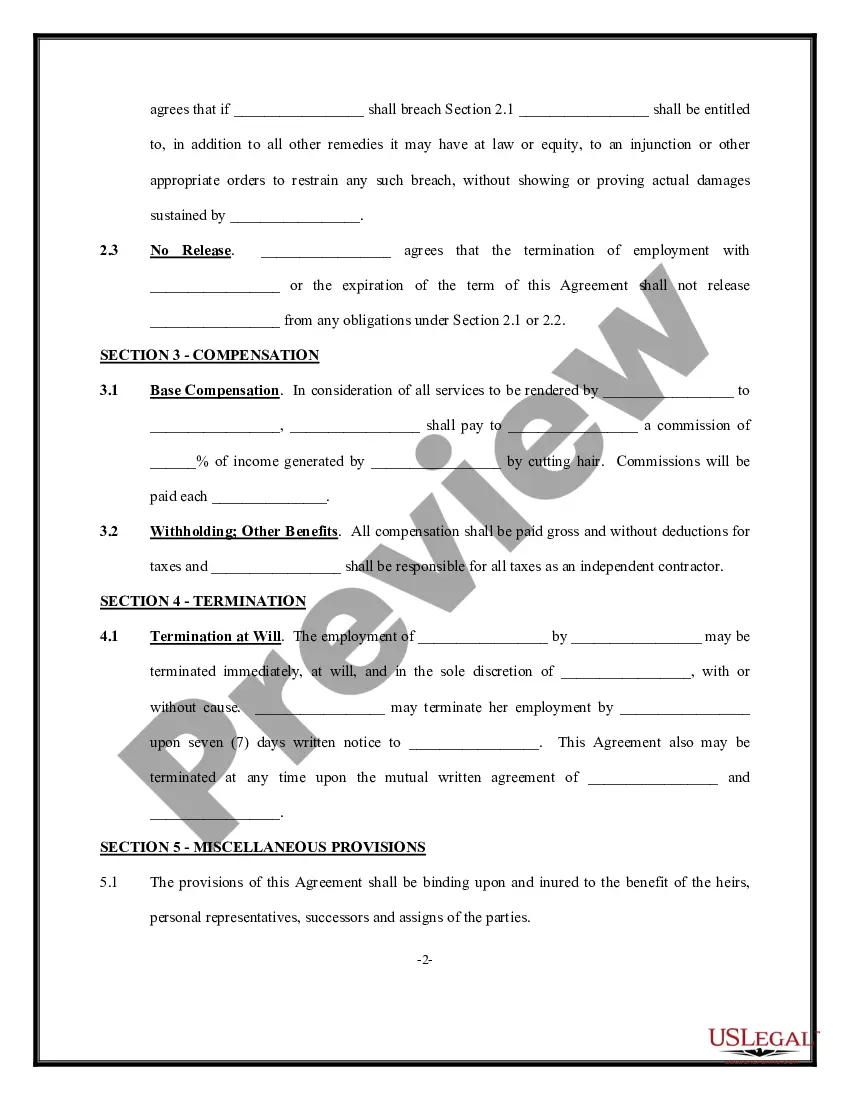

Washington Independent Contractor Agreement for Hair Stylist

Description

How to fill out Independent Contractor Agreement For Hair Stylist?

If you want to total, download, or printing legitimate document templates, use US Legal Forms, the largest variety of legitimate types, which can be found online. Make use of the site`s simple and handy lookup to find the files you require. Various templates for organization and specific functions are sorted by groups and states, or search phrases. Use US Legal Forms to find the Washington Independent Contractor Agreement for Hair Stylist in just a few clicks.

In case you are previously a US Legal Forms consumer, log in to your accounts and then click the Down load option to obtain the Washington Independent Contractor Agreement for Hair Stylist. You may also entry types you earlier saved inside the My Forms tab of your respective accounts.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form to the correct town/nation.

- Step 2. Take advantage of the Preview method to examine the form`s content material. Don`t forget to see the description.

- Step 3. In case you are not happy with the develop, make use of the Look for area near the top of the display screen to locate other variations from the legitimate develop format.

- Step 4. Upon having located the form you require, click on the Buy now option. Pick the costs plan you like and put your credentials to register for the accounts.

- Step 5. Method the transaction. You may use your bank card or PayPal accounts to complete the transaction.

- Step 6. Select the structure from the legitimate develop and download it on your device.

- Step 7. Full, edit and printing or indication the Washington Independent Contractor Agreement for Hair Stylist.

Each legitimate document format you get is your own property forever. You may have acces to every single develop you saved inside your acccount. Select the My Forms segment and select a develop to printing or download again.

Be competitive and download, and printing the Washington Independent Contractor Agreement for Hair Stylist with US Legal Forms. There are millions of specialist and status-distinct types you can utilize to your organization or specific demands.

Form popularity

FAQ

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Who Is Affected by AB5 Legislation? AB5 legislation is likely to affect any businesses that rely on independent contract work in the state of California. This includes companies like Uber, Lyft, and DoorDash. In fact, The Outline reports that Uber and Lyft have pledged to spend $90 million on a fight against the bill.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Hairdressers are Exempt from AB5 Under AB5's Professional Services carve-out, hairdressers (defined as a licensed barber or cosmetologist) are exempt from AB5.

The Professional Services Exemption AB 5 exempted a number of professionals from application of the ABC test, including lawyers, doctors, securities broker-dealers, and certain commercial fishermen.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The Legal Structure of a Beauty Salon The usual choices as sole-proprietorship, LLC and LLP. Sole-proprietors are simply single-owned salons, with the owner taking on the financial and legal risks of the business. If things go great, the owner gets all the credit.

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual