Washington Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

Are you in a situation that you need documents for possibly enterprise or personal purposes virtually every day? There are a lot of legitimate record templates available on the Internet, but finding types you can trust is not simple. US Legal Forms provides thousands of form templates, like the Washington Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, which can be published to meet federal and state requirements.

When you are currently informed about US Legal Forms web site and have your account, merely log in. Afterward, you are able to obtain the Washington Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 format.

Unless you come with an accounts and wish to start using US Legal Forms, abide by these steps:

- Find the form you will need and ensure it is for that appropriate metropolis/county.

- Make use of the Preview key to check the form.

- Look at the description to actually have selected the right form.

- In the event the form is not what you are trying to find, take advantage of the Look for discipline to find the form that meets your requirements and requirements.

- When you obtain the appropriate form, click on Purchase now.

- Select the pricing plan you want, submit the specified information and facts to produce your money, and buy your order utilizing your PayPal or credit card.

- Pick a practical document format and obtain your backup.

Locate all the record templates you possess purchased in the My Forms menus. You can aquire a more backup of Washington Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 whenever, if possible. Just select the needed form to obtain or produce the record format.

Use US Legal Forms, by far the most substantial variety of legitimate varieties, to save some time and prevent errors. The service provides expertly created legitimate record templates that you can use for a selection of purposes. Create your account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

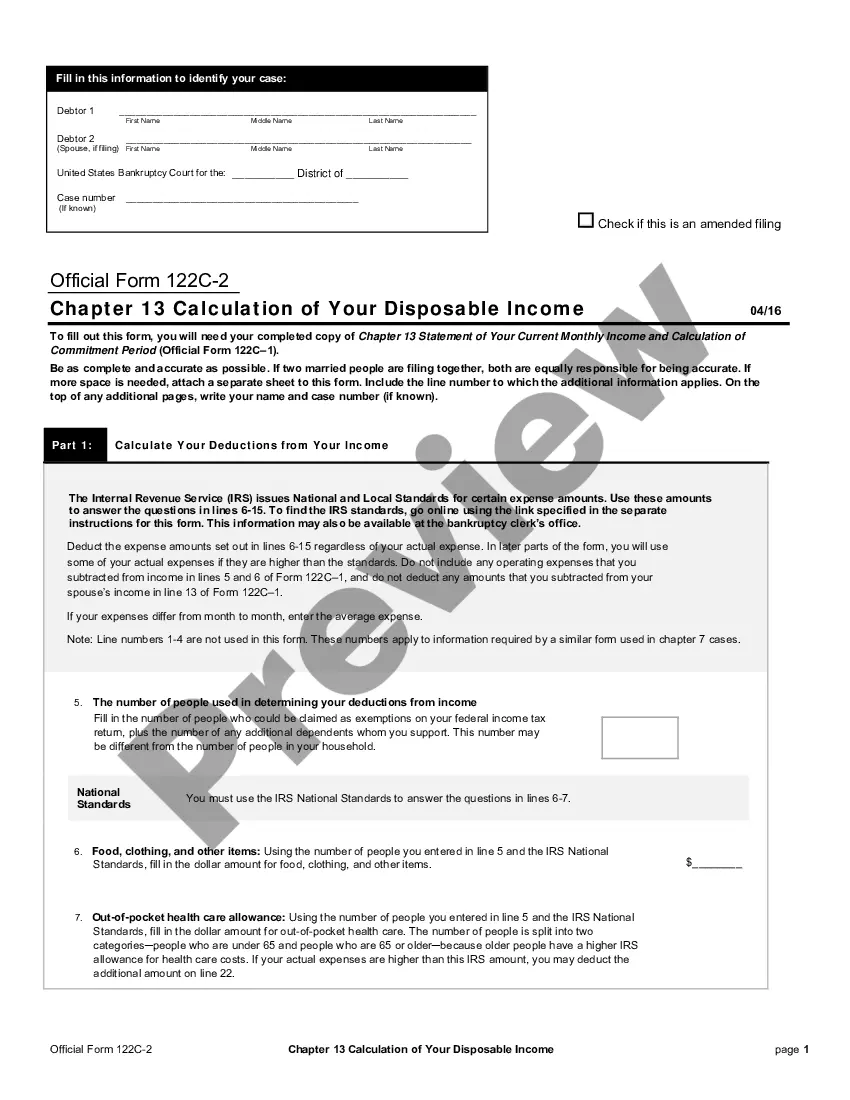

In chapter 13, "disposable income" is income (other than child support payments received by the debtor) less amounts reasonably necessary for the maintenance or support of the debtor or dependents and less charitable contributions up to 15% of the debtor's gross income.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

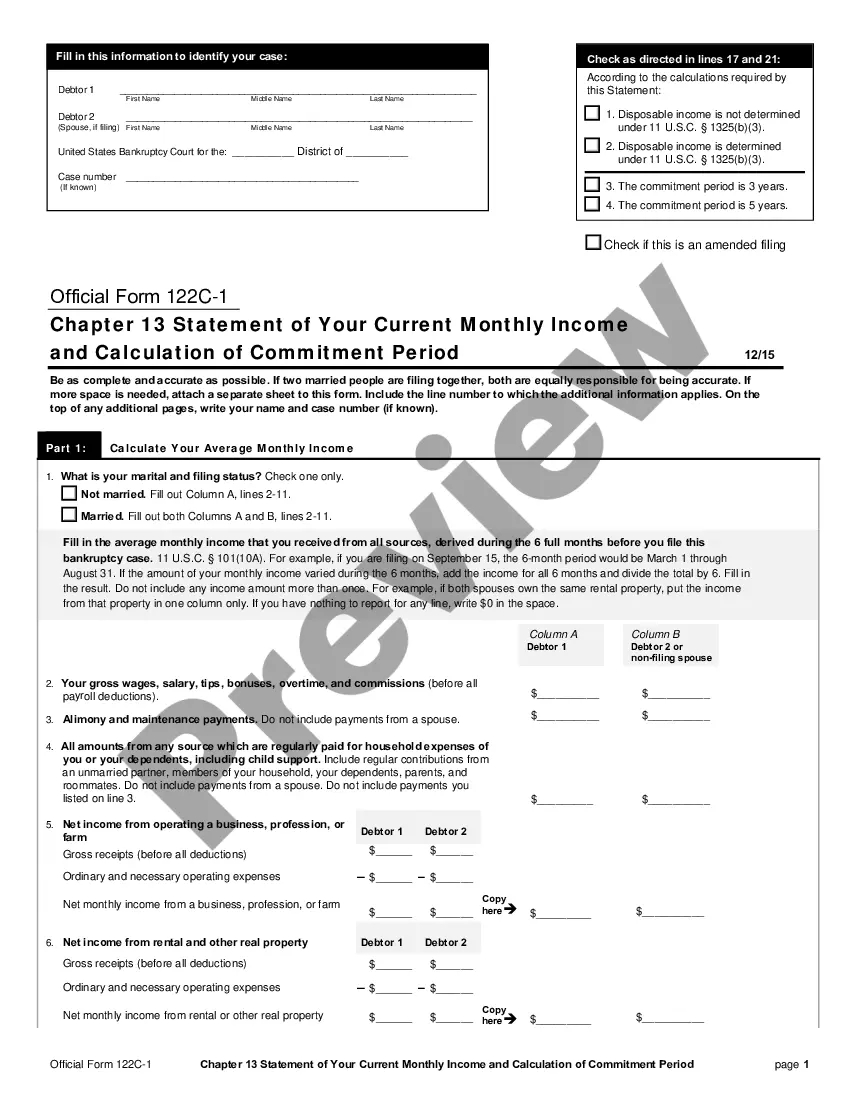

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

These can include expenses all households must take on monthly, including: Rent or home mortgage payments. Utilities like electricity, natural gas, cable TV, internet service and phone service. Municipal services like water, sewer and trash pickup.

Take your monthly income and deduct living expenses, priority debt payments, and secured payments. The remaining amount is your disposable income. You'd are responsible to pay this amount to creditors each month.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.