Title: Understanding the Washington Notice of Disputed Account: Types and Key Information Introduction: The Washington Notice of Disputed Account plays a crucial role in protecting consumer rights when dealing with disputed debts or inaccurate information on their credit reports. This comprehensive guide aims to provide a detailed overview of what a Washington Notice of Disputed Account is, its significance, and the various types that exist. Key Keywords: Washington Notice of Disputed Account, disputed debts, credit reports, consumer rights, inaccurate information I. What is a Washington Notice of Disputed Account? The Washington Notice of Disputed Account is a formal communication sent by individuals to creditors or credit bureaus, indicating that a specific debt or information reported on their credit report is being disputed. This written notice serves as a powerful tool for consumers to challenge and investigate alleged debts and inaccuracies. II. Significance of Washington Notice of Disputed Account: 1. Consumer Protection: The Washington Notice of Disputed Account is governed by the Fair Credit Reporting Act (FCRA) and offers consumers protection against erroneous or fraudulent information on their credit reports. 2. Fair Investigation: The notice triggers an obligation for creditors and credit bureaus to investigate the dispute within a specific timeframe and provide resolution. 3. Legal Implications: Failure to respond appropriately to a Notice of Disputed Account can lead to legal actions against creditors or credit bureaus for non-compliance with federal regulations. III. Types of Washington Notice of Disputed Account: 1. Notice of Disputed Debt: This type of notice is used when consumers disagree with the validity of the debt claimed by a creditor. Consumers can request information regarding the debt's verification or proof of ownership. Keywords: Notice of Disputed Debt, validity of debt, creditors, verification, proof of ownership 2. Notice of Disputed Credit Report Entry: This notice is utilized when individuals identify inaccurate, outdated, or misleading information on their credit reports. It prompts credit bureaus to conduct proper investigations and correct any errors found. Keywords: Notice of Disputed Credit Report Entry, inaccurate information, outdated information, misleading information, credit bureaus, investigations 3. Notice of Incomplete or Incorrect Information: When there are missing or incomplete details concerning an account or transaction, this type of notice is employed. It compels creditors or credit bureaus to provide the complete and accurate information required to resolve the matter. Keywords: Notice of Incomplete Information, Notice of Incorrect Information, missing details, incomplete details, accurate information, creditors, credit bureaus IV. Key Steps in Submitting a Notice of Disputed Account: 1. Compose a Clear and Concise Letter: Clearly state the reason for your dispute, provide necessary details, and attach relevant documents. 2. Mail the Notice: Send the notice via certified mail with a return receipt to ensure documentation of the dispute. 3. Keep Copies and Track Communications: Maintain a copy of the notice and any subsequent correspondence related to the dispute for future reference. Conclusion: Understanding the Washington Notice of Disputed Account empowers consumers to take charge of their financial information and challenge inaccuracies. By employing the relevant type of notice and following the correct procedures, individuals can assert their rights and achieve fair resolution in disputing debts and inaccurate credit report entries. Keywords: Consumer empowerment, financial information, fair resolution, disputing debts, accurate credit report entries, Fair Credit Reporting Act, federal regulations.

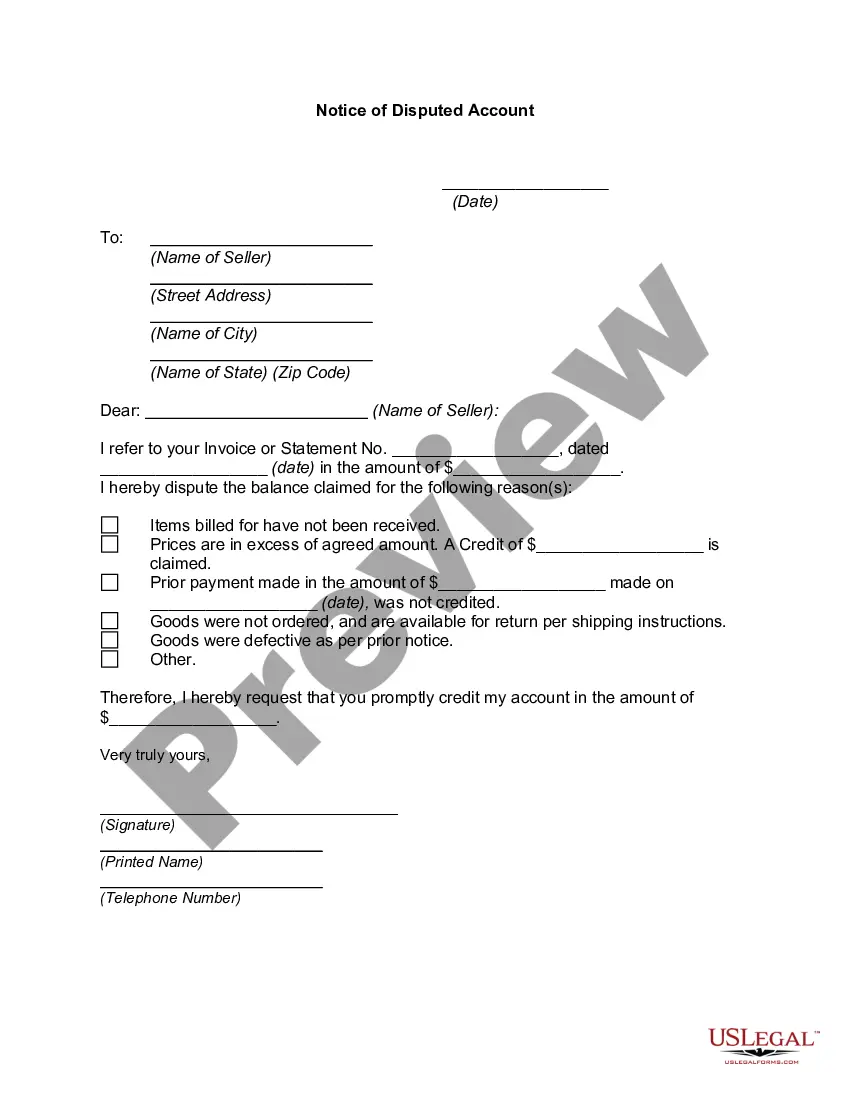

Washington Notice of Disputed Account

Description

How to fill out Washington Notice Of Disputed Account?

Are you currently in the placement that you need files for sometimes business or personal functions nearly every time? There are plenty of legal papers web templates available on the Internet, but getting types you can trust isn`t simple. US Legal Forms gives a large number of kind web templates, such as the Washington Notice of Disputed Account, that happen to be created in order to meet federal and state demands.

In case you are previously acquainted with US Legal Forms web site and have an account, merely log in. Next, you may down load the Washington Notice of Disputed Account design.

If you do not offer an accounts and need to begin to use US Legal Forms, abide by these steps:

- Find the kind you need and make sure it is for that correct metropolis/area.

- Make use of the Review switch to examine the form.

- Read the description to ensure that you have chosen the right kind.

- In the event the kind isn`t what you are trying to find, utilize the Lookup industry to obtain the kind that fits your needs and demands.

- If you discover the correct kind, just click Buy now.

- Opt for the costs prepare you want, complete the necessary details to generate your bank account, and buy an order using your PayPal or charge card.

- Pick a convenient document formatting and down load your copy.

Locate all the papers web templates you have bought in the My Forms menu. You can get a more copy of Washington Notice of Disputed Account anytime, if needed. Just click on the required kind to down load or print out the papers design.

Use US Legal Forms, probably the most extensive selection of legal kinds, to conserve time and prevent errors. The services gives skillfully made legal papers web templates which you can use for a selection of functions. Make an account on US Legal Forms and initiate producing your lifestyle easier.