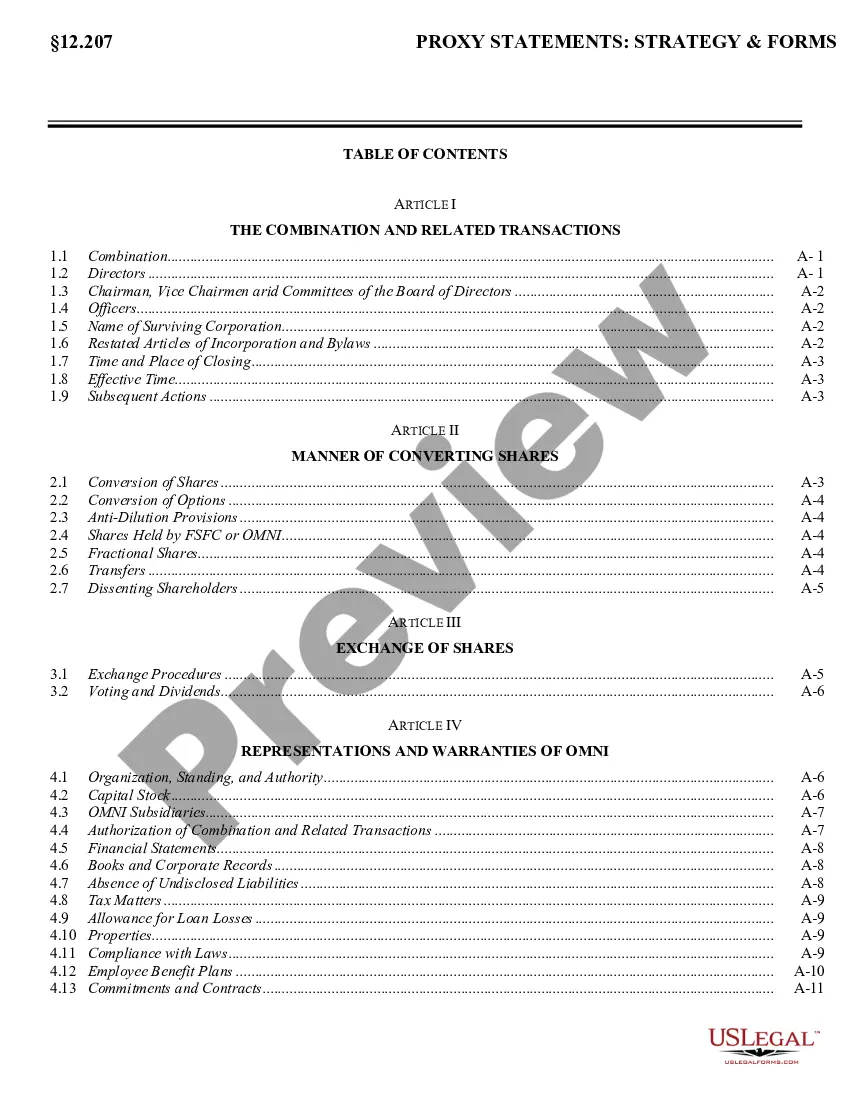

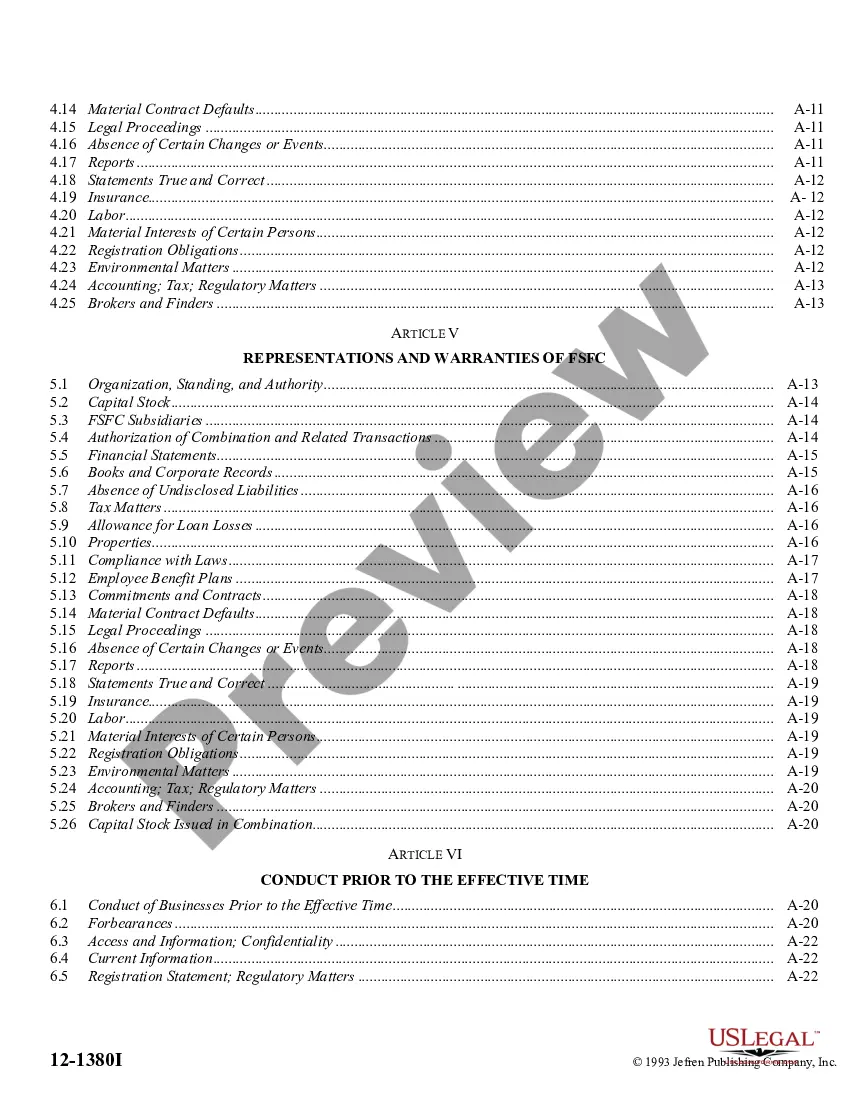

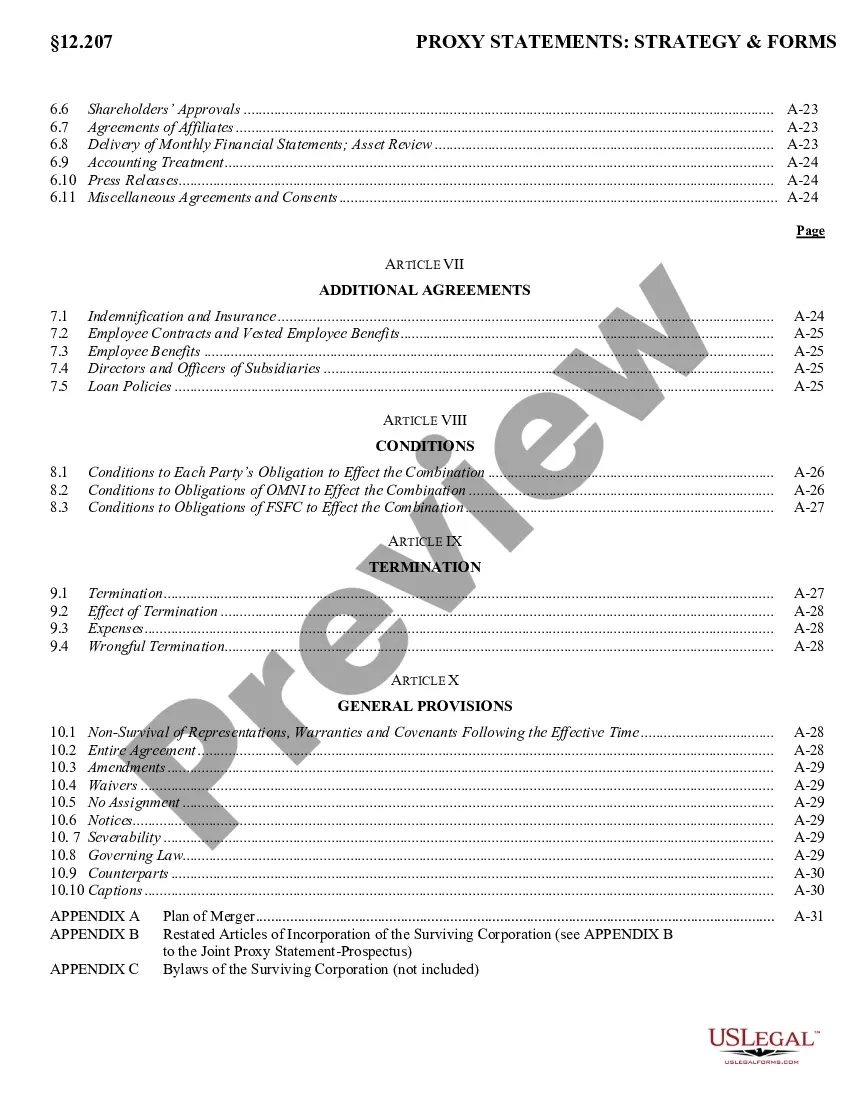

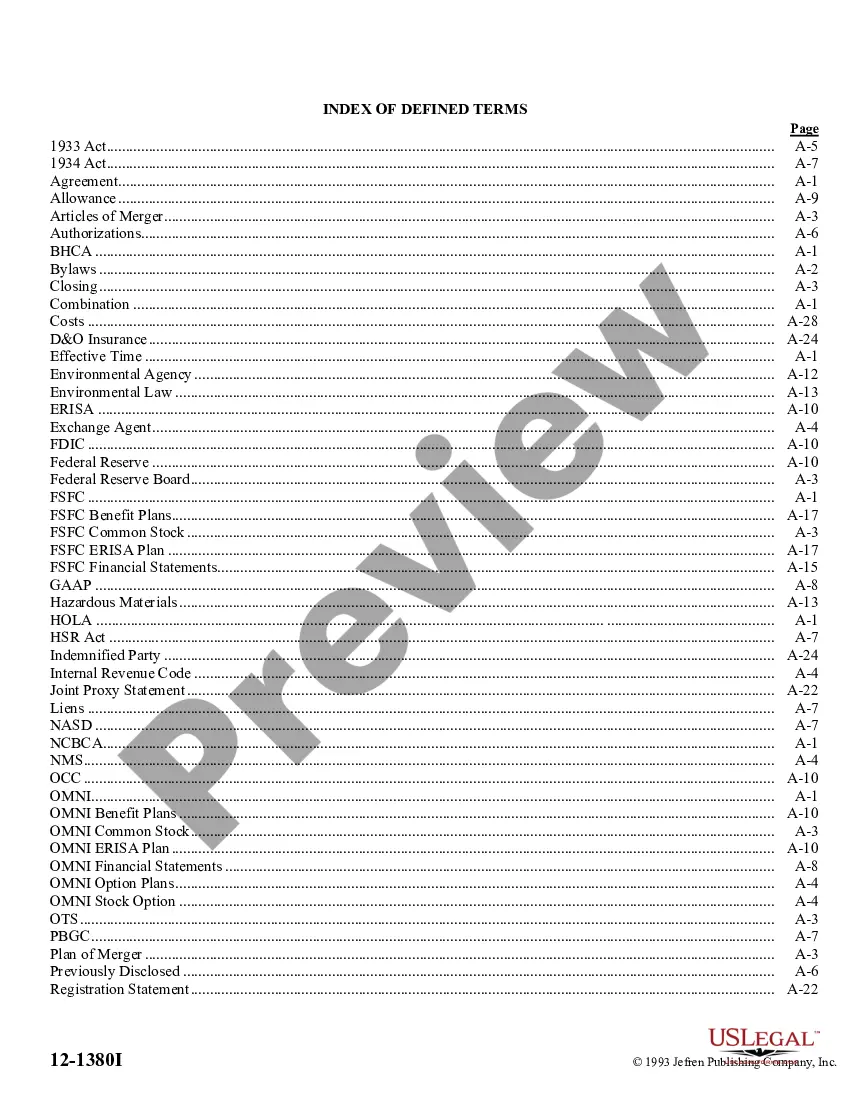

Washington Agreement of Combination

Description

How to fill out Agreement Of Combination?

Have you been in a position the place you need documents for possibly organization or specific uses virtually every time? There are plenty of legal document layouts accessible on the Internet, but discovering ones you can depend on isn`t simple. US Legal Forms offers a huge number of type layouts, such as the Washington Agreement of Combination, which can be created in order to meet federal and state requirements.

Should you be already knowledgeable about US Legal Forms internet site and have a merchant account, just log in. Following that, you are able to obtain the Washington Agreement of Combination format.

If you do not have an accounts and want to begin to use US Legal Forms, adopt these measures:

- Discover the type you will need and make sure it is to the appropriate city/region.

- Make use of the Preview key to check the form.

- See the description to actually have chosen the correct type.

- In the event the type isn`t what you`re searching for, make use of the Search industry to discover the type that meets your requirements and requirements.

- If you obtain the appropriate type, just click Get now.

- Select the pricing strategy you desire, complete the desired information to make your money, and pay for an order using your PayPal or bank card.

- Select a convenient data file formatting and obtain your version.

Find all the document layouts you possess bought in the My Forms food list. You may get a more version of Washington Agreement of Combination at any time, if needed. Just select the needed type to obtain or print the document format.

Use US Legal Forms, probably the most comprehensive collection of legal kinds, to save time as well as avoid mistakes. The service offers expertly made legal document layouts that you can use for a selection of uses. Create a merchant account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

It is the understanding of the United States that neither party is obligated, under Article III of the above Treaty, to come to the aid of the other except in case of an external armed attack against such party; nor shall anything in the present Treaty be construed as requiring the United States to give assistance to ...

Substantively, the NCG established an agenda of 1) improved security for intelligence sharing; 2) nuclear command and control coordination processes; 3) development of planning, operations, exercises, and training; and 4) joint planning of South Korean conventional support to U.S. nuclear operations.

Washington Agreement Bosnian President Alija Izetbegovi? and Croatian President Franjo Tu?man sign the Washington AgreementTypeCeasefire agreementSigned18 March 1994LocationWashington, D.C., United States Vienna, AustriaSealed24 March 19945 more rows

An agreement announced at the 2008 G20 Washington summit regarding objectives to strengthen economic growth and deal with financial crisis.

As the United States developed a post-war alliance system, the question of extended deterrence?the ability of U.S. military forces, particularly nuclear forces, to deter attack on U.S. allies and thereby reassure them?received greater attention.

The US reaffirmed its strong commitment to extended deterrence, which refers to its commitment to help defend South Korea using all its military, including nuclear, capabilities, while agreeing to launch a new Nuclear Consultative Group, which the allies said will allow South Korean input into how or even when the US ...