Washington Stock Option Agreement of Hayes Wheels International, Inc. - general form

Description

How to fill out Stock Option Agreement Of Hayes Wheels International, Inc. - General Form?

Choosing the best lawful file format could be a have a problem. Obviously, there are tons of layouts available online, but how do you obtain the lawful type you require? Use the US Legal Forms internet site. The service gives thousands of layouts, including the Washington Stock Option Agreement of Hayes Wheels International, Inc. - general form, which you can use for business and personal requires. Each of the types are checked by professionals and satisfy state and federal specifications.

Should you be presently authorized, log in in your profile and then click the Down load switch to get the Washington Stock Option Agreement of Hayes Wheels International, Inc. - general form. Make use of profile to check from the lawful types you possess purchased in the past. Visit the My Forms tab of your respective profile and have yet another version from the file you require.

Should you be a new user of US Legal Forms, listed below are simple instructions that you should comply with:

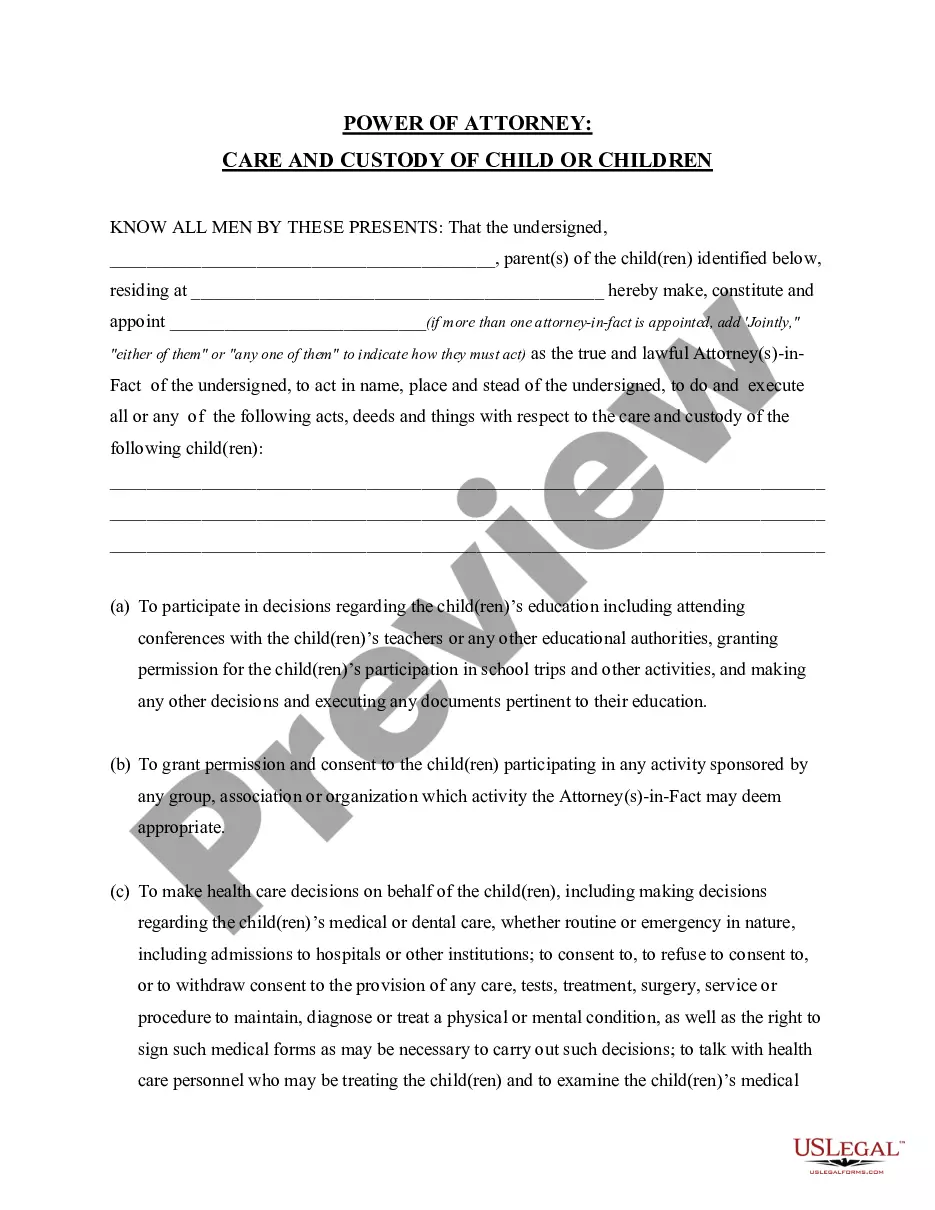

- Very first, be sure you have chosen the correct type for your personal metropolis/state. It is possible to examine the form making use of the Preview switch and study the form outline to guarantee it is the right one for you.

- In the event the type is not going to satisfy your requirements, make use of the Seach discipline to obtain the correct type.

- When you are sure that the form is suitable, click the Buy now switch to get the type.

- Select the rates strategy you would like and enter in the required info. Build your profile and buy the order using your PayPal profile or charge card.

- Select the file formatting and download the lawful file format in your device.

- Complete, edit and print out and indicator the attained Washington Stock Option Agreement of Hayes Wheels International, Inc. - general form.

US Legal Forms will be the most significant catalogue of lawful types where you can discover different file layouts. Use the service to download expertly-made documents that comply with condition specifications.