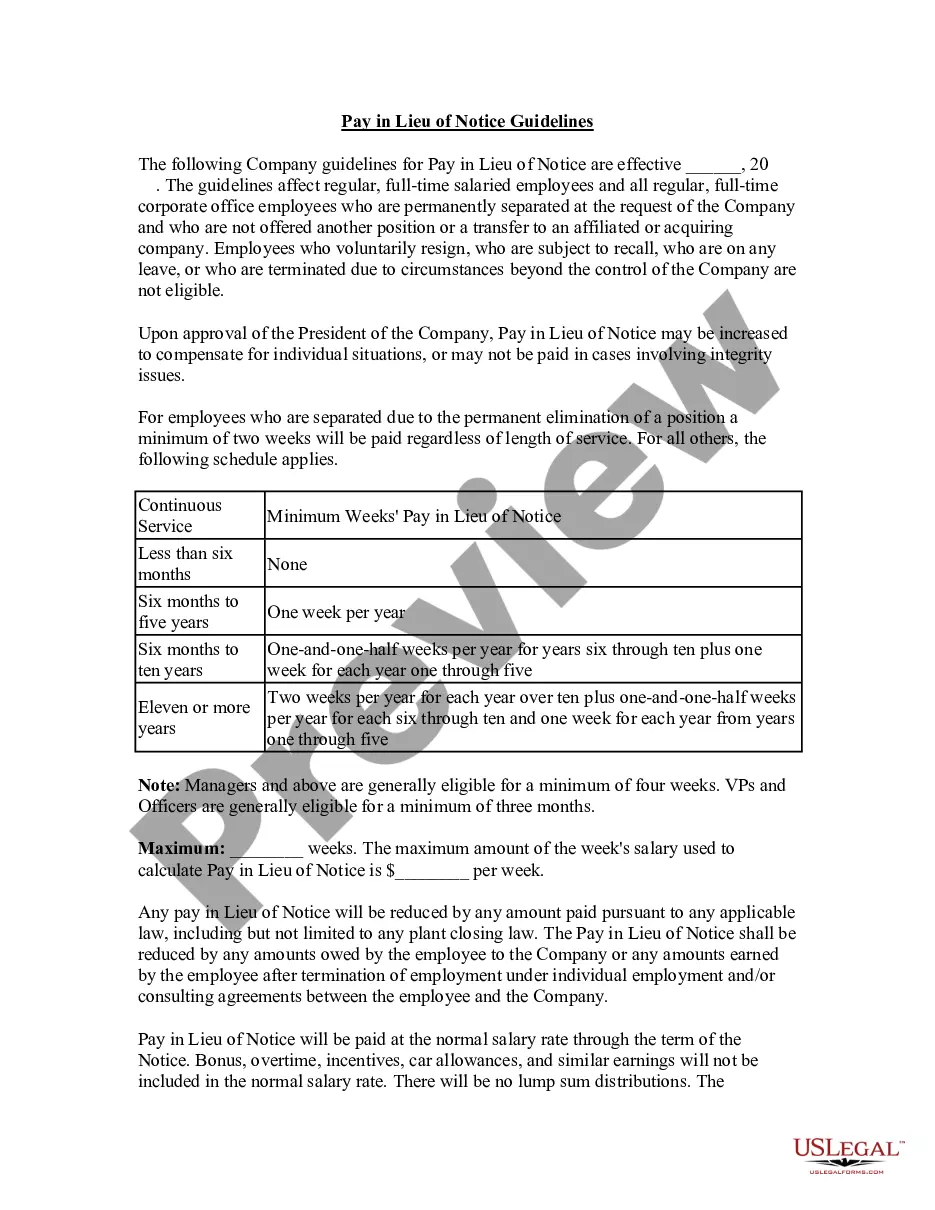

Washington Pay in Lieu of Notice Guidelines are regulations that govern the compensation provided to employees who are terminated from their jobs without being given proper notice by their employers. When an employer terminates an employee in Washington State, they must comply with certain requirements regarding pay in lieu of notice. According to the Washington Pay in Lieu of Notice Guidelines, if an employer does not provide sufficient notice of termination, they are obligated to pay the employee for the duration of the notice period they should have received. This payment is meant to replace the wages the employee would have earned during that time, had they been given proper notice. The amount of pay in lieu of notice is based on the employee's regular wages, including any overtime or additional compensation they might have received. In Washington State, the guidelines state that the payment must be made within the regular pay period following the employee's termination. There are different types of Washington Pay in Lieu of Notice Guidelines depending on the circumstances of the termination: 1. For employees who are terminated without any prior notice given, employers must compensate them for the full amount of the notice period they should have received. This means that the employee is entitled to receive their regular wages, including any additional compensation, for the entire notice period. 2. In cases where the employer provides partial notice but falls short of the required duration, the guidelines mandate that the employee should receive pay for the remaining duration not covered by the notice. The payment should be calculated based on the wages the employee would have earned during that remaining period. 3. If an employer terminates an employee and provides an alternative form of notice, such as payment in lieu of notice, the guidelines require that the payment must be equal to the wages the employee would have earned during the notice period. The employer cannot provide a lesser amount than the employee's regular wages. It is essential for both employers and employees in Washington State to understand the Pay in Lieu of Notice Guidelines to ensure compliance with the law. By adhering to these guidelines, employers can avoid potential legal issues related to notice and termination, while employees can ensure that they receive proper compensation in case of a sudden termination without adequate notice.

Washington Pay in Lieu of Notice Guidelines are regulations that govern the compensation provided to employees who are terminated from their jobs without being given proper notice by their employers. When an employer terminates an employee in Washington State, they must comply with certain requirements regarding pay in lieu of notice. According to the Washington Pay in Lieu of Notice Guidelines, if an employer does not provide sufficient notice of termination, they are obligated to pay the employee for the duration of the notice period they should have received. This payment is meant to replace the wages the employee would have earned during that time, had they been given proper notice. The amount of pay in lieu of notice is based on the employee's regular wages, including any overtime or additional compensation they might have received. In Washington State, the guidelines state that the payment must be made within the regular pay period following the employee's termination. There are different types of Washington Pay in Lieu of Notice Guidelines depending on the circumstances of the termination: 1. For employees who are terminated without any prior notice given, employers must compensate them for the full amount of the notice period they should have received. This means that the employee is entitled to receive their regular wages, including any additional compensation, for the entire notice period. 2. In cases where the employer provides partial notice but falls short of the required duration, the guidelines mandate that the employee should receive pay for the remaining duration not covered by the notice. The payment should be calculated based on the wages the employee would have earned during that remaining period. 3. If an employer terminates an employee and provides an alternative form of notice, such as payment in lieu of notice, the guidelines require that the payment must be equal to the wages the employee would have earned during the notice period. The employer cannot provide a lesser amount than the employee's regular wages. It is essential for both employers and employees in Washington State to understand the Pay in Lieu of Notice Guidelines to ensure compliance with the law. By adhering to these guidelines, employers can avoid potential legal issues related to notice and termination, while employees can ensure that they receive proper compensation in case of a sudden termination without adequate notice.