A Washington Letter Requesting Transfer of Property to Trust is a legally significant document used in estate planning and asset management. This letter is used to formally request the transfer of property ownership from an individual to a trust entity. By transferring assets to a trust, an individual ensures that their property is managed according to their wishes and bypasses the probate process. Keywords: Washington, letter, requesting, transfer, property, trust, estate planning, asset management, ownership, individual, probate process. Types of Washington Letter Requesting Transfer of Property to Trust: 1. Washington Revocable Living Trust Transfer Letter: This type of letter is used to initiate the transfer of assets to a revocable living trust. A revocable living trust is a flexible estate planning tool that enables the creator (granter) to maintain control over their assets during their lifetime while avoiding probate and ensuring a smooth transfer of assets upon their death. 2. Washington Irrevocable Trust Transfer Letter: In contrast to a revocable living trust, an irrevocable trust cannot be modified or revoked by the granter without the consent of the beneficiaries. This type of letter initiates the transfer of property ownership to an irrevocable trust, which provides distinct estate planning advantages like tax benefits and asset protection. 3. Washington Testamentary Trust Transfer Letter: A testamentary trust is established through a will and becomes effective upon the death of the granter. This type of letter is used to request the transfer of property ownership to a testamentary trust, ensuring that assets are distributed according to the specific instructions outlined in the will. 4. Washington Special Needs Trust Transfer Letter: A special needs trust is designed to protect individuals with disabilities by providing them with financial support without jeopardizing their eligibility for government assistance programs. This type of letter initiates the transfer of assets to a special needs trust, ensuring that the financial needs of the beneficiary are met while preserving their access to critical benefits such as Medicaid. 5. Washington Charitable Remainder Trust Transfer Letter: This type of letter is used when transferring assets to a charitable remainder trust, which enables individuals to support charitable organizations while receiving income from the trust during their lifetime. By transferring property to a charitable remainder trust, individuals can achieve their philanthropic goals while potentially enjoying tax benefits. In conclusion, a Washington Letter Requesting Transfer of Property to Trust is a crucial document used for various estate planning purposes. Different types of letters are associated with different types of trusts, such as revocable living trusts, irrevocable trusts, testamentary trusts, special needs trusts, and charitable remainder trusts. These letters facilitate the proper transfer of property ownership, ensuring assets are managed according to the individual's intentions and objectives.

Washington Letter Requesting Transfer of Property to Trust

Description

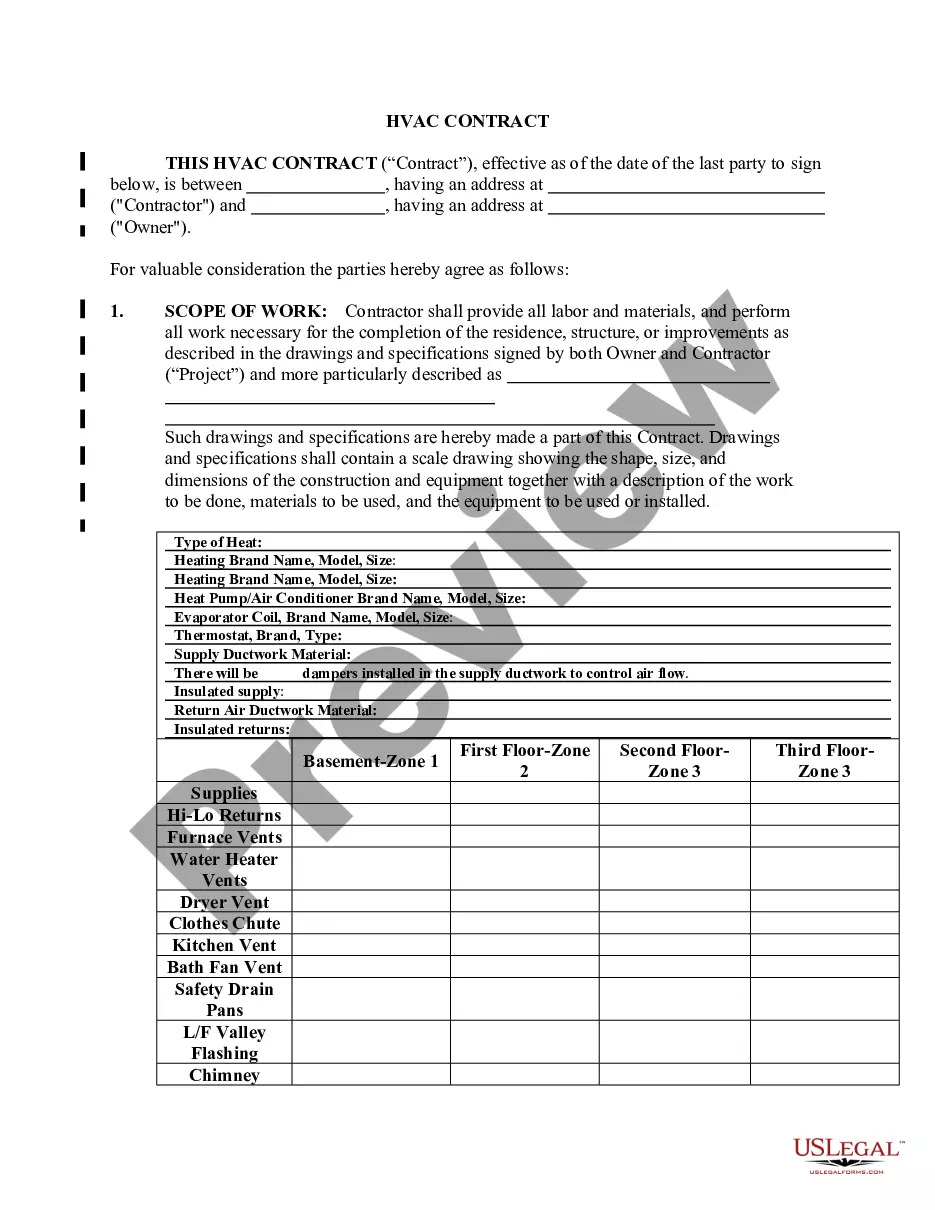

How to fill out Washington Letter Requesting Transfer Of Property To Trust?

It is possible to devote hrs on-line trying to find the legal document web template which fits the federal and state requirements you need. US Legal Forms supplies thousands of legal varieties that are evaluated by specialists. It is simple to acquire or print the Washington Letter Requesting Transfer of Property to Trust from my service.

If you already possess a US Legal Forms profile, it is possible to log in and then click the Obtain option. After that, it is possible to comprehensive, edit, print, or sign the Washington Letter Requesting Transfer of Property to Trust. Each legal document web template you get is the one you have for a long time. To obtain another backup for any purchased type, go to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms web site for the first time, stick to the basic directions beneath:

- Initial, ensure that you have selected the correct document web template to the region/area of your liking. Look at the type outline to make sure you have picked out the right type. If offered, make use of the Preview option to appear with the document web template at the same time.

- In order to discover another version of your type, make use of the Search industry to get the web template that meets your needs and requirements.

- Upon having discovered the web template you would like, just click Buy now to carry on.

- Choose the prices prepare you would like, enter your accreditations, and register for your account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal profile to cover the legal type.

- Choose the format of your document and acquire it for your system.

- Make adjustments for your document if necessary. It is possible to comprehensive, edit and sign and print Washington Letter Requesting Transfer of Property to Trust.

Obtain and print thousands of document templates using the US Legal Forms site, that offers the most important variety of legal varieties. Use expert and state-distinct templates to take on your organization or specific requires.

Form popularity

FAQ

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a trustee. The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

Real property is transferred into trust by a deed from the settlor, granting the property to the trust in the name of the trustee. Because the trustee now holds legal title to the property, the trustee must execute a deed to remove property from the trust.

To make a living trust in Washington, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

The Washington transfer-on-death deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

Washington Deed of Trust and Promissory Note Information It's similar to a mortgage but differs in that mortgages only include two parties (borrower and lender). In Washington, a Deed of Trust is the most commonly used instrument to secure a loan.

Gifting Property To Family Trust The first option you can choose when transferring the property title is to gift it to the trustee. The trustee and the trust will have to sign a gift deed, which establishes that the ownership of the property is being transferred without payment.

While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

Filing the Deed of Trust You can locate the office online or in the government pages (blue pages) of your local phone book. Call to confirm the mailing address for deeds of trust and either send the deed in the mail or go to the County Clerk's office to file the deed of trust in person.