Title: Understanding Washington Conflict of Interest Disclosure for Corporate Directors Introduction: In the state of Washington, corporate directors play a crucial role in governing corporations. To ensure transparency and avoid any perceived conflicts of interest, Washington law mandates directors to disclose their potential conflicts of interest through a Conflict of Interest Disclosure. This detailed description will explore the requirements, importance, and different types of Conflict of Interest Disclosures for directors of corporations operating in Washington. Keywords: Washington, Conflict of Interest Disclosure, Director of Corporation, requirements, importance, different types. 1. General Overview: The Washington Conflict of Interest Disclosure for Directors is a legal requirement that mandates corporate directors to openly disclose any potential conflicts of interest that may arise from their personal, financial, or professional relationships. 2. Purpose and Importance: The primary purpose of the Conflict of Interest Disclosure is to maintain transparency and protect the interests of corporations and their shareholders. By disclosing potential conflicts upfront, directors are held accountable for acting in the best interest of the corporation, free from any personal biases or external influences. 3. Required Disclosures: Directors in Washington are obliged to disclose any potential conflicts of interest that could impact their decision-making process, jeopardize the corporation's financial well-being, or compromise the trust of shareholders. These disclosures encompass various areas such as: a. Financial Relationships: Directors must disclose any significant financial interests or relationships they have with other companies, individuals, or entities that may affect their judgment or actions as a director. b. Personal Relationships: Directors must disclose personal relationships that could potentially create a conflict of interest, ensuring that their decisions remain objective and unbiased. c. Investments: Directors must disclose any investments they hold in competing businesses or industries to avoid conflicts that may arise from their personal financial interests. 4. Specific Situations: Apart from the general requirements mentioned above, several specific scenarios may warrant additional types of Conflict of Interest Disclosures. These include: a. Corporate Opportunities: Directors must disclose any opportunities that arise, either directly or indirectly, that could benefit them personally or compete with the interests of the corporation they serve. b. Compensation: Directors must disclose any additional compensation received from the corporation beyond their standard compensation package or any potential conflicts that may arise in relation to their compensation. 5. Legal Compliance and Penalties: Directors are legally bound to provide accurate and timely Conflict of Interest Disclosures. Failure to comply with these disclosure requirements can result in severe penalties, legal consequences, damage to reputation, or removal from their director position. Conclusion: The Washington Conflict of Interest Disclosure for Directors ensures transparency, protects the corporation and its shareholders, and fosters trust in the decision-making processes of corporate directors. By diligently disclosing potential conflicts of interest, directors can maintain their impartiality, act in the best interest of the corporation, and contribute to its overall success. Note: The specific types of Conflict of Interest Disclosures mentioned in section 4 are examples and may vary depending on the specific regulations and circumstances applicable to Washington corporations.

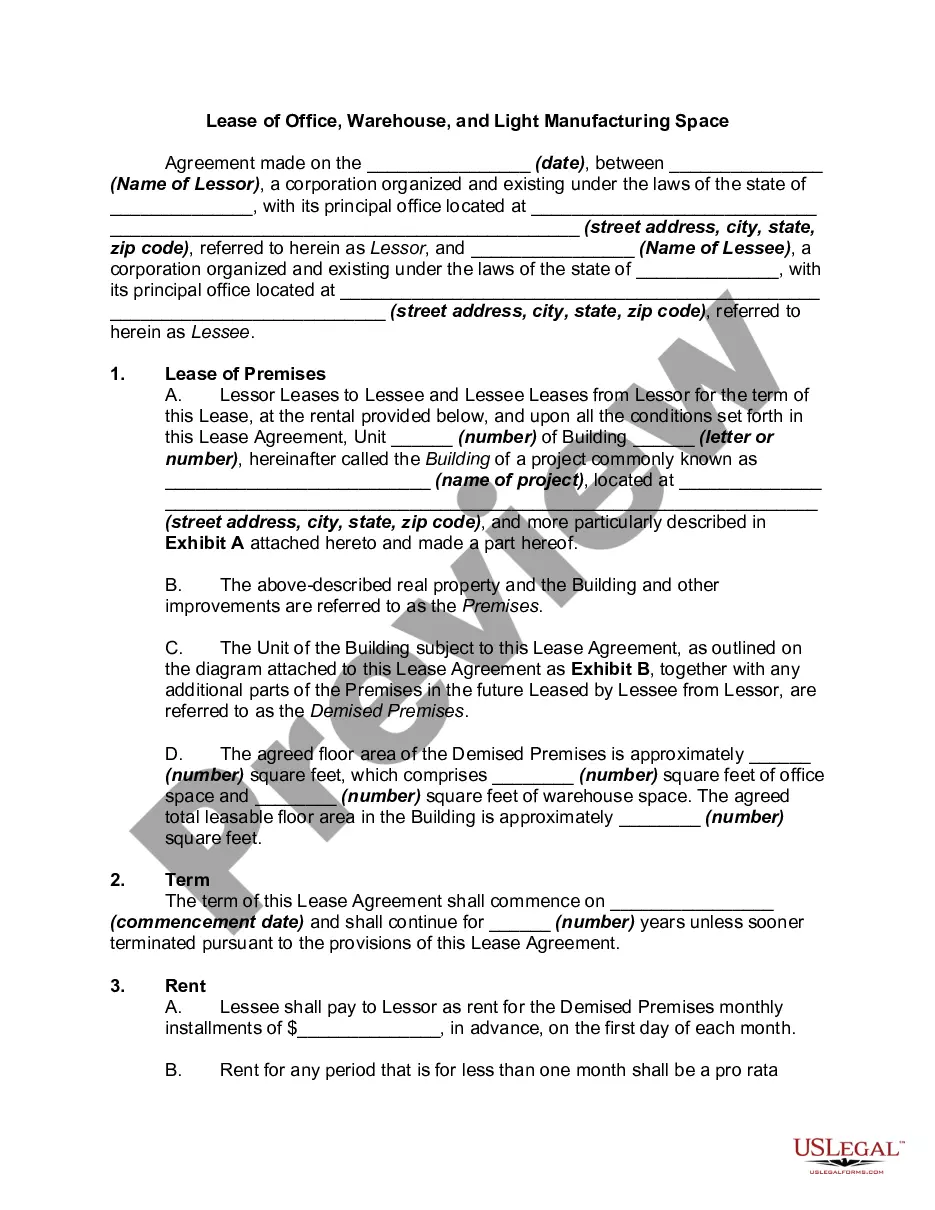

Washington Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Washington Conflict Of Interest Disclosure Of Director Of Corporation?

Have you been within a place the place you will need files for both enterprise or personal reasons virtually every day? There are a variety of authorized document layouts available on the net, but discovering ones you can depend on isn`t effortless. US Legal Forms delivers thousands of type layouts, much like the Washington Conflict of Interest Disclosure of Director of Corporation, that are created to satisfy state and federal specifications.

Should you be currently knowledgeable about US Legal Forms internet site and possess an account, basically log in. Afterward, you can obtain the Washington Conflict of Interest Disclosure of Director of Corporation design.

Unless you come with an account and need to start using US Legal Forms, adopt these measures:

- Find the type you want and ensure it is for your right city/county.

- Use the Preview option to review the form.

- See the outline to ensure that you have selected the proper type.

- If the type isn`t what you`re searching for, utilize the Look for field to get the type that fits your needs and specifications.

- When you obtain the right type, simply click Buy now.

- Choose the costs program you would like, fill out the required information and facts to generate your money, and buy the transaction utilizing your PayPal or credit card.

- Pick a hassle-free file file format and obtain your duplicate.

Find all the document layouts you have bought in the My Forms food selection. You can obtain a further duplicate of Washington Conflict of Interest Disclosure of Director of Corporation whenever, if necessary. Just click the essential type to obtain or print out the document design.

Use US Legal Forms, the most extensive collection of authorized forms, in order to save time as well as stay away from errors. The service delivers skillfully produced authorized document layouts which you can use for an array of reasons. Create an account on US Legal Forms and commence creating your daily life a little easier.