The Washington Business Reducibility Checklist is an essential tool for businesses operating in the state of Washington to ensure they are claiming all the eligible tax deductions. This comprehensive checklist provides a detailed overview of various deductible expenses that businesses can claim on their tax returns, ultimately maximizing their tax savings. One important aspect covered in the Washington Business Reducibility Checklist is the deduction for business-related expenses, such as rent, utilities, and office supplies. By carefully documenting these expenses and meeting the necessary criteria, businesses can claim a deduction, reducing their overall tax liability. Another notable section of the Washington Business Reducibility Checklist focuses on employee-related expenses. This includes deductions for wages, benefits, and training expenses. By adhering to the specific guidelines laid out in this checklist, businesses can ensure they are claiming all the appropriate deductions associated with their employees. Additionally, the Washington Business Reducibility Checklist covers deductions related to business travel and entertainment expenses. This section outlines the requirements for deducting expenses incurred during business trips, including airfare, accommodation, and meals. It also provides guidance on deducting entertainment expenses that are directly related to business activities. Furthermore, the Washington Business Reducibility Checklist encompasses various deductions specific to different industries. For instance, there may be separate categories for deductions relevant to retail businesses, manufacturing companies, service providers, and professionals like doctors or attorneys. These industry-specific checklists help businesses identify deductions that are unique to their sector and ensure they are not overlooking any eligible expenses. It is important to note that the Washington Business Reducibility Checklist may have different versions, updated annually or periodically, to keep pace with changing tax regulations and guidelines. Businesses should always use the most recent version to ensure compliance and accurate deduction claims. In conclusion, the Washington Business Reducibility Checklist is a comprehensive resource designed to assist businesses in Washington State to claim all eligible tax deductions. By regularly referencing and following this checklist, businesses can optimize their tax savings, reduce their overall tax liability, and stay in full compliance with the state's tax laws.

Washington Business Deductibility Checklist

Description

How to fill out Washington Business Deductibility Checklist?

Are you currently in a position the place you will need documents for both company or specific functions virtually every day time? There are a lot of legitimate record themes available on the net, but discovering kinds you can rely on isn`t straightforward. US Legal Forms gives a huge number of form themes, much like the Washington Business Deductibility Checklist, which can be written in order to meet state and federal requirements.

In case you are already familiar with US Legal Forms internet site and also have a free account, basically log in. Following that, it is possible to obtain the Washington Business Deductibility Checklist template.

Unless you come with an profile and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is for that proper town/region.

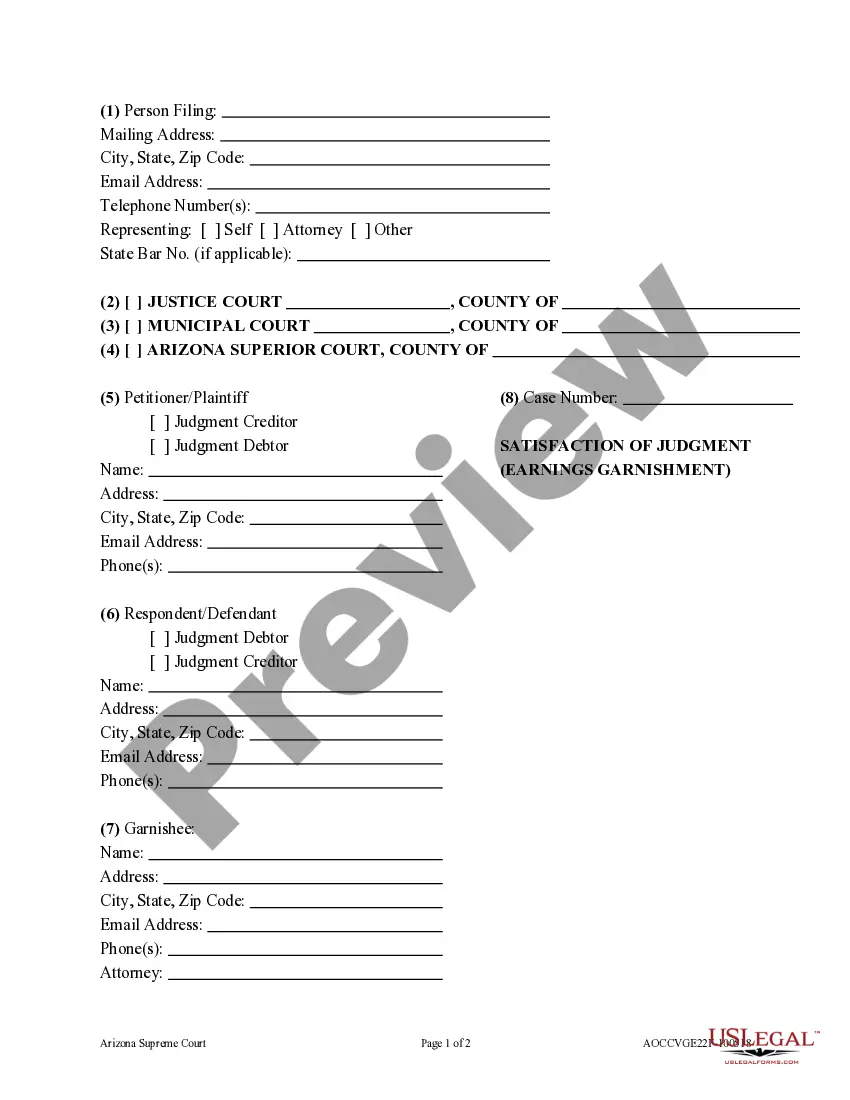

- Take advantage of the Review button to review the form.

- See the outline to ensure that you have selected the correct form.

- In case the form isn`t what you`re searching for, make use of the Look for discipline to obtain the form that meets your needs and requirements.

- Once you obtain the proper form, click on Get now.

- Opt for the rates program you desire, fill in the required details to create your money, and purchase an order with your PayPal or Visa or Mastercard.

- Select a hassle-free document structure and obtain your backup.

Get all the record themes you have purchased in the My Forms menus. You may get a more backup of Washington Business Deductibility Checklist whenever, if possible. Just select the needed form to obtain or produce the record template.

Use US Legal Forms, one of the most considerable variety of legitimate forms, to save time as well as prevent blunders. The service gives professionally manufactured legitimate record themes which can be used for an array of functions. Create a free account on US Legal Forms and begin creating your lifestyle a little easier.