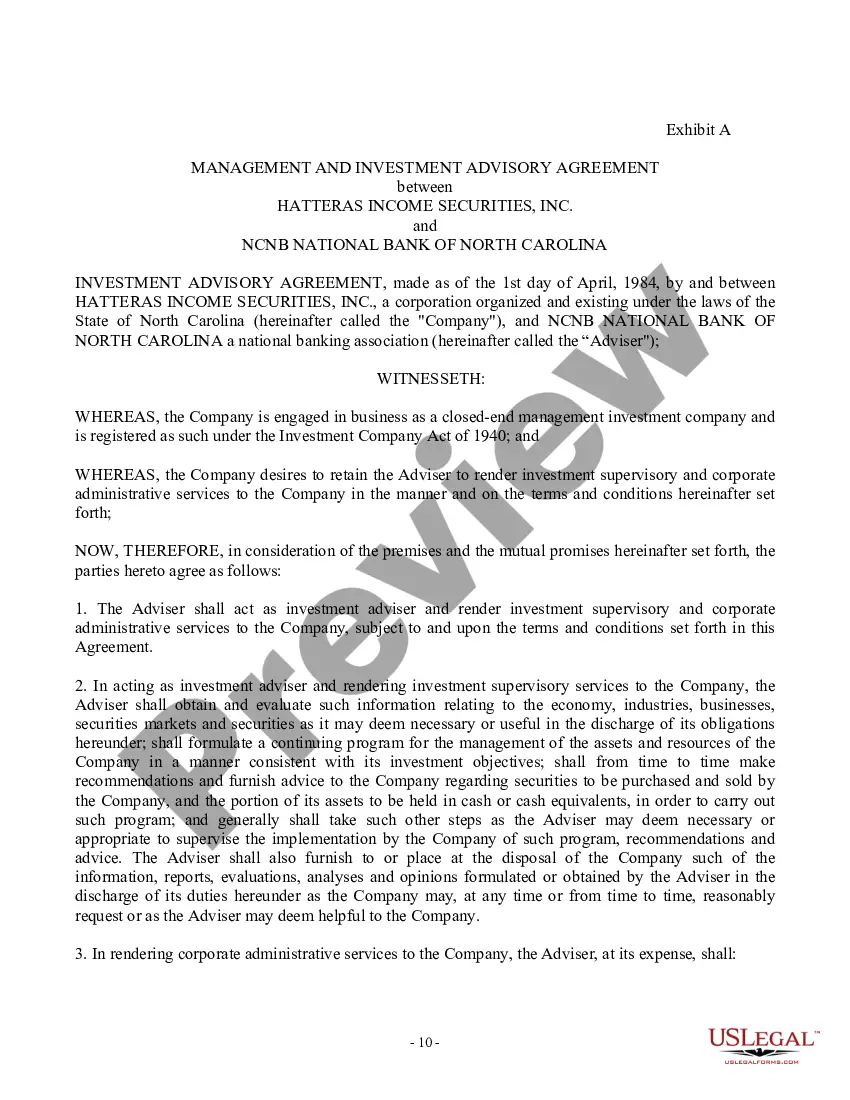

Washington Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement

Description

How to fill out Proxy Statement - Hatteras Income Securities, Inc. With Copy Of Advisory Agreement?

If you have to complete, obtain, or print lawful document themes, use US Legal Forms, the most important variety of lawful varieties, that can be found online. Utilize the site`s simple and easy convenient look for to discover the files you will need. Numerous themes for organization and person purposes are sorted by types and suggests, or key phrases. Use US Legal Forms to discover the Washington Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement within a couple of clicks.

In case you are presently a US Legal Forms consumer, log in to the profile and then click the Acquire switch to have the Washington Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement. You may also access varieties you previously saved in the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for your appropriate metropolis/region.

- Step 2. Take advantage of the Preview option to examine the form`s content. Do not forget about to see the information.

- Step 3. In case you are not happy with the kind, use the Research field near the top of the display to find other variations of the lawful kind web template.

- Step 4. Once you have located the form you will need, go through the Get now switch. Opt for the rates strategy you favor and include your accreditations to register on an profile.

- Step 5. Process the transaction. You may use your credit card or PayPal profile to complete the transaction.

- Step 6. Select the format of the lawful kind and obtain it on your own product.

- Step 7. Complete, change and print or sign the Washington Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement.

Every single lawful document web template you acquire is your own for a long time. You possess acces to every single kind you saved in your acccount. Go through the My Forms portion and pick a kind to print or obtain once more.

Contend and obtain, and print the Washington Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement with US Legal Forms. There are thousands of specialist and state-certain varieties you can utilize to your organization or person needs.