Washington Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

Are you within a situation the place you will need paperwork for possibly business or specific functions almost every time? There are a lot of authorized record themes available online, but finding kinds you can depend on is not effortless. US Legal Forms gives 1000s of form themes, like the Washington Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, which are published in order to meet state and federal requirements.

When you are previously knowledgeable about US Legal Forms web site and possess a merchant account, simply log in. Next, you may down load the Washington Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers web template.

Unless you offer an account and would like to begin to use US Legal Forms, follow these steps:

- Find the form you want and ensure it is for that proper city/county.

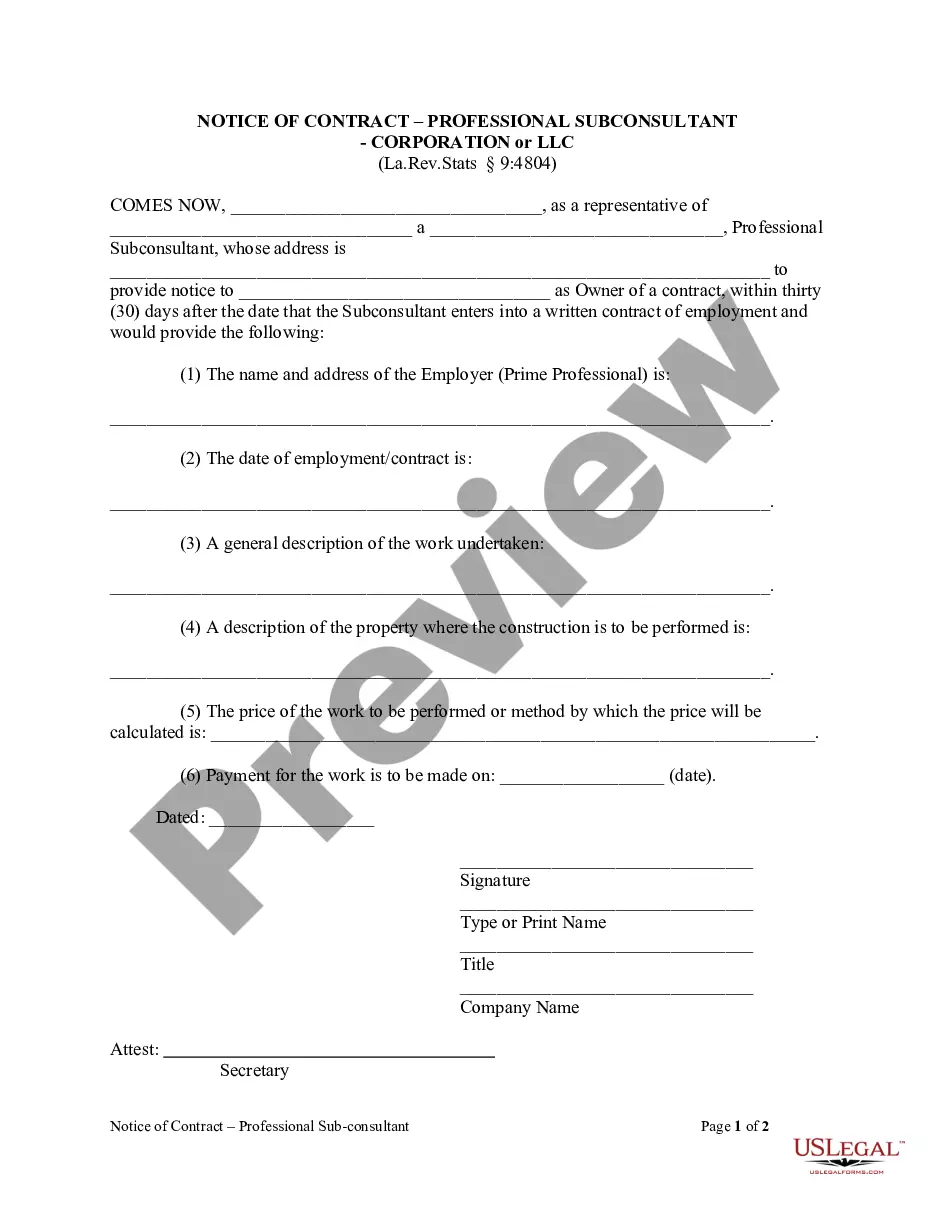

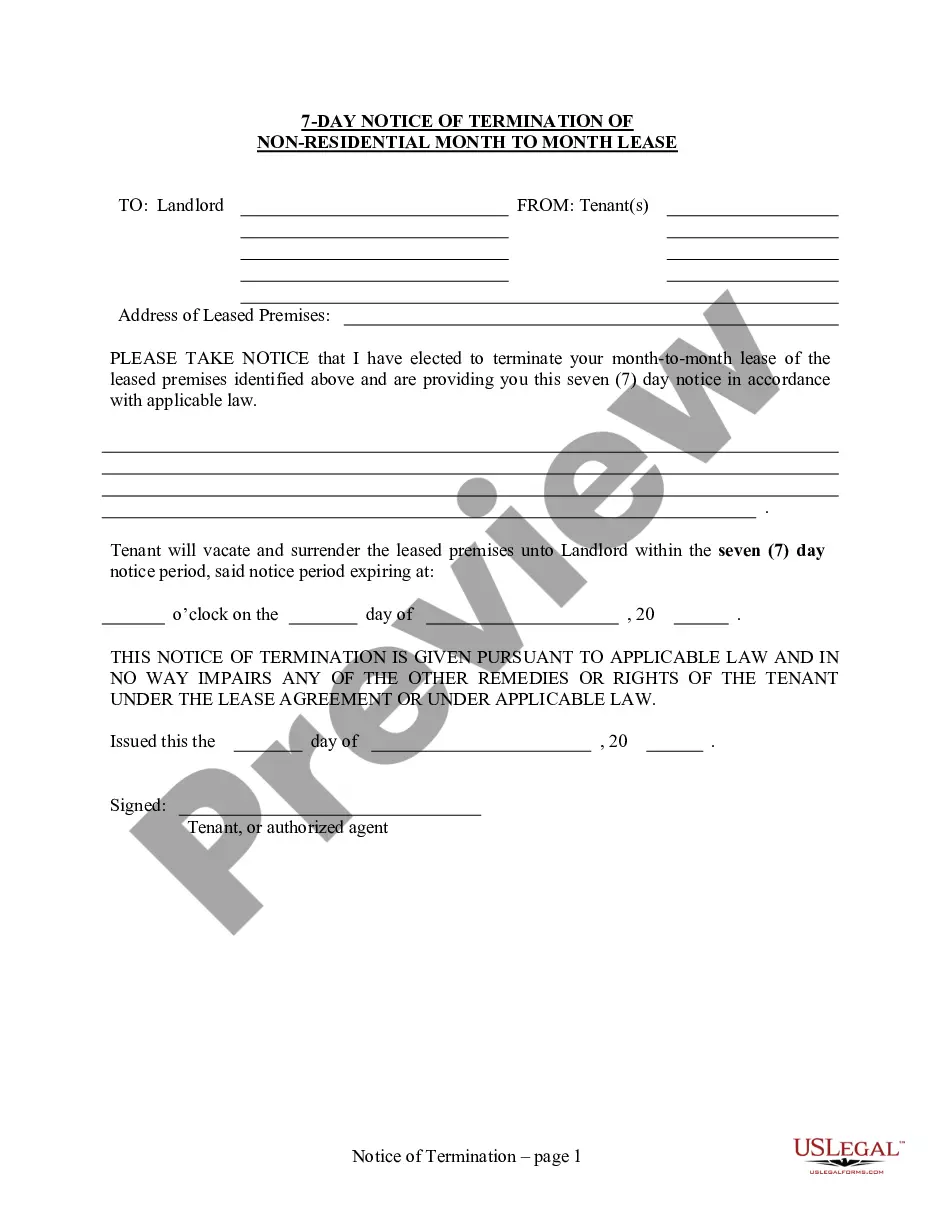

- Make use of the Preview switch to review the form.

- Read the description to ensure that you have selected the appropriate form.

- In case the form is not what you are seeking, use the Research industry to find the form that meets your needs and requirements.

- Whenever you find the proper form, click Acquire now.

- Pick the costs strategy you need, submit the specified information to make your money, and pay for an order making use of your PayPal or credit card.

- Select a practical paper format and down load your version.

Discover all of the record themes you have purchased in the My Forms menu. You may get a additional version of Washington Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers anytime, if possible. Just select the essential form to down load or print out the record web template.

Use US Legal Forms, probably the most considerable variety of authorized kinds, to save time and stay away from errors. The assistance gives appropriately created authorized record themes which you can use for an array of functions. Create a merchant account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

To Whom Can The ESOP Be Issued? A permanent employee of the company who is working in India or outside India. A Director of the company, including a whole-time or part-time director but not an independent director.

For example, if you're based in the US, you can offer ISOs to your domestic employees. However, as you cannot use an EOR to offer ISOs to foreign employees, you would need to offer an alternative, such as NSOs, RSUs, or VSOs.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.