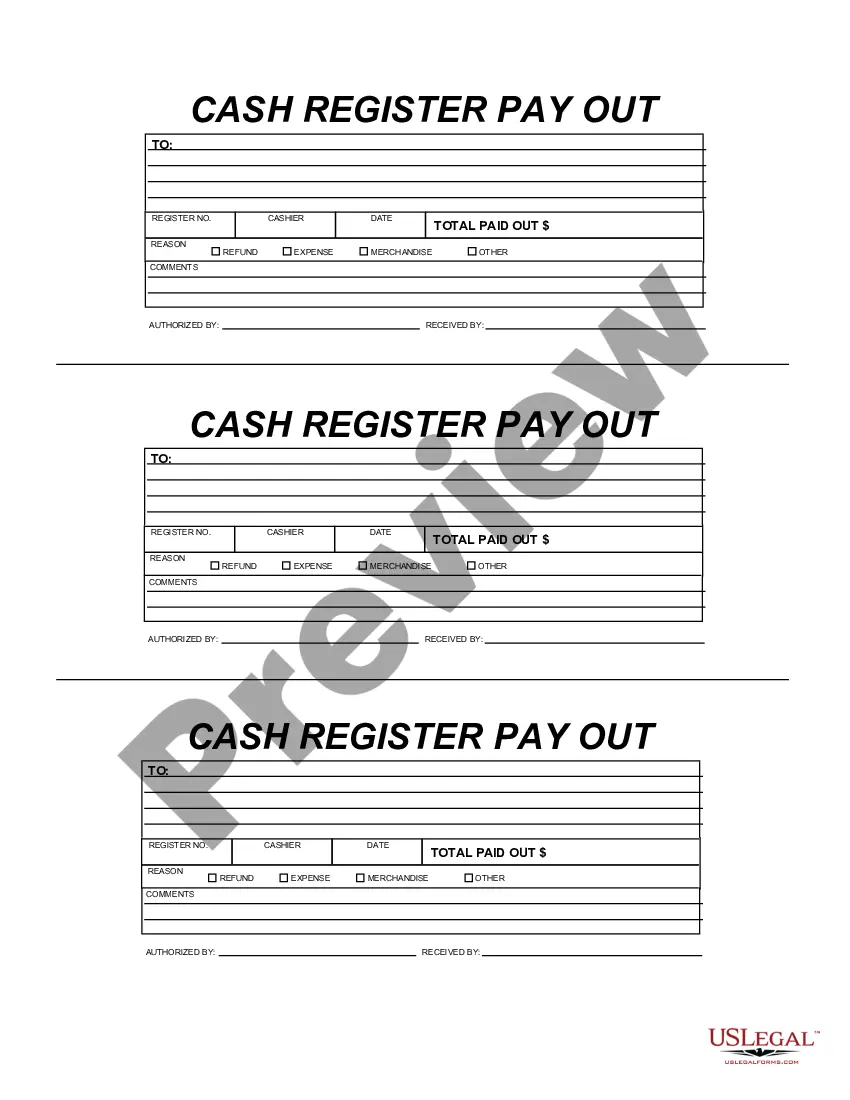

Washington Cash Register Payout

Description

How to fill out Cash Register Payout?

Finding the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how can you acquire the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Washington Cash Register Payout, which you can use for business and personal needs.

All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Washington Cash Register Payout. Use your account to browse through the legal forms you have previously purchased. Go to the My documents tab in your account and download another copy of the document you need.

Select the document format and download the legal document template to your system. Complete, modify, and print the acquired Washington Cash Register Payout. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form with the Preview button and examine the form outline to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are certain the form is appropriate, click the Get now button to acquire the form.

- Choose the pricing plan you desire and enter the necessary information.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

Unless a different payment interval applies by law, the employer must pay wages no later than the 25th day of the current month for the first pay period, and no later than the 10th day of the following month for the second pay period.

Under the California Labor Code, employers can make deductions from employee wages if the deductions are: Required or "empowered" by state or federal law. Expressly authorized in writing by the employee to cover insurance premiums, or hospital or medical dues.

Allowable Paycheck DeductionsPersonal loans (cash advances, 401(k) or retirement loan payment, bail or bond payments, etc.)Personal purchases of a business's goods or services such as: Food purchases from the cafeteria.Employee's health, dental, vision, and other insurance payments or co-payments.

No, your employer cannot legally make such a deduction from your wages if, by reason of mistake or accident a cash shortage, breakage, or loss of company property/equipment occurs.

After the cashier balances the register or cash drawer, the staff person in charge of cash deposits (usually the store manager or someone on the accounting or bookkeeping staff) takes all cash out except the amount that will be needed for the next day and deposits it in the bank.

Your cash drawer, also called a register or till, stores cash, coins, checks, and other valuable items (e.g., coupons) at the point-of-sale (POS). At the end of each day, shift, or period, you must balance your cash drawer to account for all incoming transactions.

A cash register logs transactions that occur in your store, creating a record of the money coming in and going out. It can also calculate and add taxes, generate receipts, and offer basic sales tracking. Many major grocery stores and department stores use cash registers.

The Fair Labor Standards Act (FLSA) allows deductions that take an employee's wages below minimum wage so long as the deduction is not for the employer's benefit. In general, insurance premium deductions are for the employee's benefit, not for the employer's, and are therefore allowable.

Mandatory payroll deductionsFICA tax. Federal Insurance Contributions Act (FICA) tax is made up of Social Security and Medicare taxes.Federal income tax.State and local taxes.Garnishments.Health insurance premiums.Retirement plans.Life insurance premiums.Job-related expenses.

Deductions and Final Pay Final pay is subjected to mandatory withholding, such as federal income tax, Social Security tax, Medicare tax, state-mandated taxes and applicable wage garnishments. Certain voluntary deductions, such as medical and dental benefits depend on company policy.