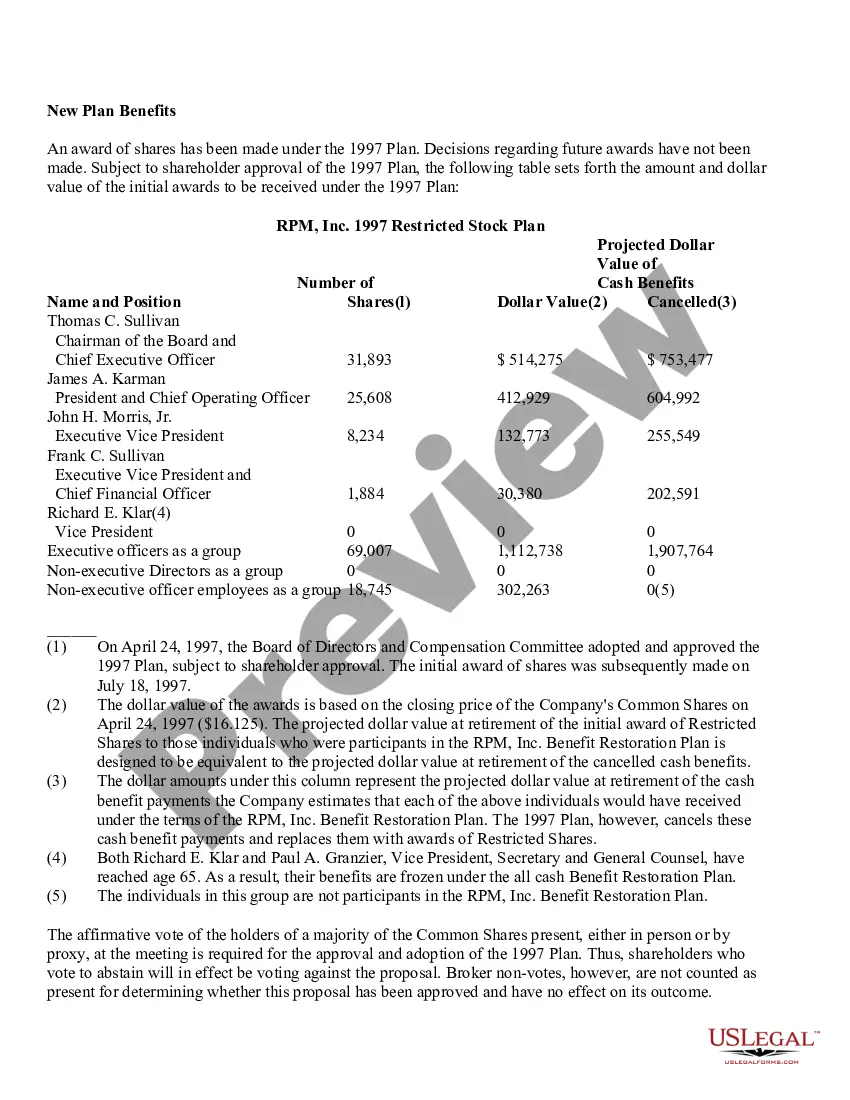

Title: Washington Adoption of Restricted Stock Plan of RPM, Inc.: A Comprehensive Overview Introduction: In this article, we will delve into the Washington Adoption of Restricted Stock Plan of RPM, Inc., examining the details, benefits, and different variations of this stock incentive program. The aim is to provide you with a well-rounded understanding of the plan and its potential implications for RPM, Inc. employees and shareholders in Washington. Keywords: Washington Adoption of Restricted Stock Plan, RPM, Inc., restricted stock, stock incentive program, Washington employees, shareholders. 1. Understanding the Washington Adoption of Restricted Stock Plan: The Washington Adoption of Restricted Stock Plan is a stock-based compensation program adopted by RPM, Inc., a leading company in its industry. This plan aims to offer incentives to the company's employees and shareholders in Washington state, promoting employee retention, motivation, and aligning their interests with the long-term growth of the organization. 2. Benefits and Objectives of the Restricted Stock Plan: The Washington Adoption of Restricted Stock Plan provides various benefits and objectives for RPM, Inc. and its participants, including: — Attracting and retaining talented employees: By providing employees with ownership in the company, the plan enhances loyalty and commitment. — Aligning employee and shareholder interests: Restricted stock provides an opportunity for employees to directly benefit from the company's success, fostering a sense of ownership and dedication. — Encouraging long-term performance: The vesting schedule encourages employees to remain with the company for an extended period, promoting long-term commitment and dedication to RPM, Inc.'s objectives. — Enhancing profitability and shareholder value: The plan motivates employees to work towards maximizing gains and driving the company's profitability, ultimately benefiting shareholders in Washington. 3. Types of Washington Adoption of Restricted Stock Plan: The Washington Adoption of Restricted Stock Plan of RPM, Inc. may include different variations, such as: a) Time-Based Vesting: Under this type, employees receive a specific grant of company stock as compensation, subject to a predetermined vesting schedule. As time progresses, the shares gradually become fully owned by the employee, incentivizing longevity and loyalty. b) Performance-Based Vesting: This variation links the vesting of restricted stock to the attainment of certain performance goals or objectives. Employees receive shares only if they fulfill predetermined criteria, such as achieving revenue targets, cost savings, or other performance metrics. c) Hybrid Vesting: Some Washington Adoption of Restricted Stock Plans may combine both time-based and performance-based vesting criteria, allowing for a more diversified approach to incentivizing employees. Conclusion: The Washington Adoption of Restricted Stock Plan plays a vital role in fostering employee loyalty, commitment, and alignment with shareholder interests within RPM, Inc. understanding the plan's benefits and various types can help employees and shareholders in Washington grasp the significance and potential impact of their participation in this stock incentive program.

Washington Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Washington Adoption Of Restricted Stock Plan Of RPM, Inc.?

If you have to full, down load, or print out legitimate record layouts, use US Legal Forms, the greatest collection of legitimate varieties, which can be found on the Internet. Make use of the site`s simple and hassle-free lookup to obtain the papers you require. Different layouts for business and individual uses are categorized by classes and suggests, or search phrases. Use US Legal Forms to obtain the Washington Adoption of Restricted Stock Plan of RPM, Inc. in a handful of mouse clicks.

When you are previously a US Legal Forms customer, log in for your bank account and then click the Obtain option to have the Washington Adoption of Restricted Stock Plan of RPM, Inc.. You can even access varieties you previously delivered electronically from the My Forms tab of the bank account.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the correct area/country.

- Step 2. Make use of the Review option to look over the form`s content material. Don`t forget to read through the information.

- Step 3. When you are not satisfied together with the type, use the Search area at the top of the screen to locate other models from the legitimate type web template.

- Step 4. Once you have discovered the shape you require, go through the Purchase now option. Opt for the costs strategy you like and add your credentials to register to have an bank account.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the formatting from the legitimate type and down load it on the gadget.

- Step 7. Full, revise and print out or indicator the Washington Adoption of Restricted Stock Plan of RPM, Inc..

Every single legitimate record web template you purchase is the one you have eternally. You have acces to every type you delivered electronically in your acccount. Select the My Forms segment and decide on a type to print out or down load once again.

Remain competitive and down load, and print out the Washington Adoption of Restricted Stock Plan of RPM, Inc. with US Legal Forms. There are millions of professional and express-certain varieties you can utilize for your business or individual needs.