firms have a presence in virtually every industry.

A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client. The agreement may also explain how much work you will perform at the client's office and how often you will work remotely.

A consulting services agreement is a contract defining the terms of service between a client and a consultant. The document can also be referred to as a consulting contract, a business consulting agreement, an independent contractor agreement, or a freelance agreement.

Except as specifically required by law, Consultant may disclose Non-Public Information only with Client's prior written consent. Consultant shall have no authority to disclose Non-Public Information except in accordance with this section.

disclosure agreement is a legally binding contract that establishes a confidential relationship. The party or parties signing the agreement agree that sensitive information they may obtain will not be made available to any others. An NDA may also be referred to as a confidentiality agreement.