Washington Determining Self-Employed Independent Contractor Status

Description

How to fill out Determining Self-Employed Independent Contractor Status?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document forms that you can download or print.

Through the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can obtain the most current versions of forms such as the Washington Determining Self-Employed Independent Contractor Status in just a few minutes.

If you have a subscription, Log In to download the Washington Determining Self-Employed Independent Contractor Status from your US Legal Forms library. The Download icon will appear on every form you view. You can access all previously downloaded documents from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your device. Make edits. Fill out, modify, and print and sign the downloaded Washington Determining Self-Employed Independent Contractor Status. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Washington Determining Self-Employed Independent Contractor Status through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your organizational or personal needs.

- Ensure that you have selected the correct form for your city/region.

- Click on the Preview option to review the form’s contents.

- Examine the form overview to confirm you have selected the right document.

- If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your credentials to set up an account.

Form popularity

FAQ

A 1099 (Miscellaneous Income) form issued by the business. A narrated conversation with the employer. For FS, self-employed clients can be certified once without income verification. At the time of certification, explain to the client - in writing - that they must begin keeping income records.

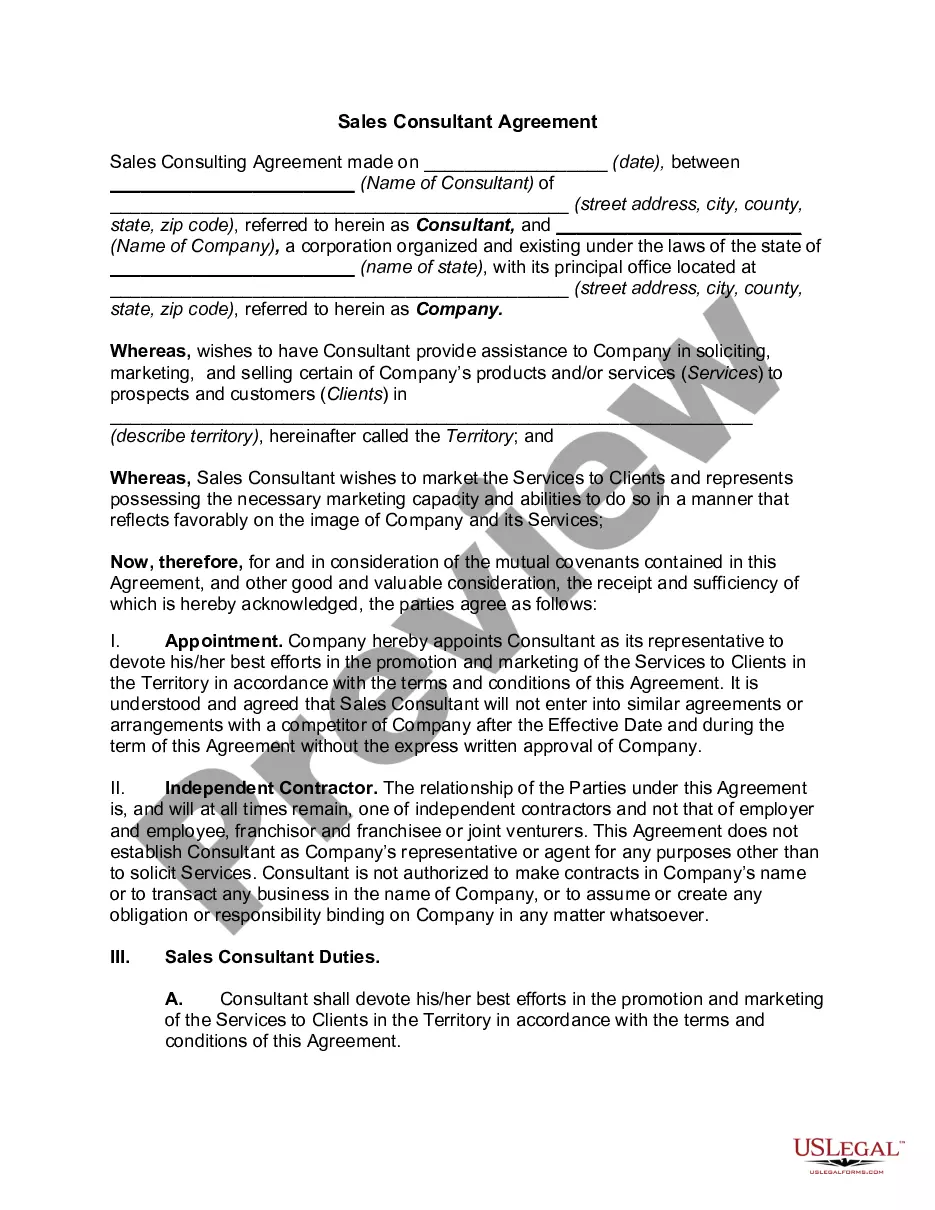

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How to demonstrate that you are an independent worker on your resumeMention that time when you had to work on a project on your own.Talk about projects that required extra accountability.Describe times when you had to manage several projects all at once.More items...

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

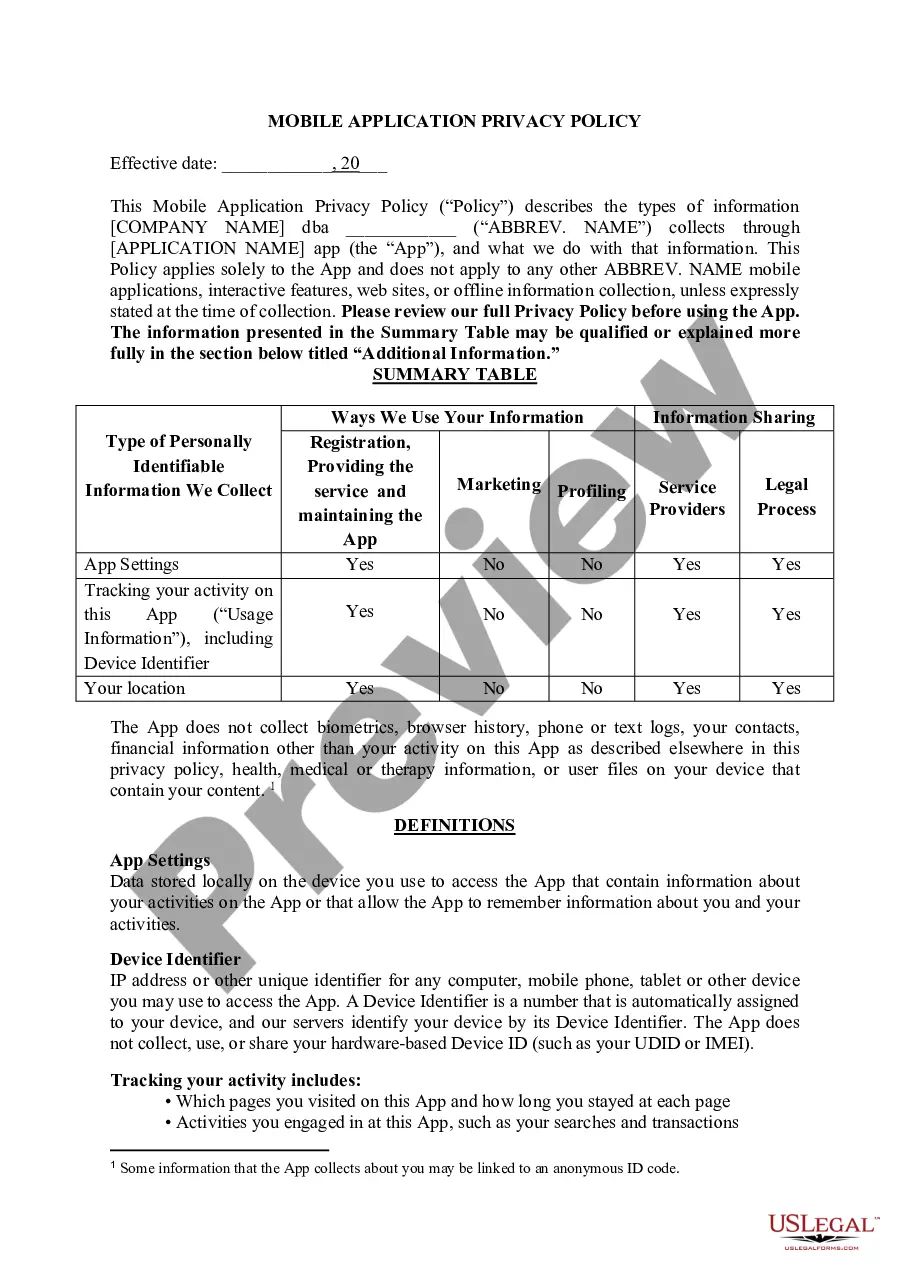

For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors. To determine whether a person is an employee or an independent contractor, the company weighs factors to identify the degree of control it has in the relationship with the person.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Independent contractors are considered to be self-employed, and so businesses that use independent contractors don't have to pay employment taxes for their contractors. Instead, contractors are required to pay self-employment taxes.