Washington Guardianship Expenditures refer to the financial transactions and disbursements associated with the guardianship of incapacitated or vulnerable individuals in the state of Washington. Guardianship is a legal relationship established by a court when an individual is unable to make personal or financial decisions on their own due to a physical or mental disability. There are several types of Washington Guardianship Expenditures that can occur depending on the specific circumstances and needs of the incapacitated person: 1. Personal Care Expenses: These include costs associated with the daily living activities and personal needs of the ward, such as housing, food, clothing, and transportation. 2. Medical and Healthcare Expenses: This category covers the medical, dental, and therapy-related costs required for the ward's well-being. It includes expenses for doctor visits, medications, hospitalization, rehabilitation, and medical equipment. 3. Legal and Court Expenses: Guardianship proceedings involve legal processes, such as filing and preparing legal documents, court appearances, and attorney fees. These expenses ensure compliance with guardianship laws and regulations. 4. Education and Training Expenses: If the ward is pursuing education or vocational training, expenses related to tuition fees, books, supplies, and specialized programs can be classified under this category. 5. Financial Management Expenses: Guardians are responsible for managing the ward's finances, which may involve expenses related to the oversight of bank accounts, bill payments, tax filings, safekeeping assets, and accounting services. 6. Protective Services Expenses: In cases where the ward is at risk of exploitation or abuse, expenses related to obtaining protective services, such as guardianship monitoring, background checks, and security measures, may be incurred. 7. Miscellaneous Expenses: Various other expenses outside the aforementioned categories may arise, such as recreational activities, travel arrangements, insurance premiums, or any other necessary expenditures to ensure the well-being and quality of life for the ward. It is important for guardians to keep accurate records of all expenditures and obtain court approval when necessary to ensure transparency and accountability. Additionally, guardianship laws and regulations in Washington establish guidelines to protect the ward's assets and prevent financial exploitation or mismanagement.

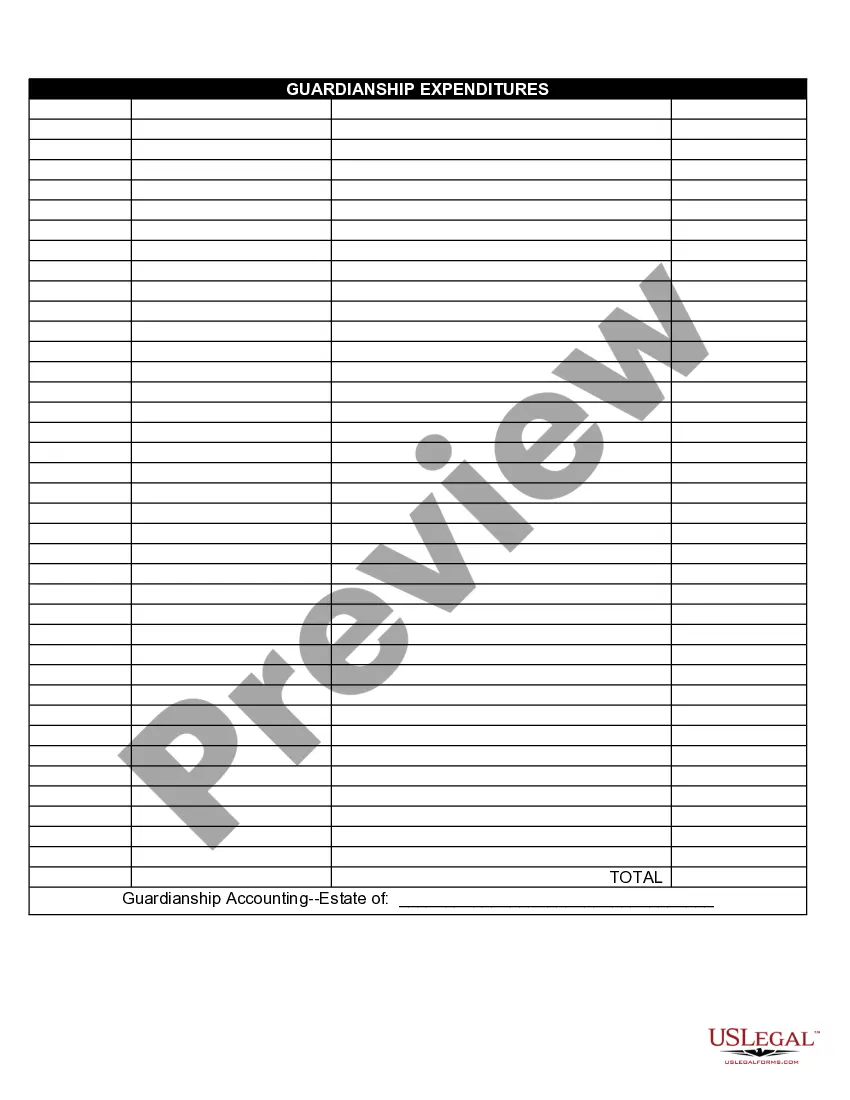

Washington Guardianship Expenditures

Description

How to fill out Washington Guardianship Expenditures?

US Legal Forms - among the most significant libraries of authorized varieties in the United States - offers a variety of authorized record themes you can acquire or printing. Making use of the website, you can find a large number of varieties for business and individual uses, sorted by classes, claims, or keywords.You will discover the most up-to-date versions of varieties such as the Washington Guardianship Expenditures in seconds.

If you already possess a monthly subscription, log in and acquire Washington Guardianship Expenditures through the US Legal Forms local library. The Down load option will appear on every single form you view. You get access to all in the past delivered electronically varieties in the My Forms tab of the accounts.

If you would like use US Legal Forms the first time, listed below are easy instructions to help you get started off:

- Ensure you have chosen the proper form to your city/region. Click the Preview option to analyze the form`s articles. Look at the form description to ensure that you have selected the right form.

- In case the form does not match your needs, utilize the Look for industry towards the top of the display to find the one that does.

- When you are content with the shape, confirm your option by clicking the Buy now option. Then, pick the prices program you favor and provide your qualifications to sign up for an accounts.

- Process the purchase. Make use of credit card or PayPal accounts to perform the purchase.

- Find the formatting and acquire the shape on your own system.

- Make alterations. Fill out, revise and printing and indicator the delivered electronically Washington Guardianship Expenditures.

Each template you put into your bank account does not have an expiry time and is also the one you have for a long time. So, if you wish to acquire or printing another duplicate, just go to the My Forms segment and then click around the form you want.

Gain access to the Washington Guardianship Expenditures with US Legal Forms, probably the most extensive local library of authorized record themes. Use a large number of specialist and status-particular themes that fulfill your small business or individual demands and needs.