Washington Trust Agreement for Pension Plan with Corporate Trustee is a legally binding document that establishes the terms and conditions for managing and safeguarding pension plan assets. This agreement is specifically designed for pension plans in the state of Washington, United States. It ensures that pension funds are effectively administered, invested, and distributed for the benefit of plan participants. A corporate trustee is appointed to act as the fiduciary and administrator of the pension plan in accordance with applicable laws and regulations. The corporate trustee is typically a financial institution or a trust company with expertise in managing pension assets. The Washington Trust Agreement for Pension Plan with Corporate Trustee includes various important provisions to protect the interests of plan participants and ensure compliance with legal requirements. These provisions may include, but are not limited to: 1. Definitions: Clear definitions of terms used throughout the agreement to provide precise interpretation and understanding. 2. Appointment and Duties of Corporate Trustee: Outlines the selection process, roles, and responsibilities of the corporate trustee. It specifies their duties, such as maintaining accurate records, making investments in accordance with the plan's investment guidelines, collecting contributions, and distributing benefits. 3. Plan Contributions: Details the contribution requirements and methods, including employer and employee contributions and any matching programs. 4. Plan Investments: Provides guidelines on investment options, allowable asset classes, risk management, and diversification strategies. 5. Vesting and Benefits: Outlines the vesting schedule (the timeline for employees to gain ownership of their plan benefits) and the calculation and distribution of retirement benefits. 6. Plan Amendments and Termination: Describes the process for making changes to the plan's provisions and the conditions under which the plan may be terminated. 7. Compliance and Reporting: Specifies the record-keeping, reporting, and auditing obligations of the corporate trustee to ensure compliance with laws and regulations. 8. Dispute Resolution: Includes provisions for resolving disputes, such as arbitration or mediation, to settle any disagreements among plan participants, the corporate trustee, and the plan sponsor. There may be different types of Washington Trust Agreements for Pension Plans with Corporate Trustees, depending on the specific needs and requirements of the plan sponsor. Some common variations may include defined benefit plans, defined contribution plans, profit-sharing plans, employee stock ownership plans (Sops), or hybrid plans that combine features of both defined benefit and defined contribution plans. In conclusion, the Washington Trust Agreement for Pension Plan with Corporate Trustee is a vital document that governs the management and administration of pension plan assets in the state of Washington. It establishes the roles and responsibilities of the corporate trustee, outlines contribution and investment guidelines, and ensures compliance with legal requirements. The specific type of trust agreement may vary depending on the type of pension plan being established.

Washington Trust Agreement for Pension Plan with Corporate Trustee

Description

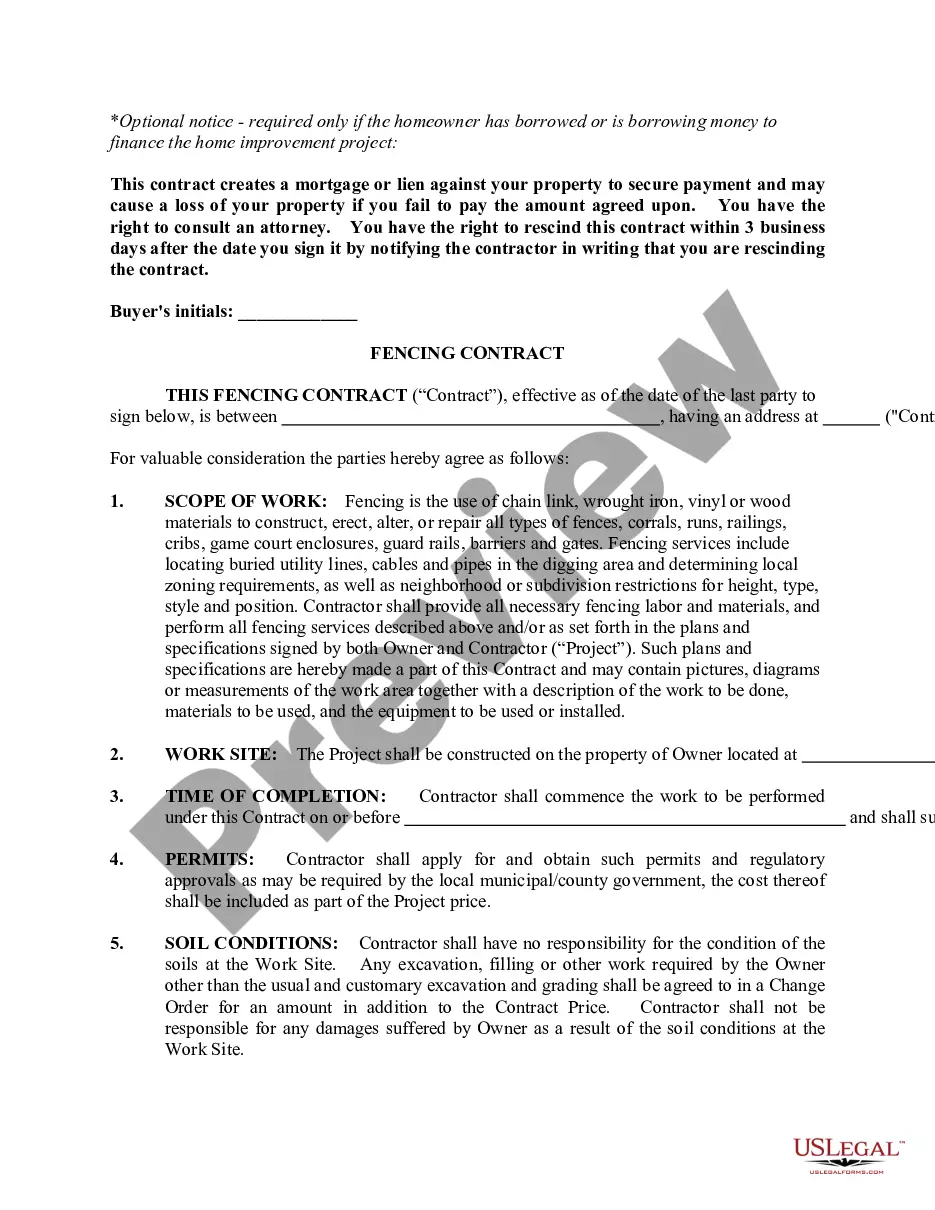

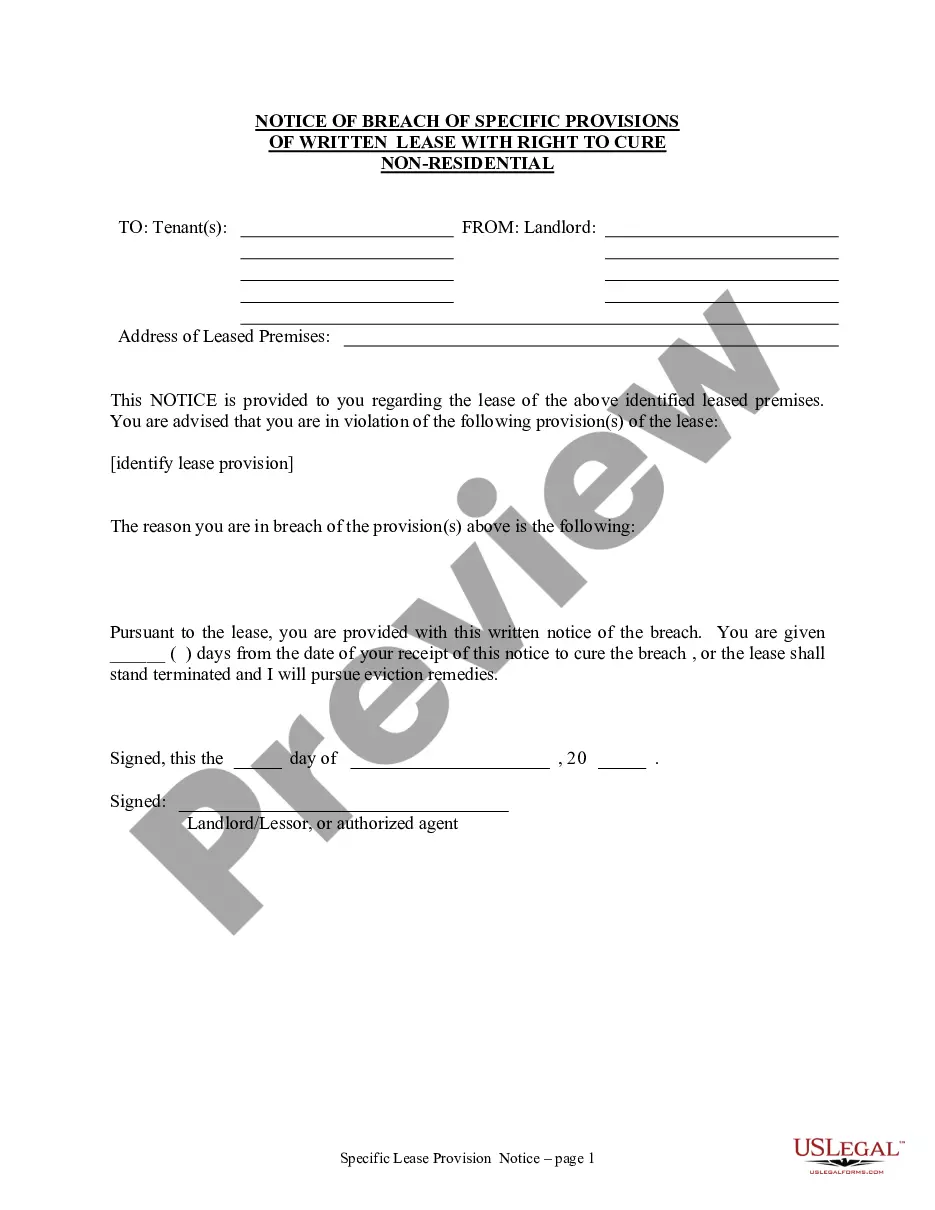

How to fill out Trust Agreement For Pension Plan With Corporate Trustee?

Choosing the right legitimate document web template can be a struggle. Naturally, there are tons of themes available online, but how would you discover the legitimate form you need? Make use of the US Legal Forms website. The assistance offers a large number of themes, like the Washington Trust Agreement for Pension Plan with Corporate Trustee, which you can use for enterprise and private requires. Each of the types are examined by experts and meet up with federal and state demands.

In case you are already listed, log in for your bank account and click on the Obtain key to obtain the Washington Trust Agreement for Pension Plan with Corporate Trustee. Utilize your bank account to appear from the legitimate types you might have acquired formerly. Visit the My Forms tab of your bank account and acquire yet another backup in the document you need.

In case you are a brand new user of US Legal Forms, listed here are easy guidelines so that you can comply with:

- First, make sure you have chosen the right form to your metropolis/area. You are able to check out the form making use of the Preview key and read the form information to ensure it is the right one for you.

- When the form fails to meet up with your needs, use the Seach industry to get the proper form.

- When you are positive that the form is acceptable, go through the Buy now key to obtain the form.

- Pick the prices strategy you need and enter in the required info. Design your bank account and buy your order making use of your PayPal bank account or bank card.

- Pick the document format and down load the legitimate document web template for your system.

- Full, modify and printing and sign the acquired Washington Trust Agreement for Pension Plan with Corporate Trustee.

US Legal Forms is the greatest collection of legitimate types that you can discover various document themes. Make use of the service to down load appropriately-made papers that comply with status demands.

Form popularity

FAQ

A 'beneficial owner' is any individual who ultimately, either directly or indirectly, owns or controls the trust and includes the settlor or settlors, the trustee or trustees, the protector or protectors (if any), the beneficiaries or the class of persons in whose main interest the trust is established.

Even if you are capable of managing your own trust, a corporate trustee can be a wise choice. You may not have the time, desire, or investment experience to manage your trust yourself, or perhaps you just feel that someone with more time and experience could do a better job than you.

Corporate trust services can provide assistance with both the issuance and administration of corporate debt. Corporate trusts might distribute the interest payments from the corporation to the bondholders and ensure that the issuer is adhering to the covenants of the bond agreement.

Retirement plans themselves cannot be transferred into a trust; those assets must be distributed from the plan first, which triggers income tax on the distribution. If you are older than 72 when you die, money generally must come out of your retirement plan according to the schedule that was required before your death.

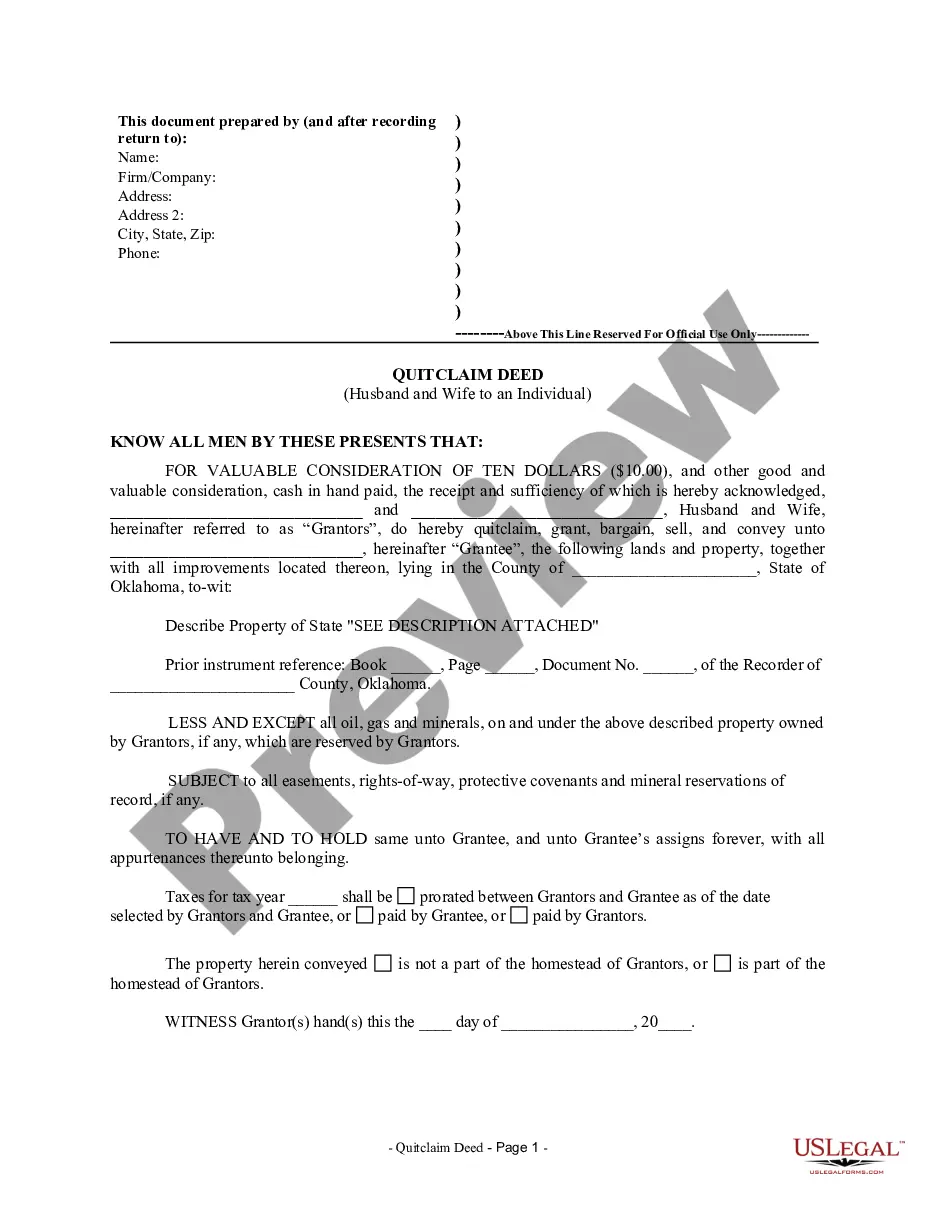

To create a living trust in Washington, prepare a written trust document and sign it before a notary public. To finalize the trust and make it effective, you must transfer ownership of your assets into it.

A trust is a legal agreement that transfers legal title of an asset to a trustee, who then manages the asset for the benefit of the grantor or another beneficiary. The trustee will hold, manage, and distribute the assets to a beneficiary as directed by the trust agreement.

To make a living trust in Washington, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

A trust is a legal arrangement intended to ensure a person's assets eventually go to specific beneficiaries. The person creating the trust puts assets in the name of the trust and authorizes a third party to administer those assets for the trust creator and the beneficiaries.

The trustee must register the trust by filing with the clerk of the court in any county where venue lies for the trust under RCW 11.96A.

A trust agreement is a legal document that allows the trustor to transfer the ownership of assets to the trustee to be held for the trustor's beneficiaries. Trust agreements are created for many reasons: Allow your trustees to avoid probate. Wealth management. Tax advantages.