The Washington Proposal to approve restricted stock plan is a comprehensive initiative aimed at enabling companies to offer restricted stock options to their employees as a form of compensation. This proposal seeks to enhance employee motivation, retain top talent, and align their interests with long-term company performance. Under this proposal, companies can grant restricted stock awards to employees, subject to certain restrictions and limitations. These awards are typically granted at no cost to the employee initially but come with specific vesting requirements. Restricted stock plans are a popular choice for companies looking to incentivize their workforce and provide a sense of ownership. The Washington Proposal emphasizes the importance of tying these awards to specific performance metrics and establishing clear guidelines for vesting. By doing so, it ensures that employees are actively contributing towards the organization's growth and success. This approach promotes a performance-driven culture and fosters a sense of loyalty and commitment among employees. The Washington Proposal also outlines guidelines for the taxation of restricted stock awards. It highlights the need for employees to understand the tax implications associated with receiving and selling these stocks. This knowledge empowers them to make informed financial decisions and appropriately plan for any tax obligations they may incur. There are several types of restricted stock plans that fall under the Washington Proposal, such as: 1. Performance-Based Restricted Stock: This type of plan requires employees to meet predefined performance targets to unlock the full benefits of their restricted stock. This incentivizes individuals to strive for excellence and aligns their efforts with company objectives. 2. Time-Based Restricted Stock: In this plan, the restricted stock awards vest over a specific period, typically a few years. It encourages employees to remain with the company for a longer duration to fully benefit from their equity compensation. 3. Restricted Stock Units (RSS): RSS represent a promise to issue shares of company stock in the future upon meeting certain vesting conditions. RSS are becoming increasingly popular as they align the interests of employees and shareholders while providing flexibility for companies when granting equity. Overall, the Washington Proposal to approve restricted stock plans aims to promote long-term employee engagement, productivity, and organizational growth. By offering employees a stake in the company's success, these plans incentivize superior performance and emphasize shared values of commitment and dedication.

Washington Proposal to approve restricted stock plan

Description

How to fill out Washington Proposal To Approve Restricted Stock Plan?

If you want to comprehensive, acquire, or produce lawful papers templates, use US Legal Forms, the largest variety of lawful forms, which can be found on the web. Use the site`s easy and practical look for to find the documents you want. Various templates for enterprise and individual purposes are categorized by groups and says, or keywords and phrases. Use US Legal Forms to find the Washington Proposal to approve restricted stock plan within a couple of mouse clicks.

When you are presently a US Legal Forms buyer, log in in your accounts and click the Download key to obtain the Washington Proposal to approve restricted stock plan. Also you can gain access to forms you formerly downloaded inside the My Forms tab of the accounts.

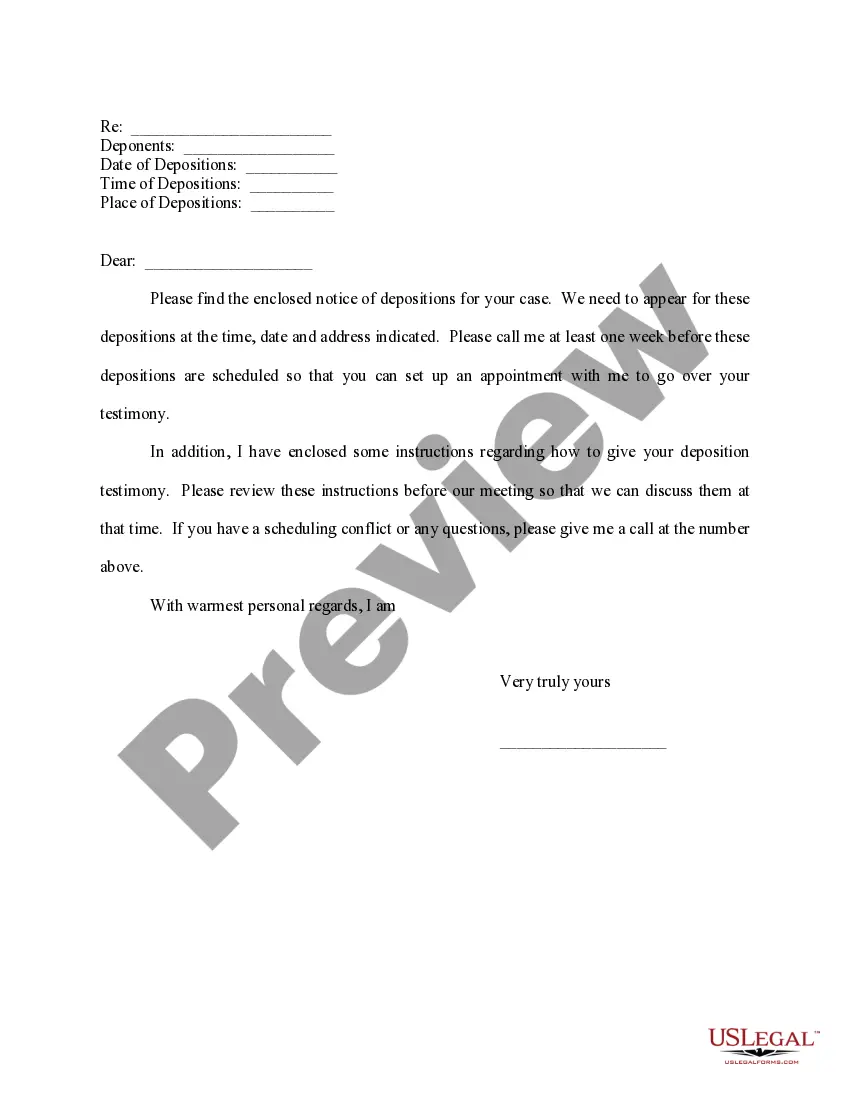

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your correct town/nation.

- Step 2. Utilize the Review method to look over the form`s information. Do not neglect to see the information.

- Step 3. When you are unhappy with the type, utilize the Lookup field near the top of the monitor to find other variations of the lawful type design.

- Step 4. Upon having identified the shape you want, select the Get now key. Pick the costs program you prefer and add your accreditations to register on an accounts.

- Step 5. Method the purchase. You may use your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Choose the file format of the lawful type and acquire it in your product.

- Step 7. Comprehensive, revise and produce or sign the Washington Proposal to approve restricted stock plan.

Every lawful papers design you get is your own property forever. You might have acces to each and every type you downloaded in your acccount. Go through the My Forms section and decide on a type to produce or acquire yet again.

Be competitive and acquire, and produce the Washington Proposal to approve restricted stock plan with US Legal Forms. There are many skilled and condition-specific forms you can use for the enterprise or individual needs.

Form popularity

FAQ

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

At the time of Vesting/Purchase: In RSUs, you don't pay anything to purchase shares. You just get it as part of the vesting schedule. So the market value of the shares at the time of vesting is considered as income and taxed ingly. In ESOP (and ESPP), the purchase price (or discount) of shares is pre-decided.

Yes, you will owe taxes when you sell your shares, but you shouldn't let the tax tail wag the investment dog. With RSUs, you will owe taxes the day they vest anyway. With ESPP shares, you will owe taxes on the discount regardless and if you have a gain, it will be taxed at the more favorable capital gains rate.

RSAs and RSUs are both restricted stocks but they have many differences. An RSA is a grant which gives the employee the right to buy shares at fair market value, at no cost, or at a discount. An RSU is a grant valued in terms of company stock, but you do not actually get the shares until the restrictions lapse or vest.

In SAR scheme, the employee is entitled to a share in the growth of the company (paid in cash or equivalent). However, he/she is not allotted any shares, whereas in ESOP the employee is allotted the shares (and thus the benefit in growth of the company).

ESOPs involve the option to purchase company shares at a predetermined grant price, providing potential profits. On the other hand, RSUs are restricted stocks that employees receive as compensation and can be sold after a vesting period or upon achieving specific milestones.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.