Washington Approval of savings plan for employees

Description

How to fill out Approval Of Savings Plan For Employees?

Are you presently in a position in which you need to have files for possibly business or personal uses nearly every day time? There are a variety of authorized file layouts available on the net, but finding ones you can rely on is not straightforward. US Legal Forms delivers a huge number of kind layouts, such as the Washington Approval of savings plan for employees, that are published to fulfill federal and state demands.

Should you be previously informed about US Legal Forms internet site and possess an account, just log in. Afterward, you can down load the Washington Approval of savings plan for employees web template.

Should you not have an bank account and need to begin to use US Legal Forms, adopt these measures:

- Get the kind you want and ensure it is to the proper area/region.

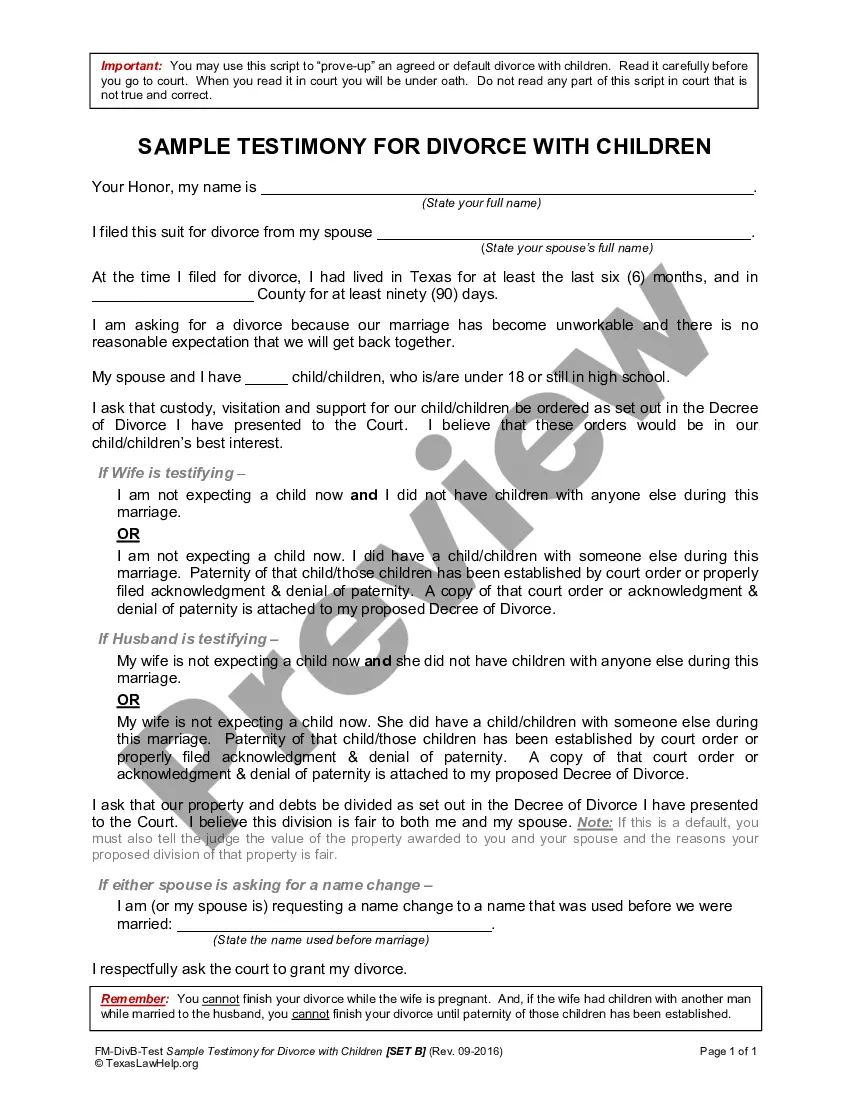

- Use the Review option to review the form.

- Read the outline to ensure that you have chosen the proper kind.

- In the event the kind is not what you are seeking, use the Research industry to obtain the kind that suits you and demands.

- Once you discover the proper kind, simply click Purchase now.

- Select the rates strategy you would like, fill in the required information and facts to create your account, and pay money for the order making use of your PayPal or credit card.

- Select a convenient data file file format and down load your backup.

Find all of the file layouts you may have bought in the My Forms menus. You may get a more backup of Washington Approval of savings plan for employees any time, if required. Just go through the essential kind to down load or print out the file web template.

Use US Legal Forms, probably the most considerable variety of authorized kinds, to save lots of time as well as steer clear of errors. The assistance delivers skillfully made authorized file layouts that you can use for an array of uses. Produce an account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Current rule: As of June 30, 2022, California requires employers with five or more employees, to offer a retirement savings plan. Plan details: Employers may choose an independent retirement plan administrator, or participate in California's state-run plan. You can read more in our guide to the Calsavers mandate.

Employer-sponsored savings plans such as 401(k) and Roth 401(k) plans provide employees with an automatic way to save for their retirement while benefiting from tax breaks. The reward to employees who participate in these programs is they essentially receive free money when their employers offer matching contributions.

Employers with one or more employees must participate in CalSavers if they do not already have a workplace retirement plan. The following deadlines to register are based on the size of the business. CalSavers deadlines by business size.

The Employee Savings Plan, or ESP, is a savings plan offered by employers that allows employees to save over many years via paycheck deductions for a variety of goals, such as retirement.

Key Takeaways. Most traditional 401(k) plans offer employer-matching contributions, but they are not required to do so. A 401(k) has significant benefits even without an employer match, including tax benefits.

Employer-sponsored savings plans such as 401(k) and Roth 401(k) plans provide employees with an automatic way to save for their retirement while benefiting from tax breaks. The reward to employees who participate in these programs is they essentially receive free money when their employers offer matching contributions.

Employers with one or more employees must participate in CalSavers if they do not already have a workplace retirement plan.

A Profit Sharing Plan or Stock Bonus Plan is a defined contribution plan under which the plan may provide, or the employer may determine, annually, how much will be contributed to the plan (out of profits or otherwise).