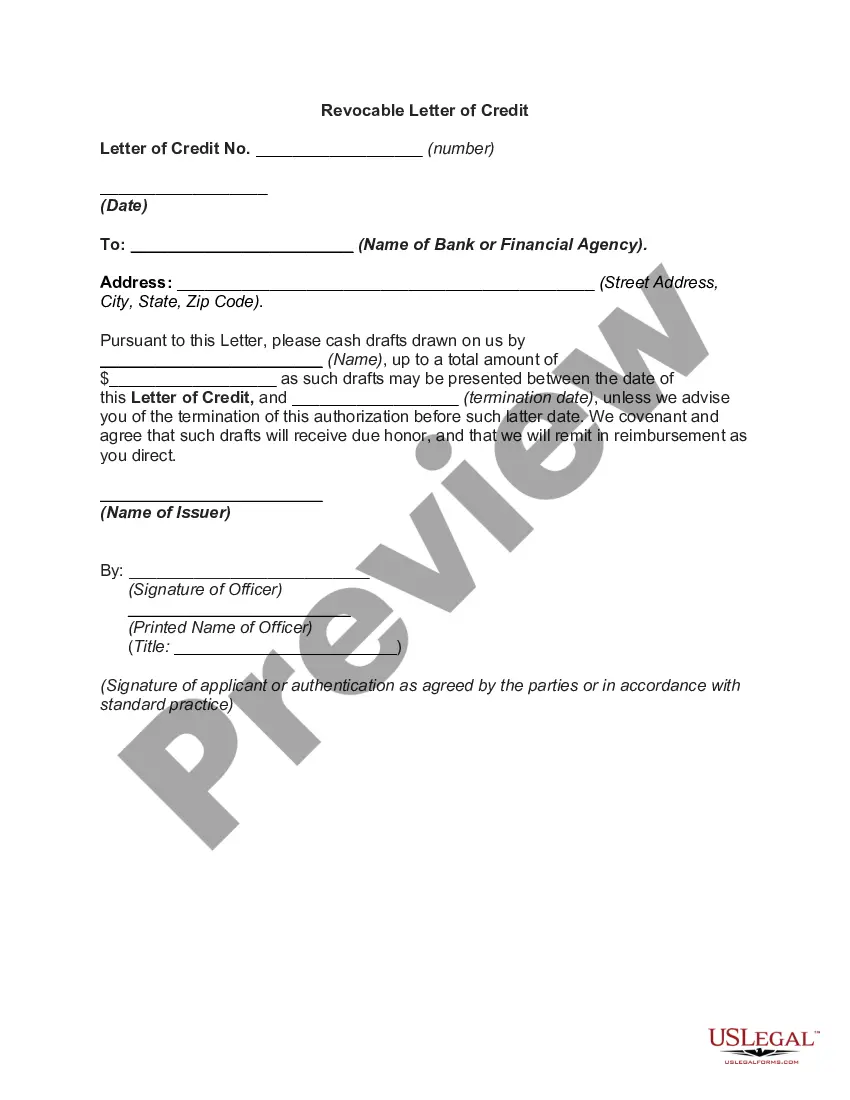

A Washington Revocable Letter of Credit is a financial instrument that guarantees payment from a bank on behalf of a buyer to a seller. It serves as a form of payment assurance, providing security to both parties in a transaction. In the state of Washington, there are various types of revocable letters of credit, each tailored to specific business needs and requirements. The most common types include: 1. Commercial Letter of Credit: This type of letter of credit is typically used in commercial transactions, ensuring that the seller will receive payment upon fulfilling the terms and conditions agreed upon in the contract. 2. Standby Letter of Credit: A standby letter of credit acts as a secondary payment method, intended to be used if the buyer fails to fulfill their financial obligations. It provides a safety net for the seller, assuring them of payment if the buyer defaults on the agreement. 3. Performance Letter of Credit: A performance letter of credit guarantees that a party will fulfill their contractual obligations. It is commonly used in construction projects or other agreements where the completion of specific tasks is required. 4. Financial Letter of Credit: This type of letter of credit ensures that a party will meet its financial obligations, such as repaying a loan or making timely interest payments. It allows lenders or investors to mitigate the risk of non-payment. 5. Revolving Letter of Credit: A revolving letter of credit provides a predetermined amount of credit for a specific period, which can be used multiple times within that period. It allows businesses to have ongoing payment security without the need to establish a new letter of credit for each transaction. In Washington, the revocable aspect of these letters of credit implies that the issuing bank has the authority to modify or cancel the credit arrangement before it is drawn upon by the seller. This flexibility provides additional protection for the buyer who may need to alter the terms of the transaction. Overall, the Washington Revocable Letter of Credit is a versatile financial tool that supports secure transactions by ensuring payment to sellers and minimizing risks for buyers. It offers various types tailored to different business needs, including commercial, standby, performance, financial, and revolving letters of credit.

Washington Revocable Letter of Credit

Description

How to fill out Washington Revocable Letter Of Credit?

Have you been within a position in which you will need documents for possibly company or individual functions nearly every day? There are tons of legal record templates accessible on the Internet, but getting ones you can rely isn`t simple. US Legal Forms provides a large number of type templates, such as the Washington Revocable Letter of Credit, that happen to be published in order to meet federal and state specifications.

When you are presently knowledgeable about US Legal Forms web site and also have a free account, simply log in. Afterward, you can download the Washington Revocable Letter of Credit template.

If you do not have an account and would like to begin using US Legal Forms, follow these steps:

- Get the type you will need and make sure it is for your proper area/state.

- Use the Preview switch to analyze the form.

- See the outline to ensure that you have chosen the appropriate type.

- In the event the type isn`t what you are looking for, use the Lookup area to discover the type that meets your requirements and specifications.

- When you find the proper type, click on Buy now.

- Choose the pricing program you would like, submit the required info to make your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a hassle-free paper format and download your version.

Find each of the record templates you may have bought in the My Forms menu. You may get a further version of Washington Revocable Letter of Credit whenever, if needed. Just click the necessary type to download or produce the record template.

Use US Legal Forms, the most comprehensive collection of legal types, to save time as well as avoid errors. The support provides skillfully manufactured legal record templates that can be used for a variety of functions. Produce a free account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

toback letter of credit can offer privacy to a buyer and seller. They may be used as a substitute if a transferable letter of credit isn't available.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

For example, under a revocable letter of credit, if the seller was unable to ship within the stipulated time period, he could simply amend the shipment date to whenever suits him. That may not suit the buyer, but he would be powerless.

Advantages and disadvantages of revocable letter of credit It has no significant advantages except that it puts the buyer on the safer side. However, this also means that this becomes a risk for the seller, and if the buyer would like, he could refuse to pay through this LC. The second benefit is that it is affordable.

A letter of credit is highly customizable and effective form which enables new trade relationships by reducing the credit risk, but it can add on to the cost of doing some uncertain business in the form of bank fees or formalities.