Washington Stock Purchase Plan with exhibit of Bancorporation

Description

How to fill out Stock Purchase Plan With Exhibit Of Bancorporation?

Are you currently inside a place that you need to have files for sometimes company or person purposes almost every day? There are a variety of lawful file templates available on the Internet, but getting versions you can rely on is not straightforward. US Legal Forms provides thousands of type templates, much like the Washington Stock Purchase Plan with exhibit of Bancorporation, that are published to fulfill state and federal needs.

In case you are presently familiar with US Legal Forms internet site and also have a merchant account, basically log in. Next, you may down load the Washington Stock Purchase Plan with exhibit of Bancorporation web template.

If you do not have an account and would like to start using US Legal Forms, adopt these measures:

- Obtain the type you want and ensure it is for the appropriate city/region.

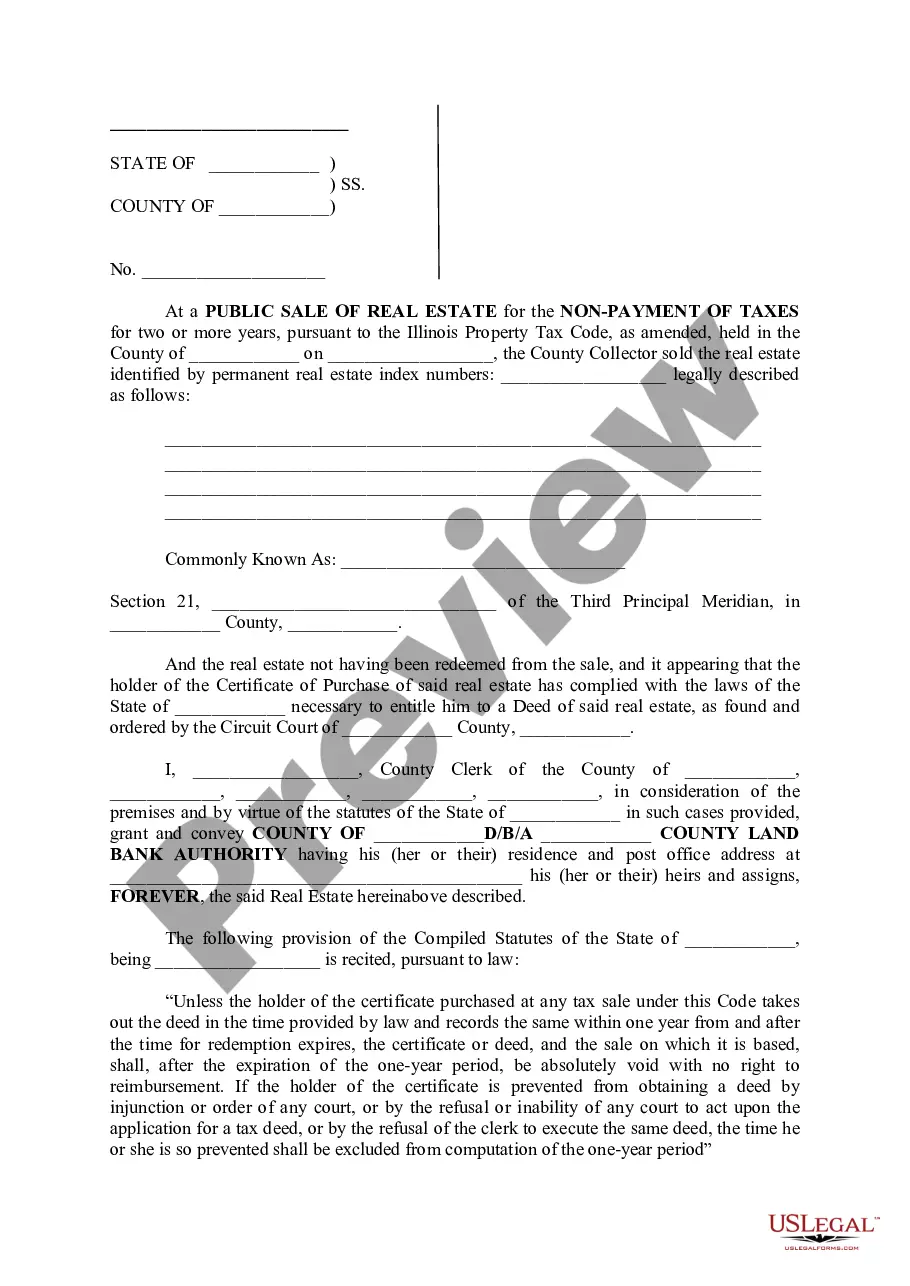

- Utilize the Review option to examine the form.

- Browse the description to ensure that you have chosen the right type.

- When the type is not what you are searching for, utilize the Look for industry to get the type that suits you and needs.

- If you obtain the appropriate type, just click Buy now.

- Select the rates prepare you want, fill in the necessary info to make your account, and pay money for the transaction with your PayPal or credit card.

- Select a hassle-free paper file format and down load your copy.

Locate all the file templates you might have bought in the My Forms menus. You can obtain a extra copy of Washington Stock Purchase Plan with exhibit of Bancorporation any time, if possible. Just select the necessary type to down load or printing the file web template.

Use US Legal Forms, probably the most extensive selection of lawful kinds, to save lots of time and stay away from blunders. The assistance provides appropriately created lawful file templates which you can use for a variety of purposes. Generate a merchant account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

Employee Share Purchase Plan (ESPP) Employee Share Purchase Plan is another benefit provided by employers to their employees to buy the company's stock at a discounted value.

An Employee Share Purchase Plan (or ESPP) is a benefit frequently offered to employees of public companies. In this case, an employee is allowed to purchase a certain amount of shares at a discounted price. The difference between the price paid by the employee and the trading price is a taxable benefit to the employee.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

An ESPP must be approved by the stockholders of the sponsoring corporation within the period commencing 12 months before and ending 12 months after the ESPP is adopted by the sponsoring corporation's board of directors.

An ESPP is a program in which employees can purchase company stock at a discounted price. Employees contribute through payroll deductions, which build until the purchase date. 1. The discount can be as much as 15% in some cases.

How much should I put in an employee stock purchase plan? You can contribute 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. The more disposable income you have, the more you can afford to put in an employee stock purchase plan. Employees contribute through payroll deductions.

If you are risk-averse, you might consider selling your ESPP shares right away so you don't have overexposure in one stock, particularly that of your own employer. ESPP shares can put you in an overexposed position. If the stock value goes down, you may suffer losses and in extreme cases, even lose your job.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.