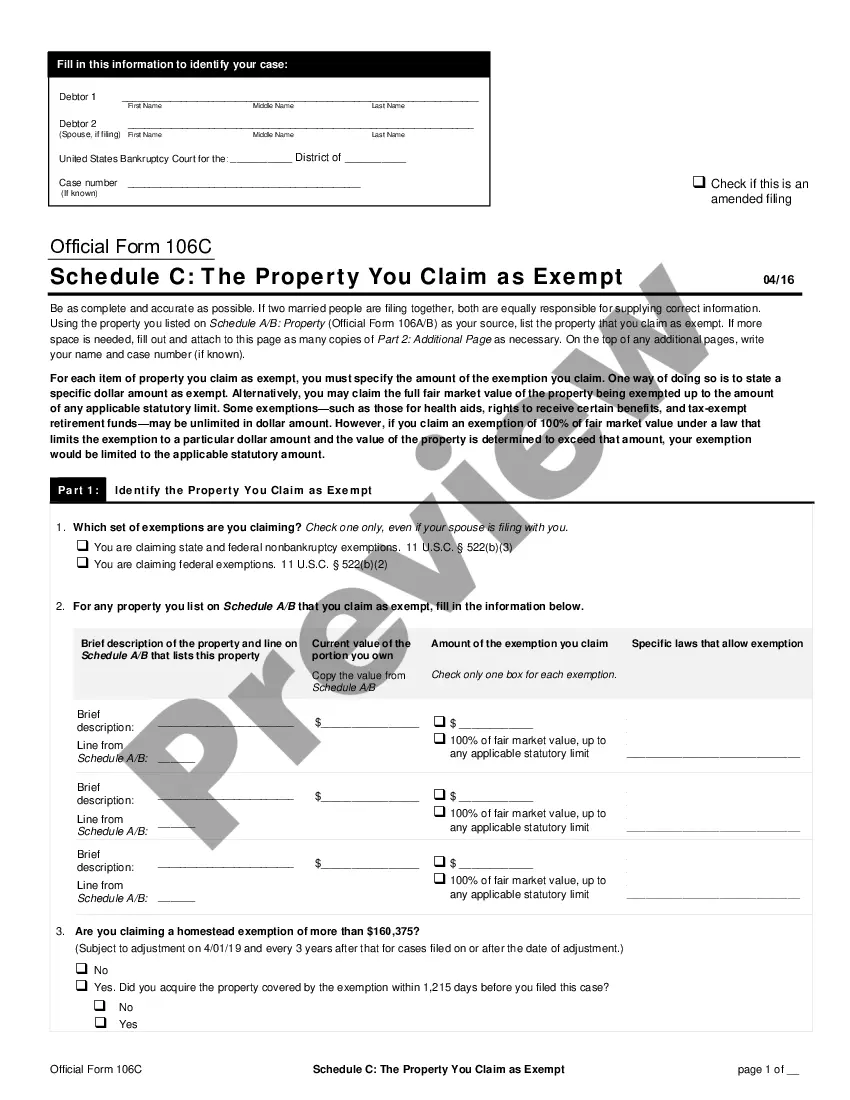

Washington Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Are you presently inside a placement that you will need papers for both business or specific purposes nearly every day? There are a variety of legitimate document templates available on the Internet, but getting versions you can depend on isn`t straightforward. US Legal Forms gives thousands of type templates, just like the Washington Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, which can be written to meet federal and state needs.

In case you are currently familiar with US Legal Forms internet site and get a merchant account, just log in. Next, you are able to download the Washington Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 web template.

Unless you offer an accounts and need to begin using US Legal Forms, abide by these steps:

- Obtain the type you will need and make sure it is for that right town/state.

- Make use of the Preview switch to check the form.

- See the information to ensure that you have chosen the right type.

- In case the type isn`t what you are trying to find, take advantage of the Lookup area to find the type that meets your needs and needs.

- Once you find the right type, click Acquire now.

- Pick the prices program you want, fill in the specified information to produce your bank account, and pay money for an order with your PayPal or Visa or Mastercard.

- Pick a practical paper structure and download your duplicate.

Locate every one of the document templates you possess purchased in the My Forms menu. You can aquire a extra duplicate of Washington Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 anytime, if necessary. Just go through the needed type to download or print out the document web template.

Use US Legal Forms, by far the most extensive collection of legitimate types, to save lots of some time and stay away from errors. The service gives appropriately made legitimate document templates which you can use for a selection of purposes. Generate a merchant account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

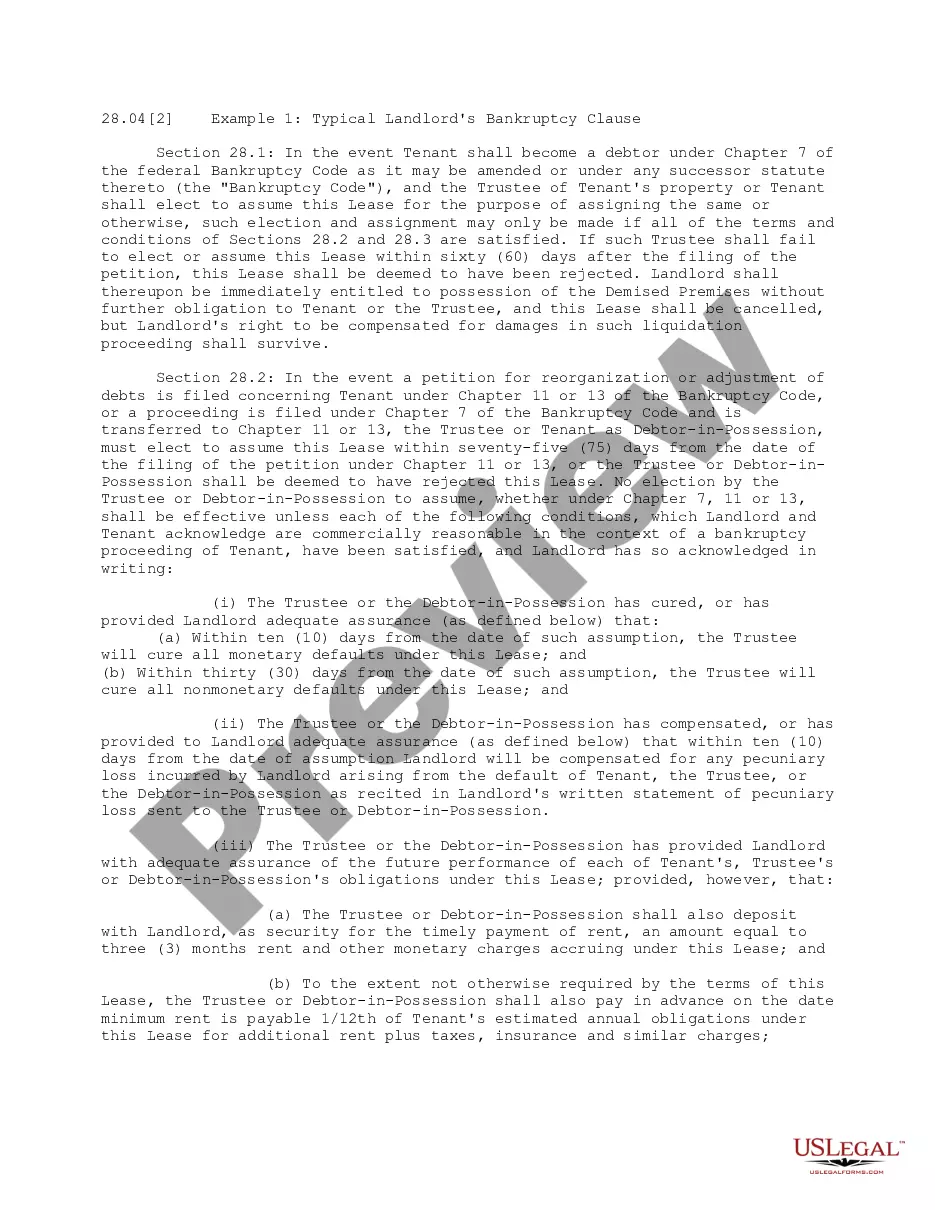

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth.

Schedule D: Secured Debts Official Form 106D, called Schedule D: Creditors Who Hold Claims Secured By Property (individuals), is for secured debts. It lists debt secured by an interest in either real property (like a house) or personal property. The most common types of secured debts are car loans and home mortgages.

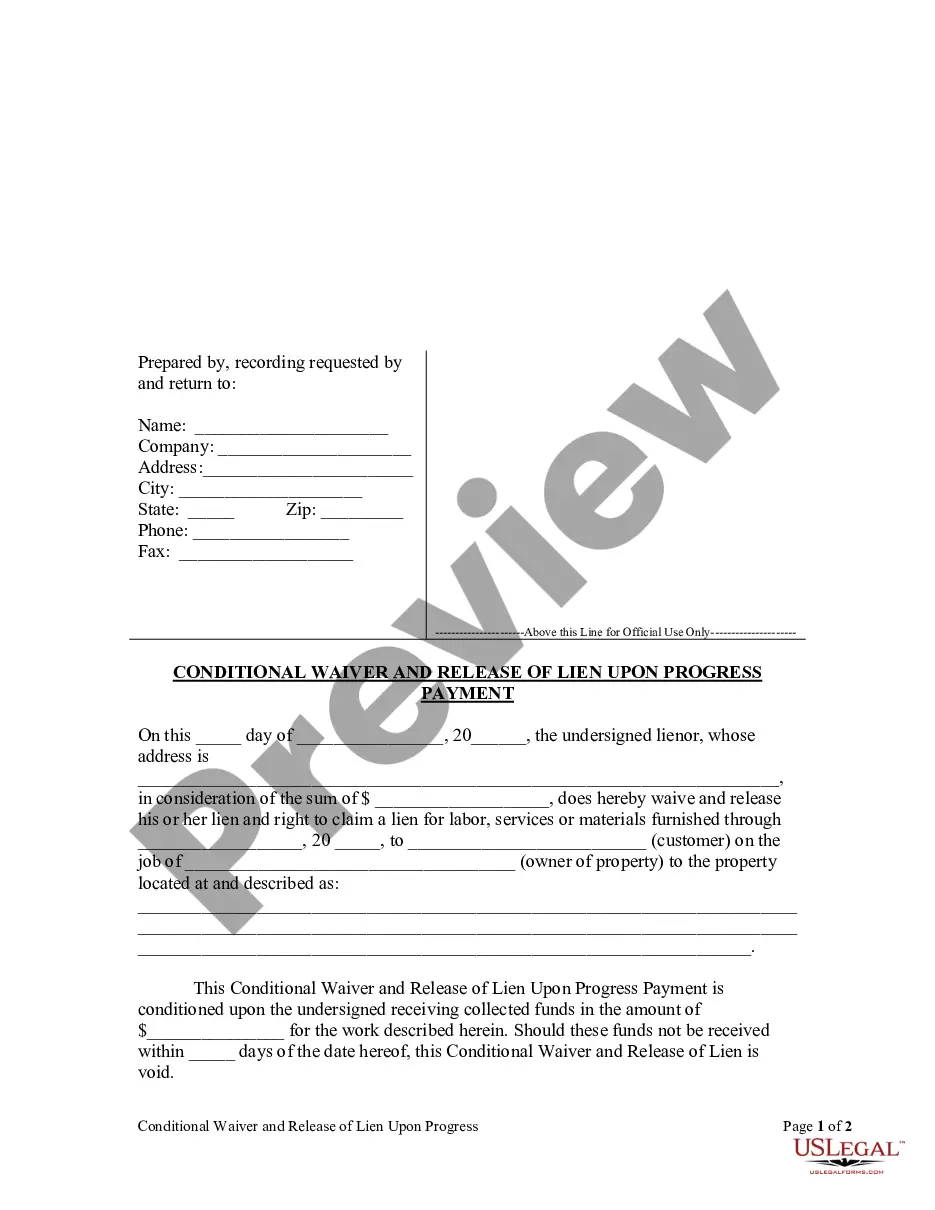

Whether the trustee can take money you receive after filing your case depends on whether you were entitled to the money at the time your case was filed and how it was listed on your forms, if at all.

Here's the information you'll need to provide: Exemption system you're using. ... Description of property. ... Schedule A/B line number. ... Current value of the portion you own. ... Amount of exemption you claim. ... Specific laws that allow the exemption. ... Claiming a homestead exemption more than $189,050.

Official Form 106Sum is the Summary of Your Assets and Liabilities and Certain Statistical Information. It contains the ?bottom line? kind of information from your schedules. Things like the total value of your property, the total amount of your debts, and information about your income and expenses.