Washington Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

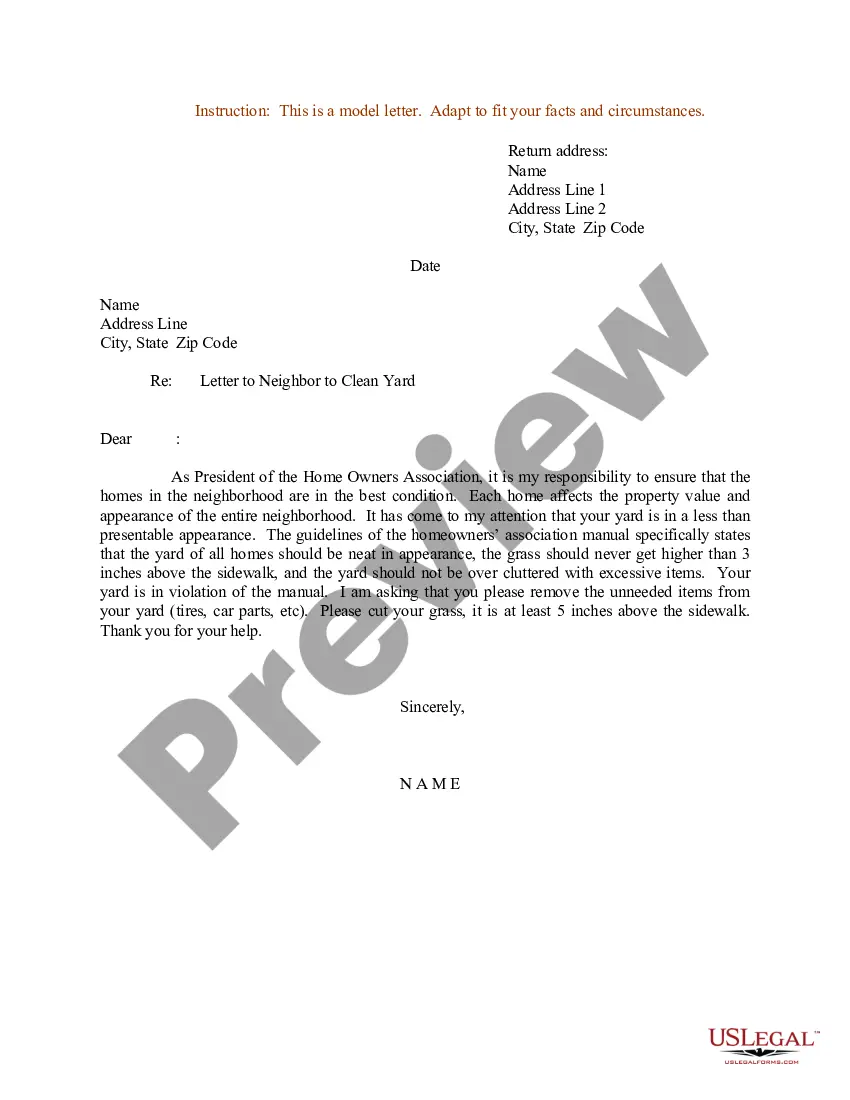

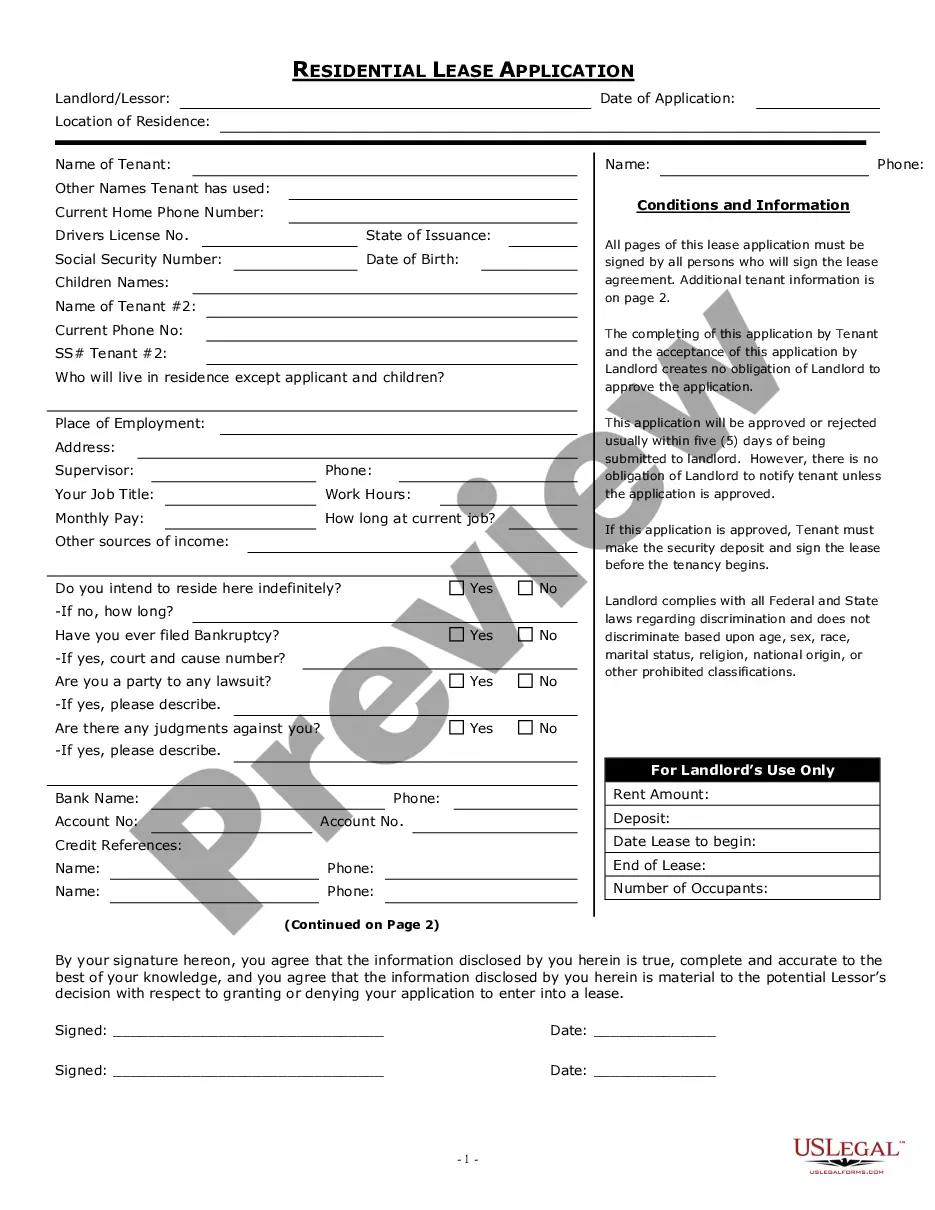

Are you currently in the situation where you require documents for both business or personal reasons on a daily basis? There are numerous legal document templates available online, but locating reliable ones can be challenging. US Legal Forms offers a vast array of form templates, such as the Washington Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, specifically designed to comply with state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Washington Liquidation of Partnership with Sale of Assets and Assumption of Liabilities template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions.

Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Washington Liquidation of Partnership with Sale of Assets and Assumption of Liabilities at any time, if required. Just click on the necessary form to retrieve or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be applied for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- Obtain the form you need and ensure it corresponds to the correct city/region.

- Utilize the Review option to evaluate the form.

- Check the explanation to confirm you have chosen the correct document.

- If the document does not meet your needs, use the Search field to find a form that aligns with your requirements and specifications.

- Once you identify the suitable form, click on Purchase now.

- Choose the pricing plan you prefer, provide the necessary information to create your account, and complete the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

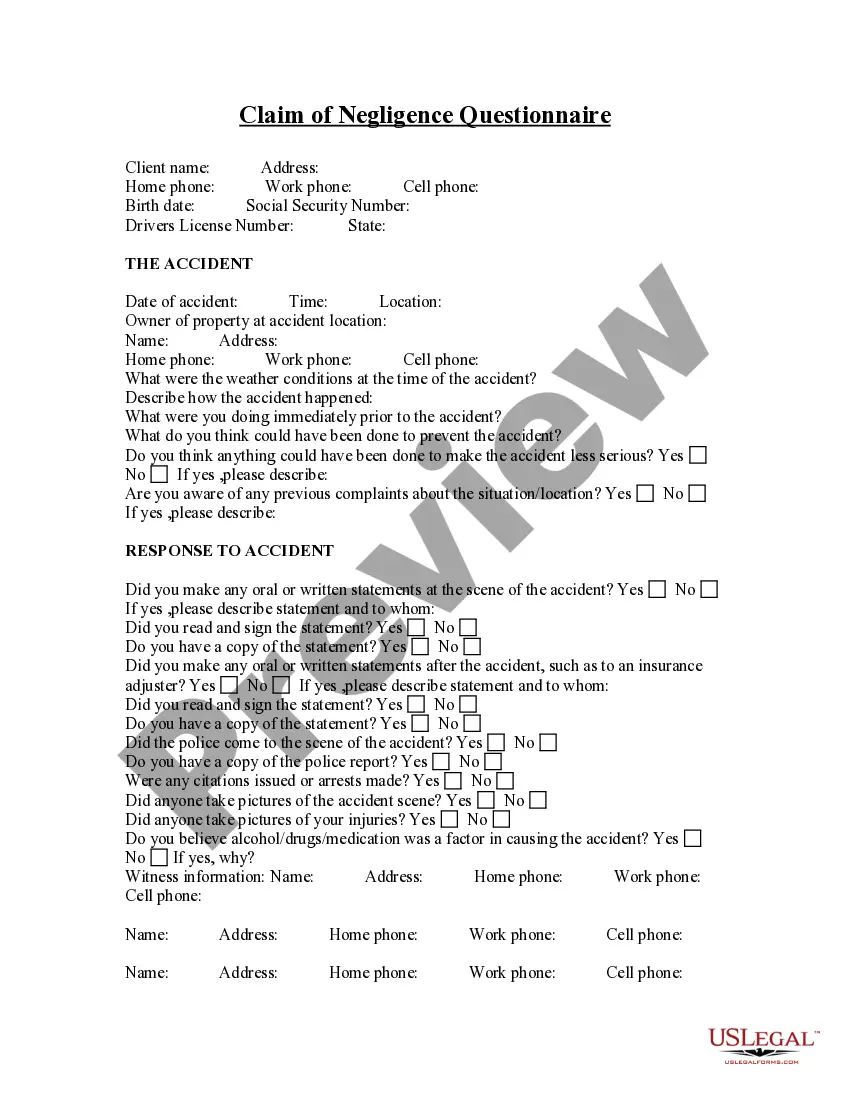

The basis of property (other than money) distributed by a partnership to a partner in liquidation of the partner's interest shall be an amount equal to the adjusted basis of such partner's interest in the partnership reduced by any money distributed in the same transaction.

Definition: Partnership liquidation is the process of closing the partnership and distributing its assets. Many times partners choose to dissolve and liquidate their partnerships to start new ventures. Other times, partnerships go bankrupt and are forced to liquidate in order to pay off their creditors.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

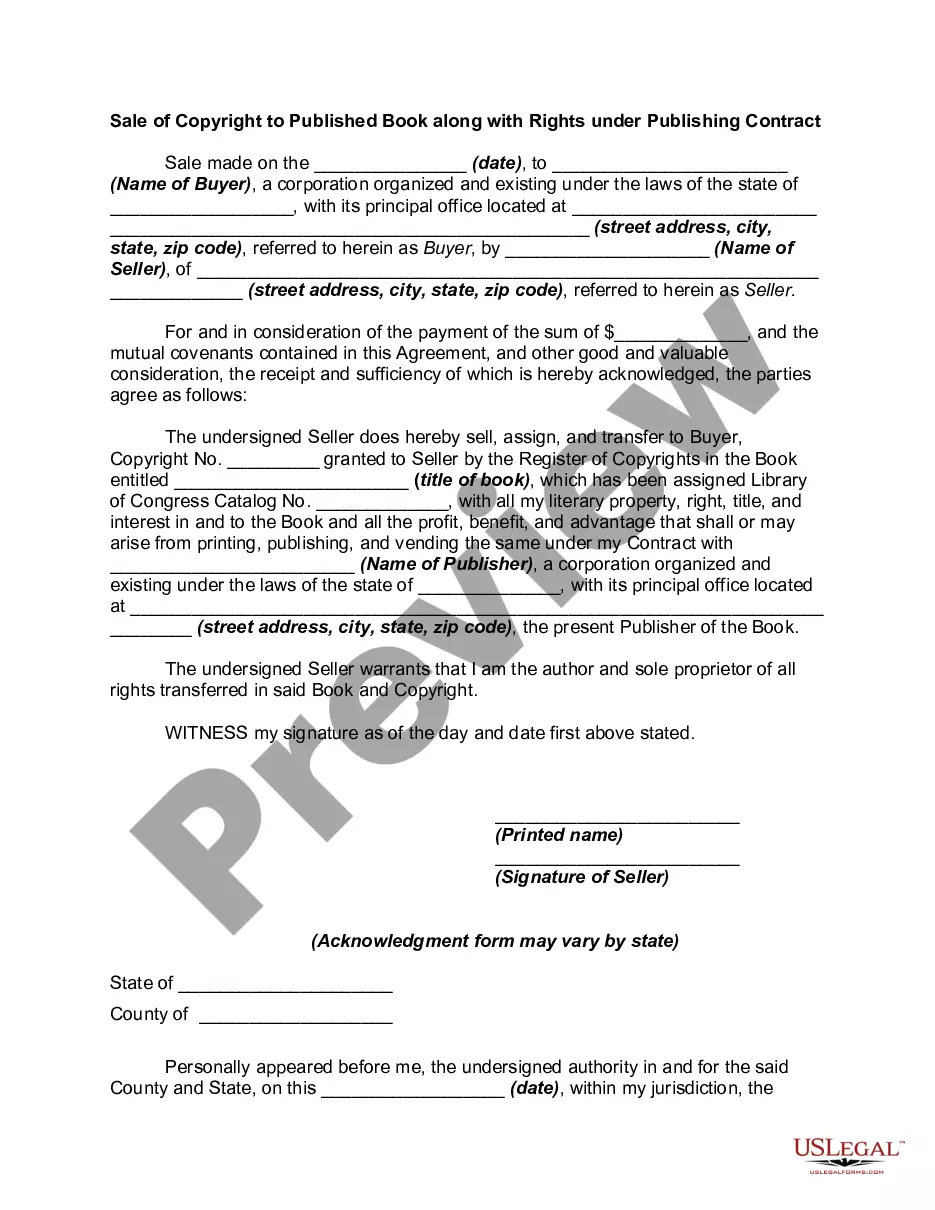

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

What Role Does Basis Play In A Partnership Liquidation? basis equal to the amount of money on hand plus the level at which any business-related assets will be contributed, ie, what they will cost.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Cases. A dividend may be referred to as liquidating dividend when a company: Goes out of business and the net assets of the company (after all liabilities have been paid) are distributed to shareholders, or. Sells a portion of its business for cash and the proceeds are distributed to shareholders.