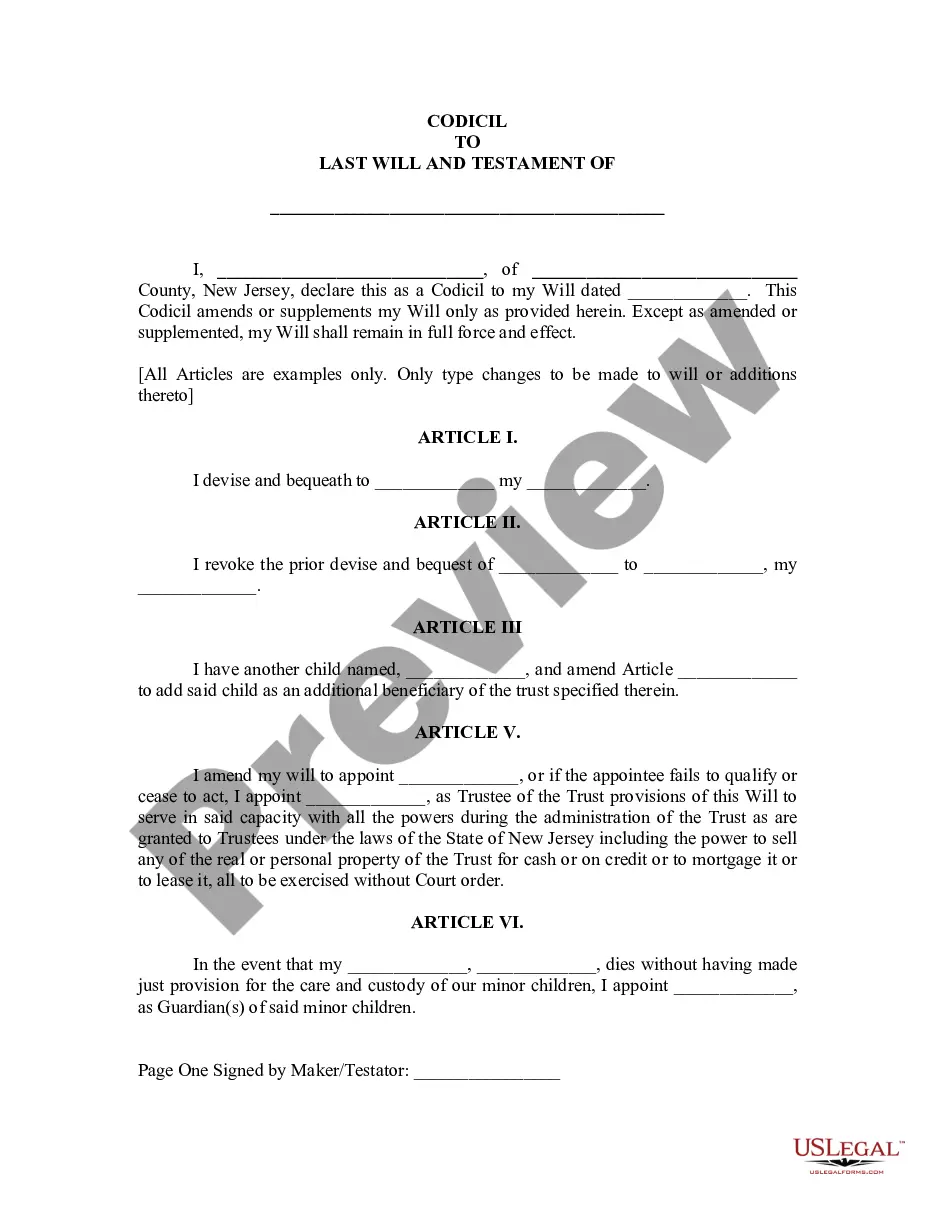

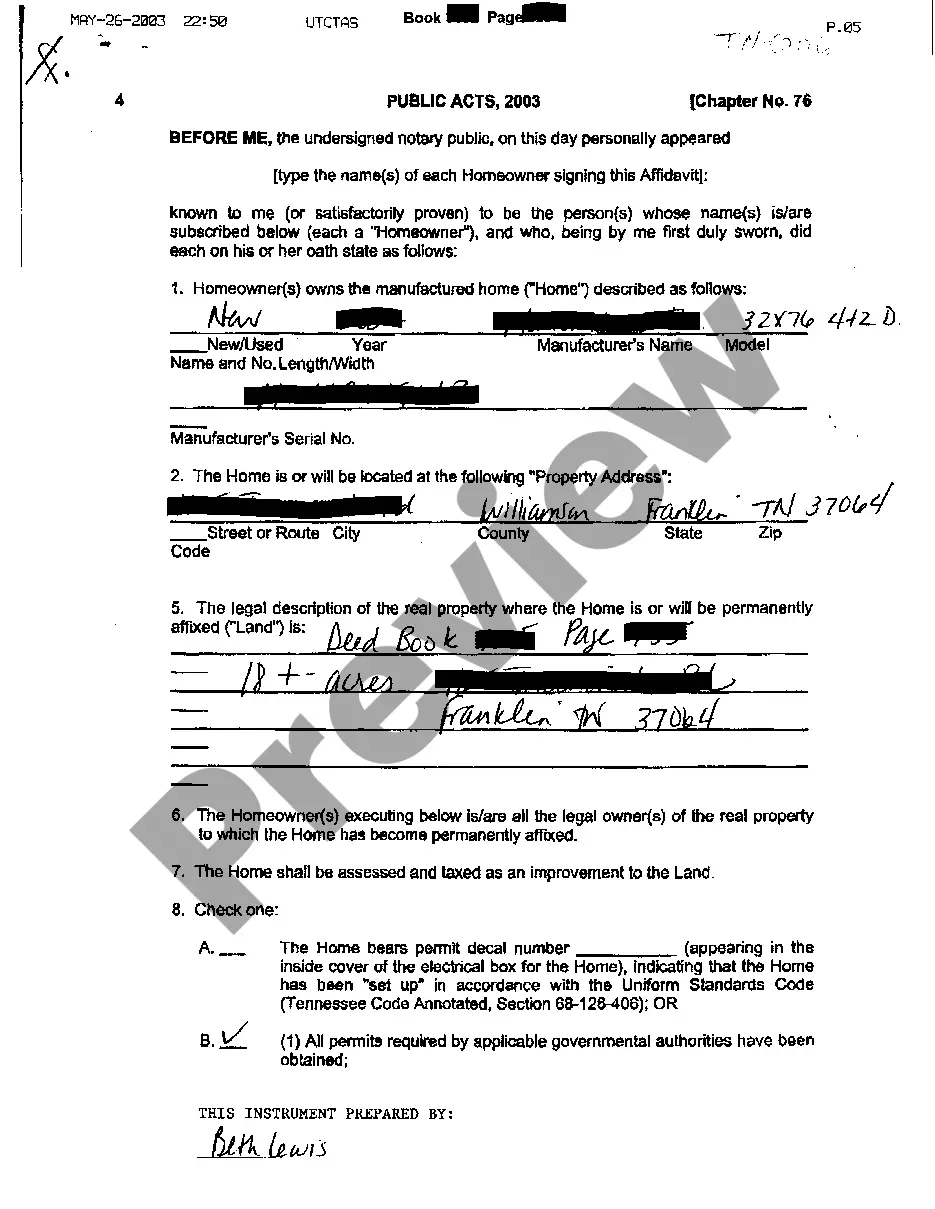

The Washington Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a legally binding document that outlines the decision and approval of LLC members to secure a loan or borrow capital from a designated bank. This document is crucial for formalizing the LLC's intent to obtain financial resources for the business's operations, expansion, or any other approved purpose. The resolution begins with a header indicating its purpose, such as "Washington Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank." It may also include other essential information like the LLC's name, registered address, and the date when the meeting took place. Key components of the Washington Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank include: 1. Introduction: This section outlines the purpose of the resolution, stating that the LLC members gathered in a meeting to deliberate and approve the decision to borrow capital from a designated bank. 2. Meeting Attendance: Here, the names of all attending LLC members are listed, along with their respective ownership percentages or interest in the LLC. This ensures that all qualified members were present during the decision-making process. 3. Resolution Approval: This segment states that the LLC members, after due discussion and consideration, have unanimously agreed to authorize the LLC to secure a loan or borrow a specified amount of capital from a designated bank. The specific loan details may include the loan amount, interest rate, repayment terms, and any collateral requirements, if applicable. 4. Loan Purpose: In this section, the resolution should clearly define the purpose for which the capital will be utilized. Common reasons include working capital, equipment purchase, business expansion, debt consolidation, or any other legitimate business need. 5. Signatures: The resolution must be signed by all LLC members attending the meeting. Each member should print their name, indicate their ownership interest, and provide their signature and the date. This validates their consent and agreement to borrow capital from the designated bank as outlined in the resolution. Different types or variations of the Washington Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank may exist depending on the specific needs of the LLC. For example, there may be: 1. The Washington Resolution of Meeting of LLC Members to Obtain a Line of Credit from Designated Bank: This type of resolution focuses on obtaining a revolving line of credit rather than a lump sum loan capital. 2. The Washington Resolution of Meeting of LLC Members to Secure Capital from Multiple Designated Banks: If the LLC decides to raise capital from various banks or financial institutions to diversify its funding sources, this type of resolution would be appropriate. Overall, the Washington Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank serves as a formal record of the LLC members' unanimous decision to seek financial resources and strengthens the LLC's ability to enter into loan agreements with designated banks.

Washington Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

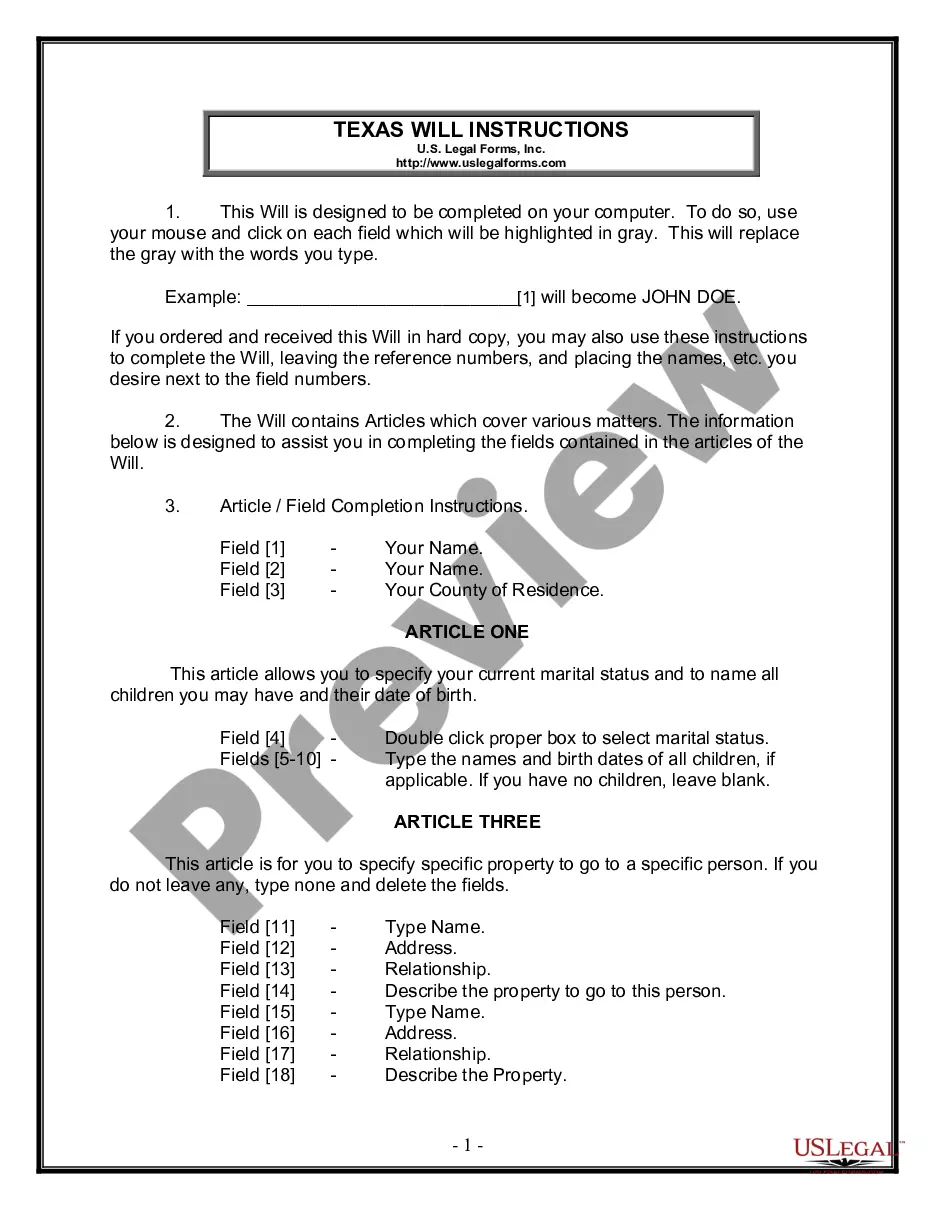

How to fill out Washington Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

US Legal Forms - one of several most significant libraries of legal varieties in the USA - provides a wide array of legal file themes you may down load or print. Using the internet site, you may get a huge number of varieties for enterprise and personal uses, categorized by classes, says, or keywords.You will find the latest versions of varieties like the Washington Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank within minutes.

If you already have a subscription, log in and down load Washington Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank from the US Legal Forms library. The Download key can look on each type you perspective. You gain access to all formerly saved varieties in the My Forms tab of your own account.

If you want to use US Legal Forms the first time, listed below are basic recommendations to help you started out:

- Make sure you have chosen the correct type for your personal metropolis/area. Select the Review key to check the form`s content. Browse the type outline to actually have chosen the proper type.

- In case the type doesn`t satisfy your specifications, utilize the Search area near the top of the display to find the the one that does.

- Should you be pleased with the form, confirm your choice by clicking the Purchase now key. Then, select the prices prepare you like and supply your qualifications to sign up for the account.

- Process the purchase. Make use of your bank card or PayPal account to perform the purchase.

- Select the structure and down load the form on the product.

- Make adjustments. Complete, revise and print and signal the saved Washington Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

Each and every format you included with your account lacks an expiration day and is the one you have forever. So, if you wish to down load or print one more copy, just proceed to the My Forms portion and then click around the type you want.

Get access to the Washington Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank with US Legal Forms, by far the most extensive library of legal file themes. Use a huge number of skilled and express-distinct themes that meet your company or personal demands and specifications.

Form popularity

FAQ

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

When you create a resolution to open a bank account, you need to include the following information:The legal name of the corporation.The name of the bank where the account will be created.The state where the business is formed.Information about the directors/members.More items...

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

When you create a resolution to authorize borrowing on a line of credit, you need to include the following information:The legal name of the corporation.The name of the bank where the corporation is authorized to borrow from.Maximum loan amount that may be borrowed from the bank.Interest rate (numerical)More items...

Loan Resolution means that certain Resolution adopted by the Board of the City on November 13, 2017, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

RESOLVED THAT the company do hereby obtain and avail financial assistance/Credit facility of an amount not exceeding (Loan or Credit/Overdraft amount) from (Name, Branch and Address of the bank) in order to meet the (requirements of the company), and such loan shall be obtained on such terms and conditions as specified

Letter of Resolution means a letter advising the party accused, and any person who, in writing informed or complained to the Executive Director concerning any such violation, that the alleged violation has been resolved and the manner by which it was resolved.