The Washington Self-Employed Independent Contractor Employment Agreement for Hair Salon or Barber Shop is a legally binding document that outlines the terms and conditions for individuals working as independent contractors in the hair salon or barber shop industry in the state of Washington. This agreement ensures a clear understanding between the salon or barbershop owner and the independent contractor, protecting both parties' rights and responsibilities. The agreement covers various key aspects related to the employment arrangement, including but not limited to: 1. Identification of Parties: Clearly specifies the names and addresses of both the salon or barbershop owner (referred to as the "Employer") and the independent contractor (referred to as the "Contractor"). 2. Nature of Relationship: Defines that the independent contractor is not an employee but a self-employed professional, responsible for their own taxes, insurance, and other obligations. 3. Scope of Work: Describes the specific services or tasks the contractor will perform, such as hairstyling, hair cutting, beard trimming, coloring, or any other related services. 4. Schedule and Compensation: Details the agreed-upon working hours, days, and the method and frequency of payment, whether it is hourly, commission-based, or a combination. 5. Clientele and Appointments: Clarifies whether the contractor will have access to the salon or barbershop's existing clientele or if they are responsible for bringing their own clients. Outlines any limitations regarding scheduling and appointments, including potential shared client lists. 6. Use of Salon or Barbershop Facilities: States whether the contractor will have access to the salon or barbershop's equipment, tools, and facilities and if any fees or additional arrangements are required. 7. Products and Supplies: Specifies who provides the necessary hair care products, tools, and supplies, as well as any obligations related to their maintenance and replacement. 8. Confidentiality and Non-competition: Establishes confidentiality obligations, preventing the contractor from disclosing trade secrets or client information, as well as any non-competition restrictions for a certain period and geographical area. 9. Termination: Outlines the conditions under which either party can terminate the agreement, including any notice period required and the consequences of early termination. 10. Governing Law and Dispute Resolution: Determines which state laws will govern the agreement and the preferred method of resolving any disputes, such as mediation or arbitration. Different types of Washington Self-Employed Independent Contractor Employment Agreement for Hair Salon or Barber Shop may exist to cater to specific circumstances. For instance, there might be separate agreements for booth renters, freelance hairstylists, or apprentice barbers. It is crucial to choose the appropriate agreement that aligns with the specific employment situation to ensure clarity and compliance with Washington state laws. In conclusion, the Washington Self-Employed Independent Contractor Employment Agreement for Hair Salon or Barber Shop is an essential document that protects both the salon or barbershop owner and the independent contractor by establishing clear guidelines for their working relationship. It ensures proper communication and responsibilities, allowing the parties involved to focus on providing quality hair care services while abiding by Washington state laws and regulations.

Washington Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

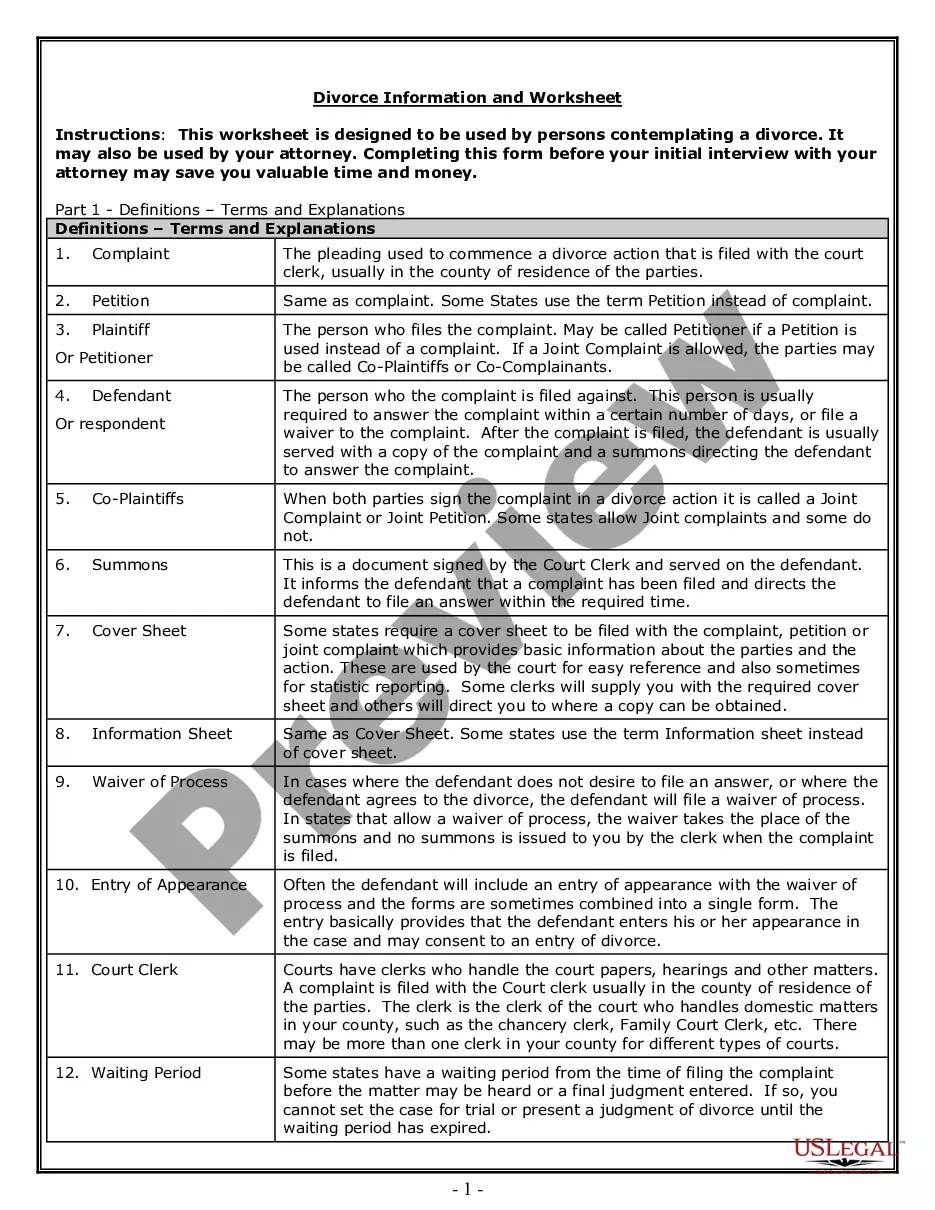

How to fill out Washington Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

Are you presently within a placement that you need files for possibly company or specific uses virtually every time? There are a variety of legal file layouts accessible on the Internet, but discovering types you can depend on is not straightforward. US Legal Forms provides a large number of develop layouts, such as the Washington Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop, that are composed in order to meet state and federal demands.

Should you be currently knowledgeable about US Legal Forms web site and get a merchant account, merely log in. After that, it is possible to obtain the Washington Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop design.

If you do not offer an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and ensure it is for that correct area/state.

- Use the Preview key to review the shape.

- Read the explanation to ensure that you have chosen the correct develop.

- In case the develop is not what you are seeking, make use of the Look for area to discover the develop that meets your needs and demands.

- Whenever you discover the correct develop, just click Purchase now.

- Opt for the pricing prepare you need, fill in the necessary info to generate your bank account, and purchase an order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper structure and obtain your version.

Discover all the file layouts you possess bought in the My Forms food list. You can obtain a extra version of Washington Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop at any time, if possible. Just select the needed develop to obtain or produce the file design.

Use US Legal Forms, probably the most substantial assortment of legal varieties, to save some time and avoid faults. The support provides skillfully manufactured legal file layouts which can be used for a selection of uses. Produce a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.

Independent contractors are considered to be self-employed, and so businesses that use independent contractors don't have to pay employment taxes for their contractors. Instead, contractors are required to pay self-employment taxes.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual