Washington Cash Disbursements and Receipts, also known as Washington CDR, is a financial accounting system used by the state of Washington to manage and track cash transactions. It provides a detailed record of money being disbursed and received by various government entities. Cash disbursements refer to the outflow of funds from government accounts for various purposes. This can include payments made for goods and services, salaries and wages, grants and subsidies, and debt repayments. The Washington CDR system ensures transparency and accountability in the state's financial activities by keeping a thorough record of each disbursement, including the amount, recipient, and purpose. On the other hand, cash receipts refer to the inflow of cash into government accounts. These receipts may come from various sources, such as taxes collected, fees and fines, revenue from state-owned assets or resources, and federal grants or reimbursements. The Washington CDR system allows for accurate tracking of cash receipts, enabling the state to manage and allocate funds effectively. The Washington CDR system helps streamline financial operations by providing real-time information on cash flows and balances. This data is crucial for budgeting, financial planning, and ensuring compliance with accounting standards and governmental regulations. Moreover, it facilitates accurate and timely financial reporting, aiding in the evaluation of government programs, projects, and overall fiscal health. While there are no specific types of Washington Cash Disbursements and Receipts, the system caters to different departments, agencies, and institutions within the state government. This ensures that each entity's cash transactions are appropriately recorded and easily accessible for auditing purposes. The implementation of Washington CDR has significantly improved financial management in the state by reducing errors, enhancing transparency, and enabling better decision-making. It enables government officials to have a comprehensive overview of cash movements, enabling them to identify potential areas of improvement and optimize resource allocation. In conclusion, Washington Cash Disbursements and Receipts is a comprehensive financial accounting system utilized by the state government of Washington to record and monitor cash transactions. By accurately documenting cash disbursements and receipts, the system ensures transparency, accountability, and efficient financial management across various government entities.

Washington Cash Disbursements and Receipts

Description

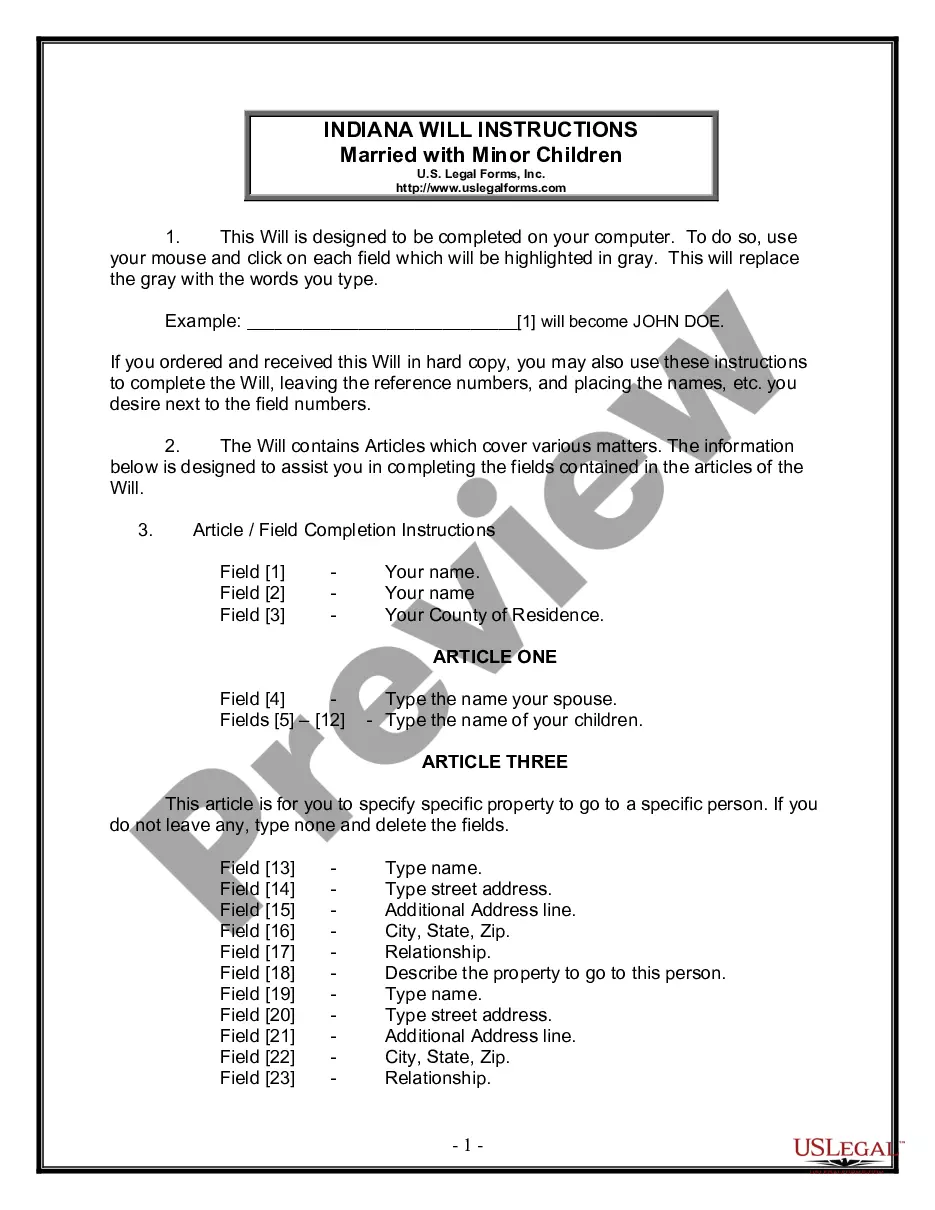

How to fill out Cash Disbursements And Receipts?

Are you presently in the situation where you need paperwork for either organization or specific uses almost every time? There are plenty of authorized file web templates accessible on the Internet, but locating types you can rely is not effortless. US Legal Forms provides thousands of develop web templates, such as the Washington Cash Disbursements and Receipts, which can be composed to satisfy federal and state demands.

Should you be already knowledgeable about US Legal Forms site and possess an account, merely log in. After that, it is possible to down load the Washington Cash Disbursements and Receipts format.

Should you not offer an bank account and would like to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and ensure it is for that proper area/region.

- Utilize the Review key to examine the form.

- Look at the explanation to actually have selected the right develop.

- In case the develop is not what you are searching for, utilize the Lookup area to discover the develop that meets your needs and demands.

- Once you discover the proper develop, just click Purchase now.

- Pick the costs plan you need, submit the desired details to create your account, and pay for the order using your PayPal or bank card.

- Decide on a convenient document file format and down load your duplicate.

Locate all of the file web templates you have purchased in the My Forms food selection. You can get a more duplicate of Washington Cash Disbursements and Receipts whenever, if necessary. Just go through the necessary develop to down load or print out the file format.

Use US Legal Forms, one of the most extensive variety of authorized forms, to save lots of time and prevent errors. The assistance provides appropriately manufactured authorized file web templates which you can use for an array of uses. Generate an account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

Cash receipts are money received from consumers for the sale of goods or services. Cash disbursements are monies paid out to individuals for the purchase of items that are needed and used by a company.

Cash receipts appear on a financial summary as an increase to the cash account or another asset account. This depends upon the nature of the sale. If a business sells services and those payments were collected in cash, then those payments would be put toward accounts receivable.

The main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. Broadly defined, cash includes both cash and cash equivalents, such as short-term investments in Treasury bills, commercial paper, and money market funds.

In accounting terms, a disbursement, also called a cash disbursement or cash payment, refers to a wide range of payment types made in a specific period, including interest payments on loans and operating expenses. It can refer to cash payments, electronic fund transfers, checks and other forms of payment.

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

Purchasing inventory or office supplies, paying out dividends, or making business loan payments with cash or cash equivalents are examples of disbursements.

Make The Sales Entry Cash sales are reported in the sales journal as a credit and the cash receipts journal as a debit. For example, a $500 cash sale is a $500 debit in the cash receipts journal and a $500 credit in the sales journal. Sometimes, customers pay with a combination of cash and in-store credit.

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

A cash disbursements journal only records cash outflow transactions. That means any transaction that credits cash is recorded in a cash disbursements journal. A cash receipts journal does the opposite it only records cash inflow transactions.

Simply put, a cash receipt is recognized when an entity receives cash from any external source, such as a customer, an investor, or a bank. Typically, this cash is recognized when money is received from a customer to offset the accounts receivable balance generated when the sale transaction occurred.