The Washington Letter of Notice to Borrower of Assignment of Mortgage is an important legal document that serves to inform borrowers about the assignment of their mortgage from one lender to another. This communication is necessary to ensure transparency and to comply with the Washington state laws governing mortgage assignments. The purpose of the Washington Letter of Notice to Borrower of Assignment of Mortgage is to notify borrowers about the change in their mortgage lender and to provide them with all the necessary information related to the assignment. It is crucial for lenders to send this letter promptly after the assignment has taken place to maintain open lines of communication and transparency with the borrowers. The content of the letter should include essential details such as the borrower's name, loan number, the name and contact information of the original lender, as well as the name and contact information of the new lender. It should clearly state the effective date of the assignment and explain that all future mortgage payments should be made to the new lender. The letter could also include information regarding any changes to the terms and conditions of the mortgage, if applicable. In Washington, there are no specific types or variations of the Letter of Notice to Borrower of Assignment of Mortgage. However, it is crucial to ensure the content is accurate, complete, and compliant with Washington state laws. Lenders should consult with legal professionals or review state-specific requirements to ensure that the content of the letter aligns with the necessary standards and guidelines. Keywords: Washington, Letter of Notice, Borrower, Assignment of Mortgage, mortgage lender, transparency, communication, legal document, loan number, terms and conditions, state laws.

Washington Letter of Notice to Borrower of Assignment of Mortgage

Description

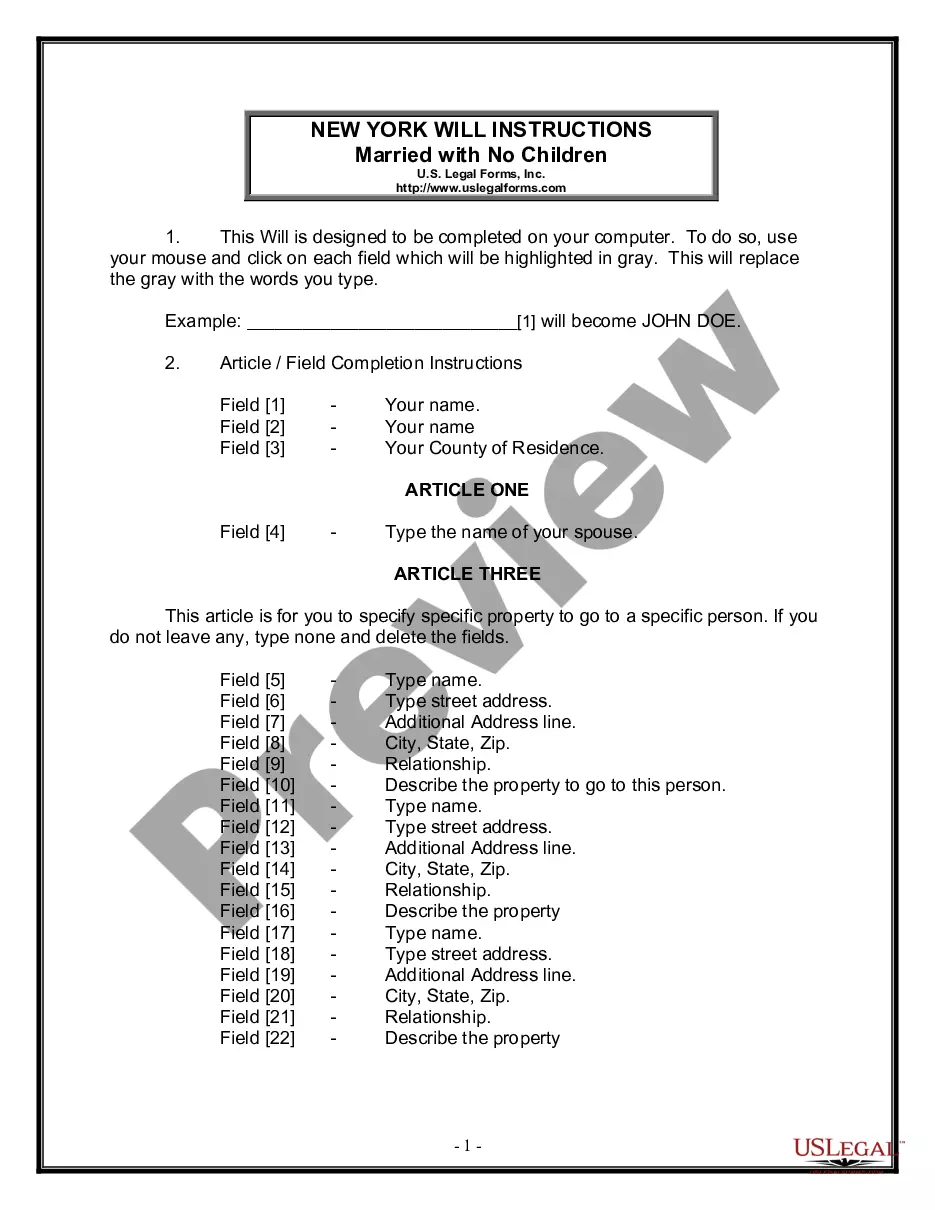

How to fill out Washington Letter Of Notice To Borrower Of Assignment Of Mortgage?

US Legal Forms - among the largest libraries of legal varieties in the USA - gives an array of legal papers web templates it is possible to download or print. Using the web site, you may get thousands of varieties for organization and individual purposes, sorted by types, claims, or keywords and phrases.You will discover the most recent types of varieties such as the Washington Letter of Notice to Borrower of Assignment of Mortgage in seconds.

If you already possess a registration, log in and download Washington Letter of Notice to Borrower of Assignment of Mortgage from the US Legal Forms collection. The Acquire button will show up on every single type you perspective. You have access to all formerly saved varieties within the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, listed here are easy instructions to get you began:

- Ensure you have picked the proper type for your personal metropolis/region. Click the Review button to analyze the form`s content. Read the type outline to actually have selected the correct type.

- In case the type doesn`t suit your demands, take advantage of the Research area at the top of the display screen to get the the one that does.

- If you are pleased with the form, affirm your option by clicking the Acquire now button. Then, pick the costs prepare you want and give your references to sign up for the accounts.

- Approach the financial transaction. Use your credit card or PayPal accounts to accomplish the financial transaction.

- Pick the file format and download the form in your device.

- Make adjustments. Complete, change and print and sign the saved Washington Letter of Notice to Borrower of Assignment of Mortgage.

Each and every format you included with your bank account does not have an expiry day which is yours for a long time. So, if you wish to download or print one more copy, just go to the My Forms portion and click about the type you want.

Gain access to the Washington Letter of Notice to Borrower of Assignment of Mortgage with US Legal Forms, probably the most comprehensive collection of legal papers web templates. Use thousands of professional and state-certain web templates that meet your small business or individual demands and demands.

Form popularity

FAQ

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

An Assignment of a Promissory note is a bilateral document that transfers the rights and obligations associated with a promissory note from one party (the assignor) to another party (the assignee).

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.