Washington Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court

Description

How to fill out Agreement For Services Between Attorney And Accountant To Audit Party's Financial Condition And To Testify In Court?

If you have to comprehensive, acquire, or printing lawful record layouts, use US Legal Forms, the greatest assortment of lawful forms, that can be found online. Use the site`s basic and practical search to get the files you want. Numerous layouts for business and person functions are categorized by categories and says, or search phrases. Use US Legal Forms to get the Washington Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court with a handful of clicks.

In case you are presently a US Legal Forms consumer, log in to the account and then click the Acquire key to find the Washington Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court. You may also entry forms you previously delivered electronically in the My Forms tab of the account.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form to the proper city/region.

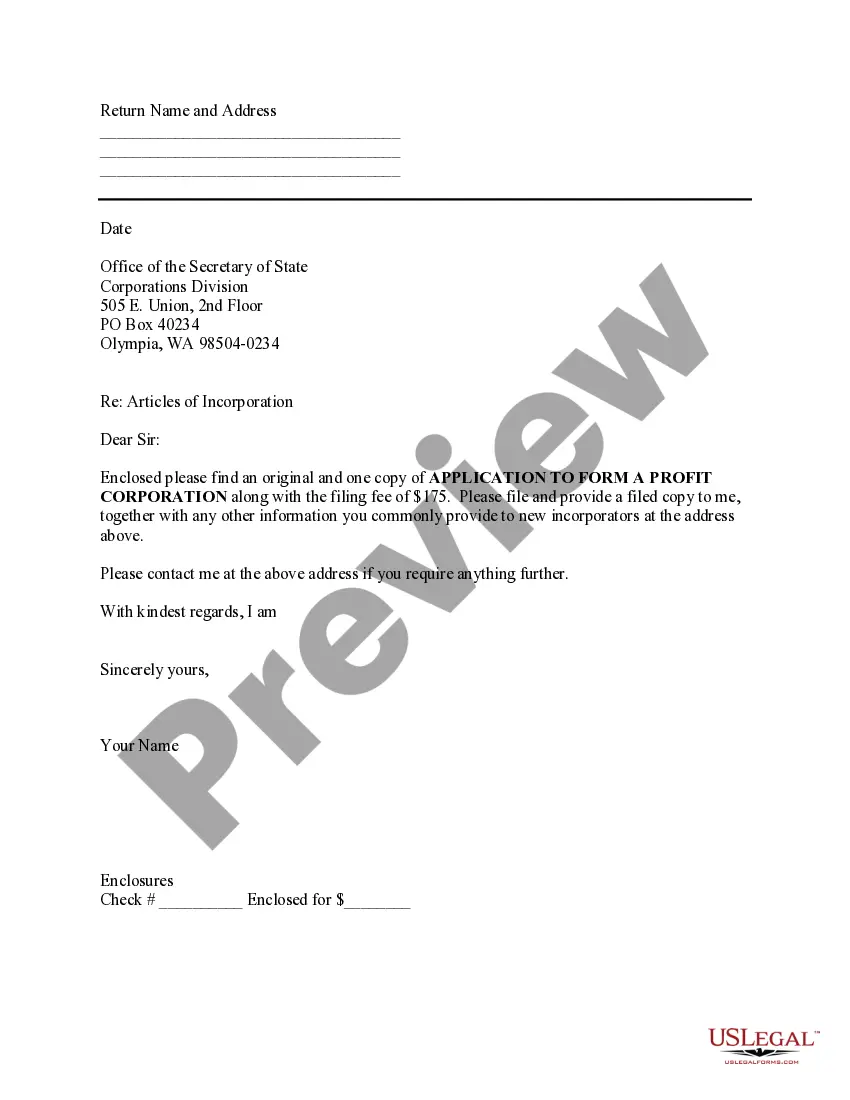

- Step 2. Take advantage of the Preview choice to look over the form`s content. Never forget about to learn the outline.

- Step 3. In case you are not happy with the kind, utilize the Look for field near the top of the display screen to locate other variations of the lawful kind format.

- Step 4. When you have found the form you want, click on the Buy now key. Choose the costs program you favor and add your credentials to register to have an account.

- Step 5. Approach the financial transaction. You should use your Мisa or Ьastercard or PayPal account to perform the financial transaction.

- Step 6. Pick the format of the lawful kind and acquire it in your system.

- Step 7. Comprehensive, edit and printing or indication the Washington Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court.

Every lawful record format you buy is yours for a long time. You possess acces to each and every kind you delivered electronically within your acccount. Click on the My Forms area and choose a kind to printing or acquire once more.

Compete and acquire, and printing the Washington Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court with US Legal Forms. There are thousands of specialist and state-particular forms you can utilize to your business or person demands.