Washington Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

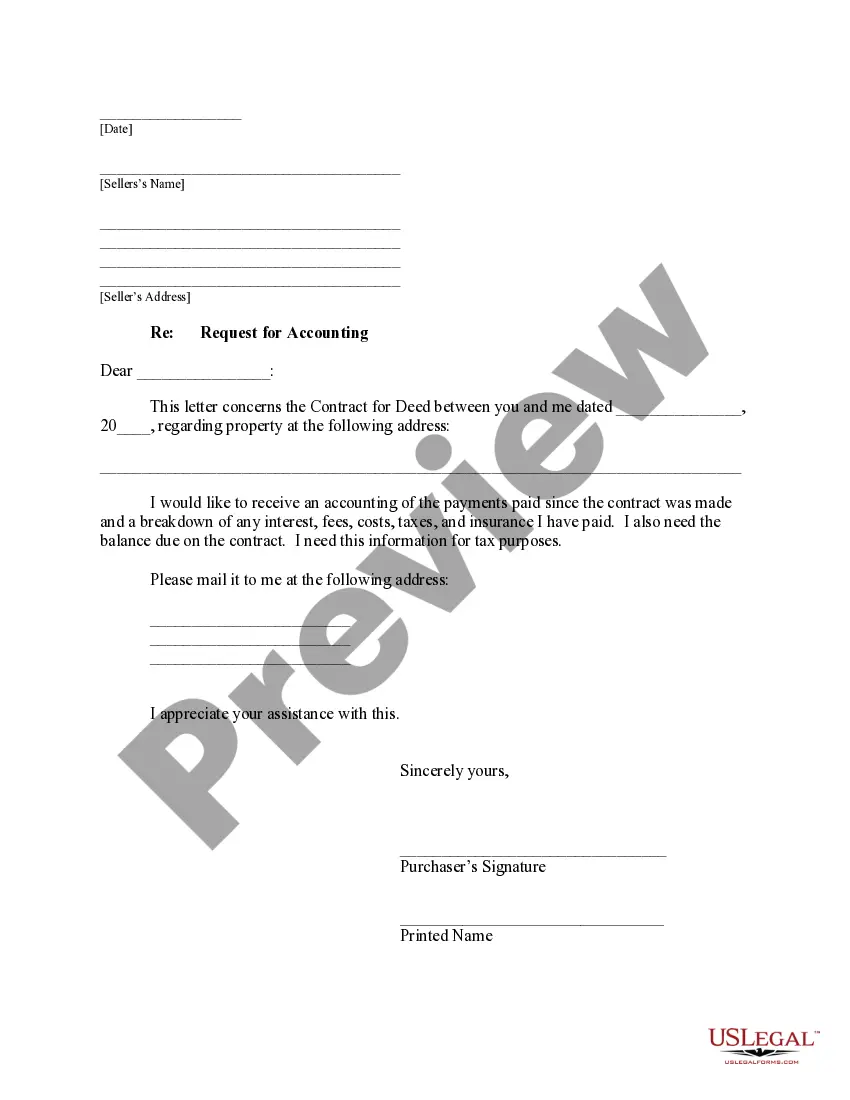

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

Have you been in a placement that you need files for both enterprise or individual functions just about every time? There are a lot of lawful record themes available on the Internet, but discovering kinds you can trust isn`t effortless. US Legal Forms delivers thousands of develop themes, just like the Washington Stock Appreciation Rights Plan of The Todd-AO Corporation, that are composed in order to meet state and federal needs.

If you are previously informed about US Legal Forms web site and possess an account, just log in. After that, it is possible to download the Washington Stock Appreciation Rights Plan of The Todd-AO Corporation web template.

Unless you offer an account and want to begin using US Legal Forms, adopt these measures:

- Find the develop you will need and make sure it is for your right metropolis/region.

- Make use of the Preview switch to check the form.

- Browse the description to ensure that you have selected the right develop.

- In the event the develop isn`t what you are seeking, utilize the Search area to discover the develop that meets your needs and needs.

- If you discover the right develop, just click Acquire now.

- Choose the rates plan you want, fill in the specified info to make your money, and buy an order making use of your PayPal or Visa or Mastercard.

- Select a convenient file formatting and download your backup.

Get each of the record themes you may have purchased in the My Forms food selection. You can aquire a extra backup of Washington Stock Appreciation Rights Plan of The Todd-AO Corporation at any time, if needed. Just go through the needed develop to download or print the record web template.

Use US Legal Forms, the most comprehensive collection of lawful forms, to save time as well as prevent errors. The support delivers appropriately made lawful record themes which can be used for a range of functions. Produce an account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

The part of the change in the value of the stocks held by a business over any period which is due to price changes. Stock appreciation - Oxford Reference oxfordreference.com ? display ? authority.2... oxfordreference.com ? display ? authority.2...

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a predetermined period. An employee stock ownership plan (ESOP) enables employees to gain an ownership interest in their employer in the form of shares of company stock. Phantom Stock Plan: What It Is, How It Works, 2 Types - Investopedia investopedia.com ? terms ? phantomstock investopedia.com ? terms ? phantomstock

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price. Share Purchase Rights vs. Options: What's the Difference? - Investopedia investopedia.com ? ask ? answers ? what-dif... investopedia.com ? ask ? answers ? what-dif...

A stock appreciation right is a contract between an employer and an employee that grants the employee the right to receive a payment tied to any increase in the value of the employer's stock. When granting a stock appreciation right, the employer does not grant the employee any shares of the employer's stock. Stock Appreciation Right - OGE.gov oge.gov ? Web ? Content ? Definitions~Sto... oge.gov ? Web ? Content ? Definitions~Sto...

How do I value it? For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.