Washington Employee Evaluation Form for Nonprofit

Description

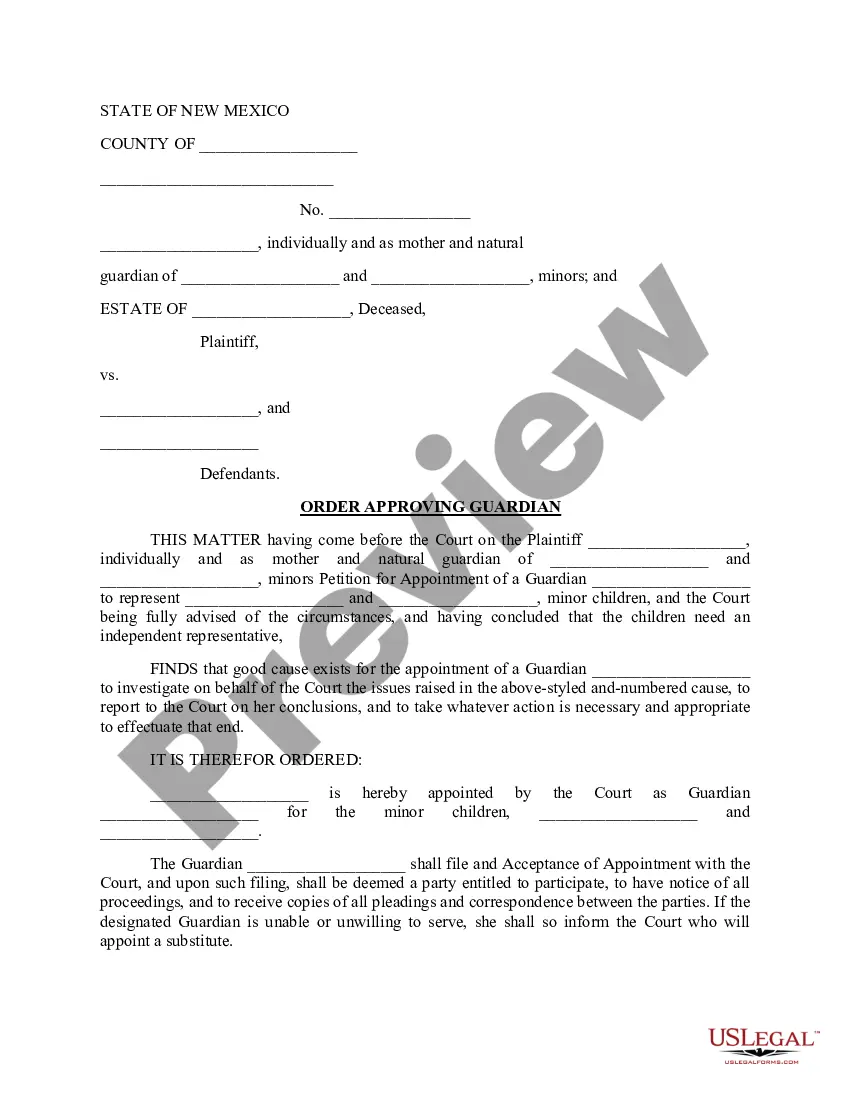

How to fill out Washington Employee Evaluation Form For Nonprofit?

US Legal Forms - one of many greatest libraries of legitimate kinds in the States - provides a wide range of legitimate record layouts it is possible to acquire or printing. Making use of the website, you can find a large number of kinds for company and individual reasons, categorized by categories, says, or keywords.You can get the most recent versions of kinds like the Washington Employee Evaluation Form for Nonprofit in seconds.

If you already have a membership, log in and acquire Washington Employee Evaluation Form for Nonprofit from the US Legal Forms local library. The Download switch can look on each and every develop you perspective. You have accessibility to all previously acquired kinds inside the My Forms tab of your own account.

If you wish to use US Legal Forms initially, listed here are straightforward guidelines to get you started:

- Make sure you have picked the correct develop for the city/state. Click the Preview switch to analyze the form`s articles. Browse the develop explanation to actually have chosen the correct develop.

- If the develop does not match your specifications, utilize the Lookup discipline towards the top of the screen to discover the one which does.

- In case you are content with the shape, confirm your decision by simply clicking the Get now switch. Then, select the prices prepare you want and supply your references to register for an account.

- Approach the purchase. Make use of your credit card or PayPal account to finish the purchase.

- Pick the file format and acquire the shape on your device.

- Make adjustments. Fill up, change and printing and indication the acquired Washington Employee Evaluation Form for Nonprofit.

Each and every design you included in your bank account lacks an expiry day which is yours permanently. So, if you wish to acquire or printing another copy, just visit the My Forms section and then click in the develop you want.

Get access to the Washington Employee Evaluation Form for Nonprofit with US Legal Forms, probably the most extensive local library of legitimate record layouts. Use a large number of skilled and state-specific layouts that meet your small business or individual requirements and specifications.

Form popularity

FAQ

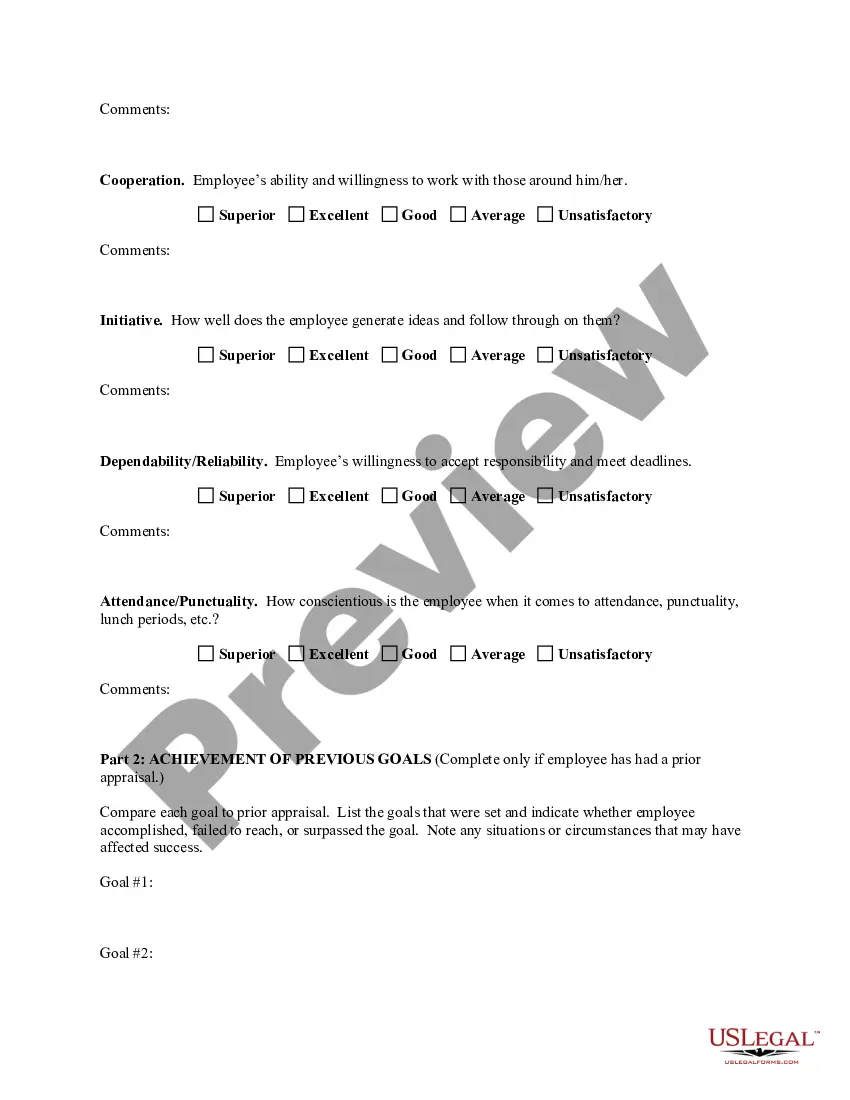

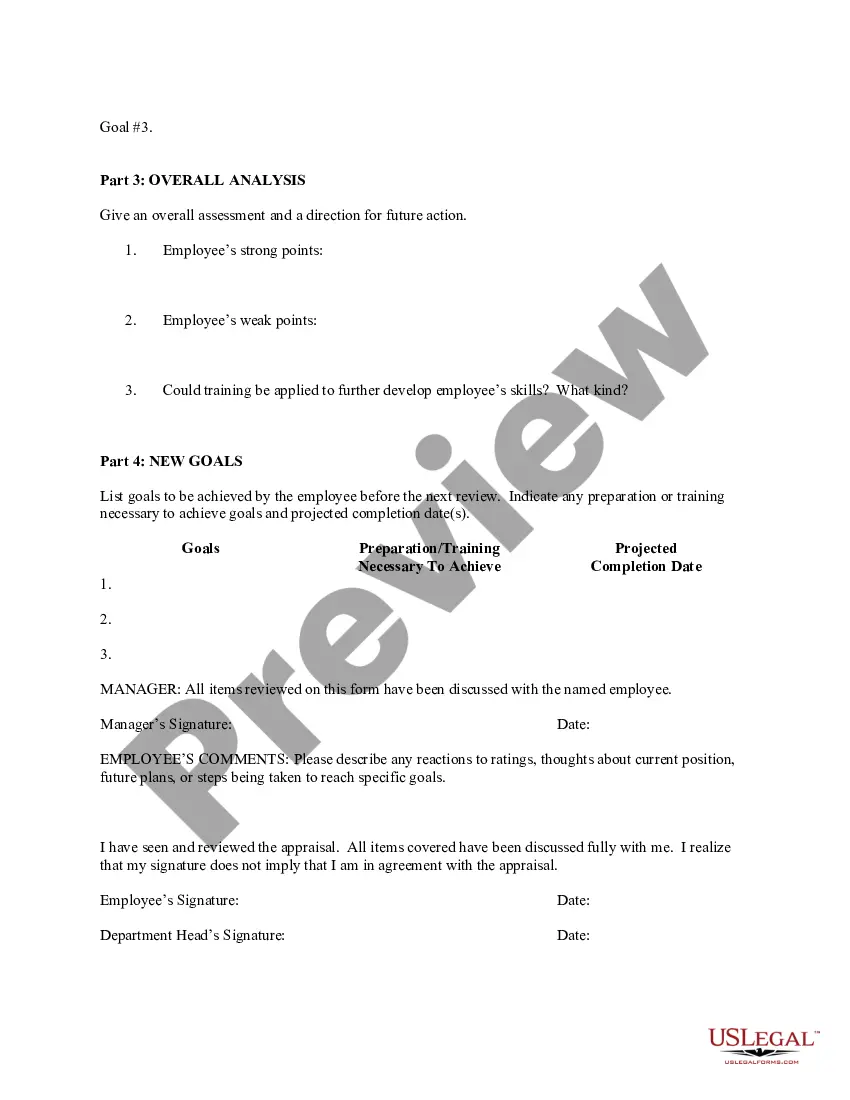

How to write an employee evaluationGather employee information. Gather required information related to the employee to get the full picture of their value to the company.List employee responsibilities.Use objective language.Use action verbs.Compare performance ratings.Ask open-ended questions.Use a point system.18-Jan-2022

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?27-Nov-2019

Most nonprofit groups track their performance by metrics such as dollars raised, membership growth, number of visitors, people served, and overhead costs. These metrics are certainly important, but they don't measure the real success of an organization in achieving its mission.

In Washington, nonprofit corporations must have at least one director. See RCW 24.03. 100. Many other states require a minimum of three directors.

The three main documents: the articles of incorporation, the bylaws, and the organizational meeting minutes; the nonprofit's directors' names and addresses (or the members' names and addresses if your nonprofit is a membership organization); and.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

Nonprofits must have at least three board members when they form.

In Washington, nonprofit corporations must have at least one director. See RCW 24.03. 100. Many other states require a minimum of three directors.

Even though nonprofits are exempt from income tax and not subject to withholding taxes, you must fill out and issue Form W-9 to the requesting business entities. In fact, all nonprofits must submit this form in order to be eligible for the tax-exempt status.

Nonprofit organizations can't legally operate without a designated board of directors that takes responsibility for ensuring legal compliance and accountability. A nonprofit board of directors is responsible for hiring capable staff, making big decisions and overseeing all operations.