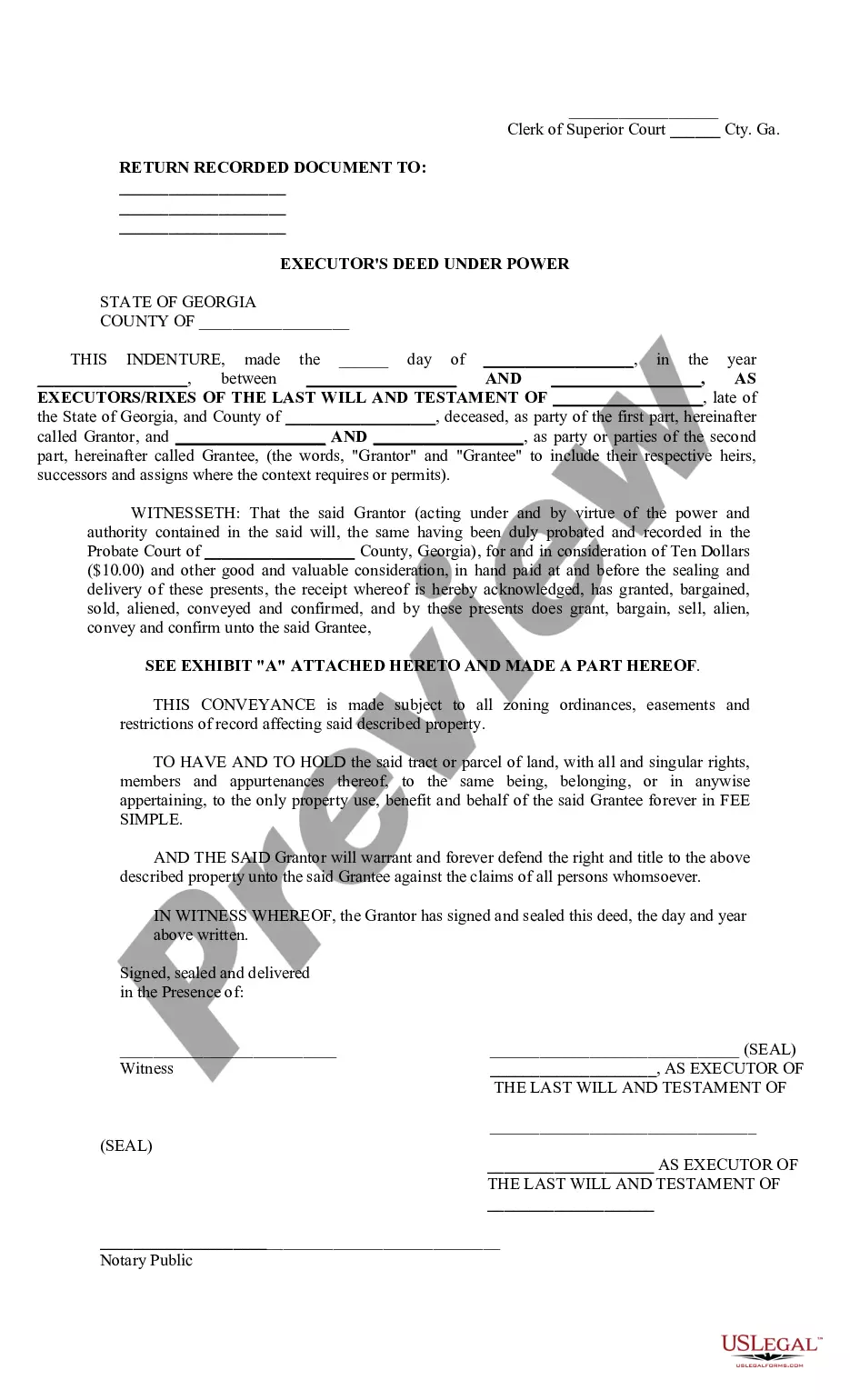

Washington Power of Attorney by Trustee of Trust

Description

How to fill out Power Of Attorney By Trustee Of Trust?

You may commit hrs on-line attempting to find the legal file web template that meets the federal and state demands you require. US Legal Forms offers a huge number of legal forms which are reviewed by experts. It is simple to acquire or produce the Washington Power of Attorney by Trustee of Trust from the support.

If you already possess a US Legal Forms profile, you are able to log in and then click the Download key. Afterward, you are able to total, revise, produce, or sign the Washington Power of Attorney by Trustee of Trust. Each and every legal file web template you get is your own eternally. To get another copy associated with a bought form, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms internet site initially, keep to the easy directions below:

- Initial, be sure that you have selected the best file web template for the county/town of your liking. Look at the form explanation to make sure you have picked the right form. If available, utilize the Review key to appear from the file web template at the same time.

- If you would like locate another edition in the form, utilize the Lookup area to find the web template that meets your needs and demands.

- After you have found the web template you would like, simply click Acquire now to proceed.

- Pick the pricing prepare you would like, enter your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal profile to purchase the legal form.

- Pick the structure in the file and acquire it to the product.

- Make modifications to the file if possible. You may total, revise and sign and produce Washington Power of Attorney by Trustee of Trust.

Download and produce a huge number of file templates while using US Legal Forms Internet site, that provides the most important assortment of legal forms. Use professional and status-particular templates to take on your company or specific demands.

Form popularity

FAQ

All trustees have the power to manage trust assets. This may include the sale and purchase of trust property and making investments. The trustee must decide whether to use its power to manage assets on a case-by-case basis and must only consider relevant factors when deciding to exercise any power.

Section 25 of the Trustee Act 1925 allows a trustee to grant a power of attorney delegating their functions as a trustee to the attorney. Section 25 provides a short form of power by which a single donor can delegate trustee functions under a single trust to a single donee. Trustees can use other forms.

A Trustee is considered the legal owner of all Trust assets. And as the legal owner, the Trustee has the right to manage the Trust assets unilaterally, without direction or input from the beneficiaries.

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

Generally, a beneficiary designation will override the trust provisions. There are situations, however, in which the beneficiary designation will fail and the proceeds of the account will pass under the terms of the trust.

Generally speaking, a Trustee (who is not also the Grantor) cannot appoint a Power of Attorney to take over the Trustee's duties or responsibilities, unless this is something that is directly permitted by the Trust Deed or a court order.

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend

1) Duty to Inform Beneficiaries (Section 16060). 2) Duty to Provide Terms of Trust at Beneficiary's Request (Section 16060.7). 3) Duty to Report at Beneficiary's Request (Section 16061).

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend