Washington Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

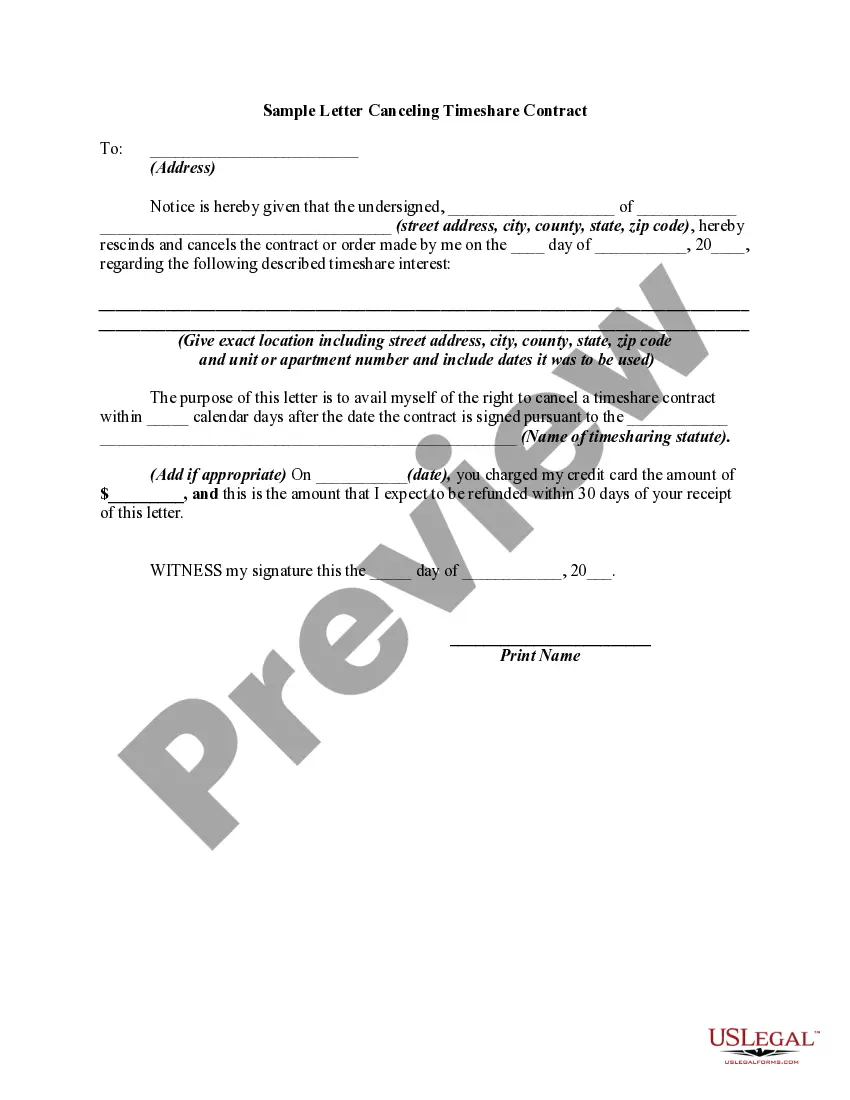

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

Finding the appropriate legal document template can be quite challenging.

Certainly, there are many templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Washington Acknowledgment Form for Consultants or Self-Employed Independent Contractors, which can be utilized for business and personal purposes.

First, ensure you have selected the correct form for your city/state. You can review the document using the Preview button and read the description to confirm it’s the right one for you.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Washington Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

- Use your account to review the legal forms you have previously obtained.

- Navigate to the My documents tab in your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple guidelines you should follow.

Form popularity

FAQ

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

While your clients do not take taxes out of your pay, they do report your 1099 earnings to the IRS. Your clients are required to send you a 1099 when you earn $600 or more in a year.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

Do Independent Contractors Need A Business License In Washington State? If you are an independent contractor, you must register with the Department of Revenue unless you: Make less than $12,000 before expenses per year; Do not sell retail; Do not pay or collect any taxes.

At that point the Consultant may be said to become a Contractor. The terms have also become blurred as industry has incorporated them into employee job titles. Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

When you work as a consultant, you are considered a self-employed individual. Most companies treat consultants as independent contractors.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.