Washington Employee Stock Option Plan of Vivien, Inc. The Washington Employee Stock Option Plan at Vivien, Inc. is an enticing compensation program offered to employees in the state of Washington. This plan allows employees to acquire stock in the company at a predetermined price, commonly known as the exercise price or grant price. The plan is designed to motivate and reward employees for their hard work and dedication, fostering a sense of ownership and alignment with corporate goals. Vivien, Inc. offers two primary types of employee stock option plans under the Washington Employee Stock Option Plan: 1. Incentive Stock Options (SOS): SOS are provided exclusively to employees and often carry certain tax benefits. These options are subject to specific rules outlined in section 422 of the Internal Revenue Code. Employees who exercise their SOS may qualify for capital gains tax treatment if certain conditions are met. 2. Non-Qualified Stock Options (Nests): Nests, also known as non-statutory stock options, are available to both employees and non-employee service providers. Unlike SOS, these options do not have to comply with the strict requirements set forth in section 422 of the Internal Revenue Code. However, Nests may be subject to ordinary income tax rates upon exercise. Employees participating in the Washington Employee Stock Option Plan can typically receive options after meeting specific eligibility criteria, such as length of service, current position, or performance-based milestones. The number of options allotted to employees is determined by various factors like their seniority, job function, and overall contribution to the company's success. It's important to note that the Washington Employee Stock Option Plan at Vivien, Inc. adheres to the legislation and regulations of the state of Washington, ensuring compliance with local laws and statutes. Additionally, employees should carefully review the terms and conditions of the plan, including vesting schedules, exercise periods, and any accompanying documents provided by the company. Overall, the Washington Employee Stock Option Plan of Vivien, Inc. is a valuable opportunity for eligible employees to share in the success of the company through stock ownership. It serves as both a motivational tool and a means of attracting and retaining talented individuals within the organization.

Washington Employee Stock Option Plan of Vivigen, Inc.

Description

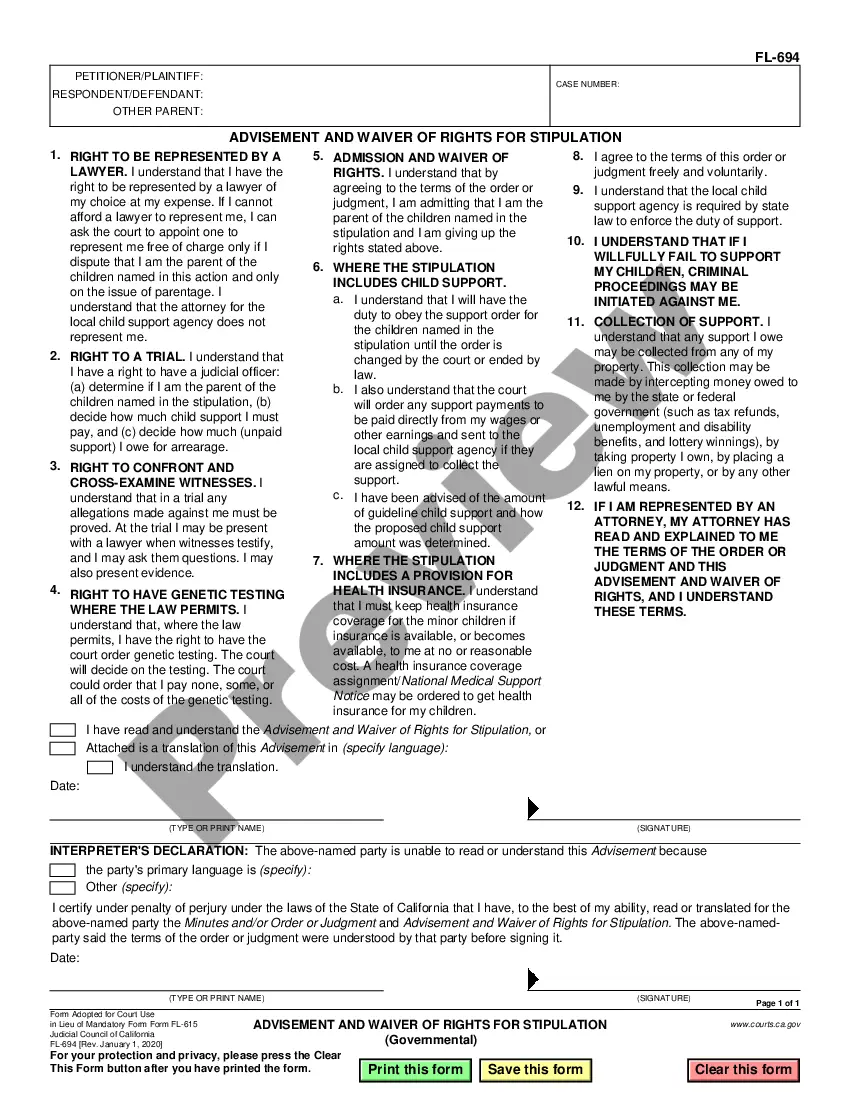

How to fill out Washington Employee Stock Option Plan Of Vivigen, Inc.?

Finding the right authorized document format could be a struggle. Needless to say, there are plenty of themes available on the Internet, but how do you get the authorized form you want? Utilize the US Legal Forms web site. The assistance delivers a huge number of themes, like the Washington Employee Stock Option Plan of Vivigen, Inc., which can be used for enterprise and personal requires. Each of the forms are inspected by pros and fulfill federal and state specifications.

In case you are previously listed, log in to your bank account and click on the Download option to obtain the Washington Employee Stock Option Plan of Vivigen, Inc.. Make use of your bank account to appear with the authorized forms you have ordered previously. Proceed to the My Forms tab of the bank account and get an additional backup of the document you want.

In case you are a fresh user of US Legal Forms, listed here are easy instructions so that you can stick to:

- First, make sure you have chosen the correct form for your personal area/region. You can look through the shape making use of the Preview option and browse the shape information to make sure it is the right one for you.

- In the event the form will not fulfill your preferences, take advantage of the Seach field to find the correct form.

- Once you are certain that the shape is proper, click on the Buy now option to obtain the form.

- Choose the prices strategy you need and enter in the required details. Build your bank account and pay money for an order using your PayPal bank account or Visa or Mastercard.

- Pick the data file file format and obtain the authorized document format to your device.

- Total, revise and produce and sign the obtained Washington Employee Stock Option Plan of Vivigen, Inc..

US Legal Forms is the biggest library of authorized forms in which you will find numerous document themes. Utilize the service to obtain expertly-made paperwork that stick to state specifications.

Form popularity

FAQ

Making ESO Offers Declare the type of stock options employees will receive (ISOs or NSOs). Explain the value in terms of the number of shares rather than the percentage of the company. State that the board must approve all stock option grant amounts before the offer letter becomes valid.

An ESPP (employee stock purchase plan) allows employees to use after-tax wages to acquire their company's shares, usually at a discount of up to 15%. Quite commonly, companies offer a ''lookback'' feature in addition to the discount offered to make the plan more attractive.

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

There are two types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). These mainly differ by how and when they're taxed. ISOs could qualify for special tax treatment. With NSOs, you usually have to pay taxes both when you exercise and sell.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

The standard stock option plan grants your employee a stock option that invests over four years. After the first year, there's a cliff?they don't own anything for their first 12 months, but after their first year, they invest in 25% of all the options you give them.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.