Keywords: Washington, Resolution, Meeting, LLC Members, Specific Loan Title: Understanding the Washington Resolution of Meeting of LLC Members to Make Specific Loan — Types and Process Introduction: The Washington Resolution of Meeting of LLC Members to Make Specific Loan is a crucial step for Limited Liability Companies (LCS) operating in Washington State when deciding to take on a specific loan. This article aims to provide a detailed description of what this resolution entails, explaining its purpose, types, and the overall process involved. I. Purpose of Resolution: The Washington Resolution of Meeting of LLC Members to Make Specific Loan serves as an official document that authorizes the LLC to pursue a particular loan. It outlines the LLC's intentions, the loan amount, terms, and any associated conditions. II. Types of Washington Resolution of Meeting of LLC Members to Make Specific Loan: 1. Acquisition Loan Resolution: This type of resolution is used when an LLC plans to obtain a loan for acquiring assets, such as properties, equipment, or inventory. The resolution specifies the loan purpose and provides the necessary authorization for the LLC to proceed with the acquisition. 2. Expansion Loan Resolution: When an LLC aims to expand its operations or undertake a significant project, an expansion loan resolution is necessary. This resolution outlines the LLC's expansion plans, the loan amount required, and the anticipated benefits to the LLC's growth and profitability. 3. Operating Loan Resolution: LCS often require short-term funding to cover day-to-day operational expenses, including salaries, utilities, and inventory. An operating loan resolution provides authorization for obtaining such loans and determines the repayment terms and conditions. III. Process of Implementing the Resolution: 1. LLC Member Meeting: The LLC's members convene a meeting to discuss the need for a specific loan and the proposed terms. Each member is given the opportunity to voice their opinions and concerns regarding the loan. 2. Drafting the Resolution: After the meeting, a written resolution is drafted, capturing the details discussed, including the loan purpose, amount, interest rate, repayment period, and any collateral offered. The resolution is typically prepared by the LLC's legal counsel or an authorized member. 3. Voting and Approval: During the LLC member meeting, a formal vote is conducted to approve the resolution. The resolution must receive the majority vote from the members to be adopted. 4. Record Keeping: Once approved, the resolution becomes an integral part of the LLC's records. It should be documented in the minutes of the meeting and placed in the LLC's official records for future reference. Conclusion: The Washington Resolution of Meeting of LLC Members to Make Specific Loan provides LCS in Washington State with a formal process to authorize and approve specific loans. By understanding the purpose, types, and process involved in implementing this resolution, LLC members can make informed decisions regarding their financial activities while ensuring compliance with Washington State regulations.

Washington Resolution of Meeting of LLC Members to Make Specific Loan

Description

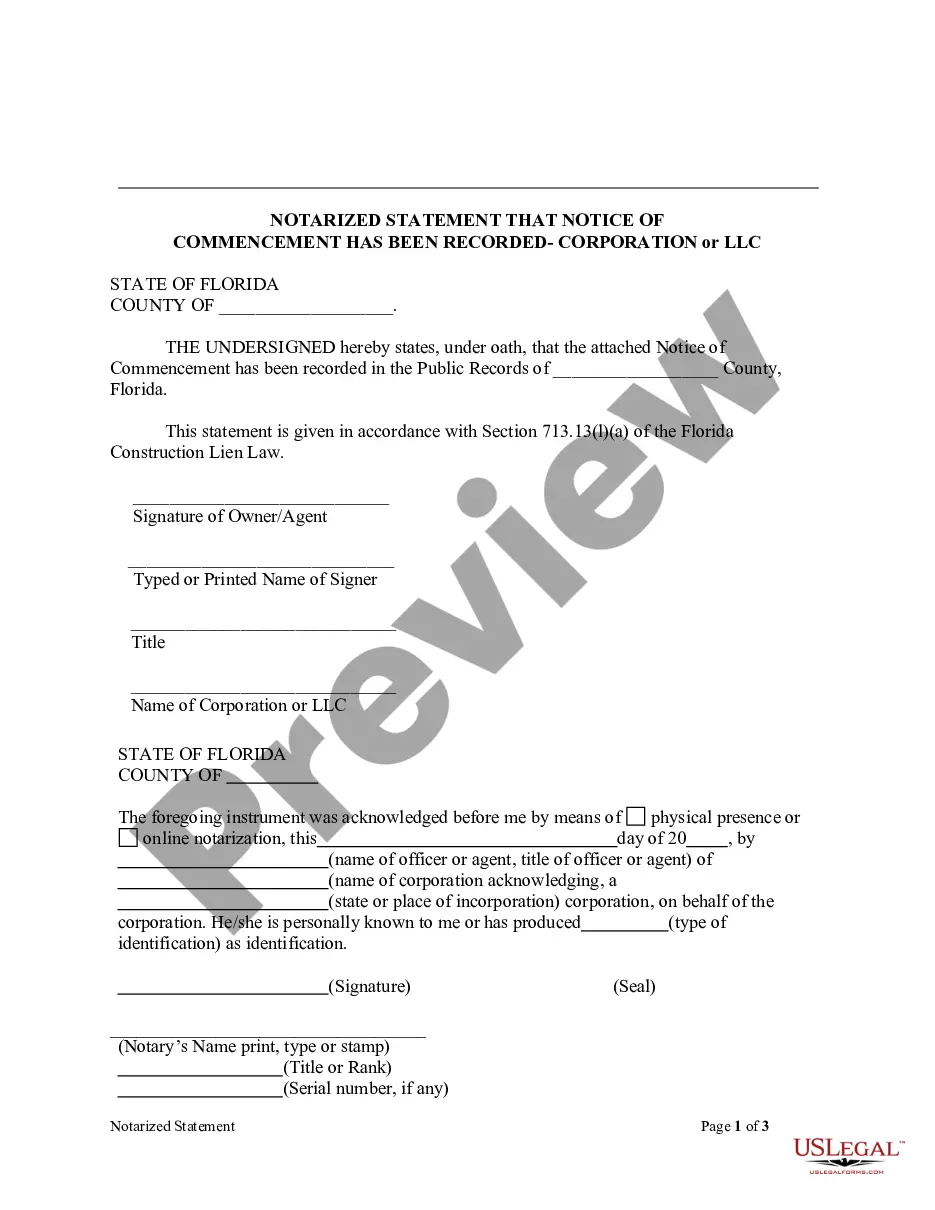

How to fill out Washington Resolution Of Meeting Of LLC Members To Make Specific Loan?

US Legal Forms - among the largest libraries of lawful types in the States - gives a variety of lawful papers layouts it is possible to down load or print out. Making use of the site, you can find a huge number of types for organization and individual reasons, sorted by categories, says, or keywords.You can find the latest versions of types such as the Washington Resolution of Meeting of LLC Members to Make Specific Loan in seconds.

If you already have a monthly subscription, log in and down load Washington Resolution of Meeting of LLC Members to Make Specific Loan through the US Legal Forms catalogue. The Down load switch can look on each and every develop you perspective. You have accessibility to all earlier saved types inside the My Forms tab of the bank account.

In order to use US Legal Forms the first time, listed below are straightforward instructions to get you began:

- Make sure you have picked out the correct develop for your town/state. Click on the Review switch to examine the form`s articles. See the develop outline to actually have selected the right develop.

- In case the develop doesn`t match your specifications, use the Lookup discipline on top of the screen to obtain the the one that does.

- If you are pleased with the form, confirm your choice by clicking on the Buy now switch. Then, opt for the rates prepare you want and supply your references to register for the bank account.

- Process the transaction. Utilize your charge card or PayPal bank account to complete the transaction.

- Find the structure and down load the form on your product.

- Make alterations. Load, modify and print out and indicator the saved Washington Resolution of Meeting of LLC Members to Make Specific Loan.

Every format you added to your account lacks an expiration time and it is your own property for a long time. So, if you would like down load or print out another duplicate, just proceed to the My Forms portion and then click in the develop you require.

Obtain access to the Washington Resolution of Meeting of LLC Members to Make Specific Loan with US Legal Forms, probably the most extensive catalogue of lawful papers layouts. Use a huge number of professional and condition-distinct layouts that satisfy your business or individual requirements and specifications.

Form popularity

FAQ

A corporate resolution is a legal document that outlines actions a board of directors will take on behalf of a corporation. by Staff.

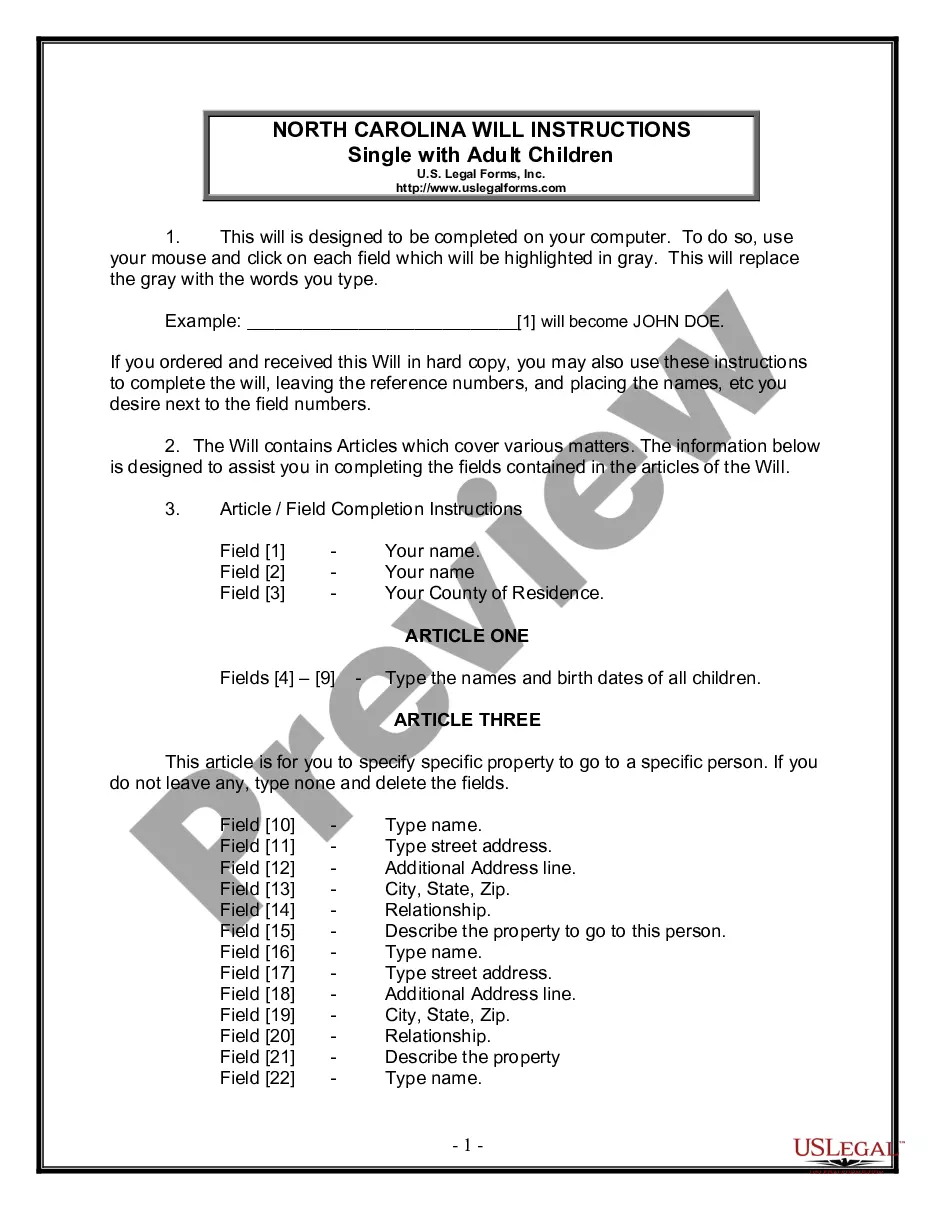

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Corporate resolutions are required whenever the board of directors makes a major decision. The resolution acts as a written record of the decision and is stored with other business documents. These board resolutions are binding on the company.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16-Jun-2021