Washington Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

Are you within a position that you require paperwork for possibly company or person functions virtually every day time? There are tons of lawful document web templates available on the Internet, but locating versions you can rely isn`t effortless. US Legal Forms delivers 1000s of develop web templates, such as the Washington Stock Option Grants and Exercises and Fiscal Year-End Values, that happen to be written to satisfy state and federal specifications.

Should you be previously acquainted with US Legal Forms internet site and have an account, just log in. Next, you are able to acquire the Washington Stock Option Grants and Exercises and Fiscal Year-End Values format.

If you do not offer an accounts and wish to start using US Legal Forms, abide by these steps:

- Get the develop you require and ensure it is for the proper area/county.

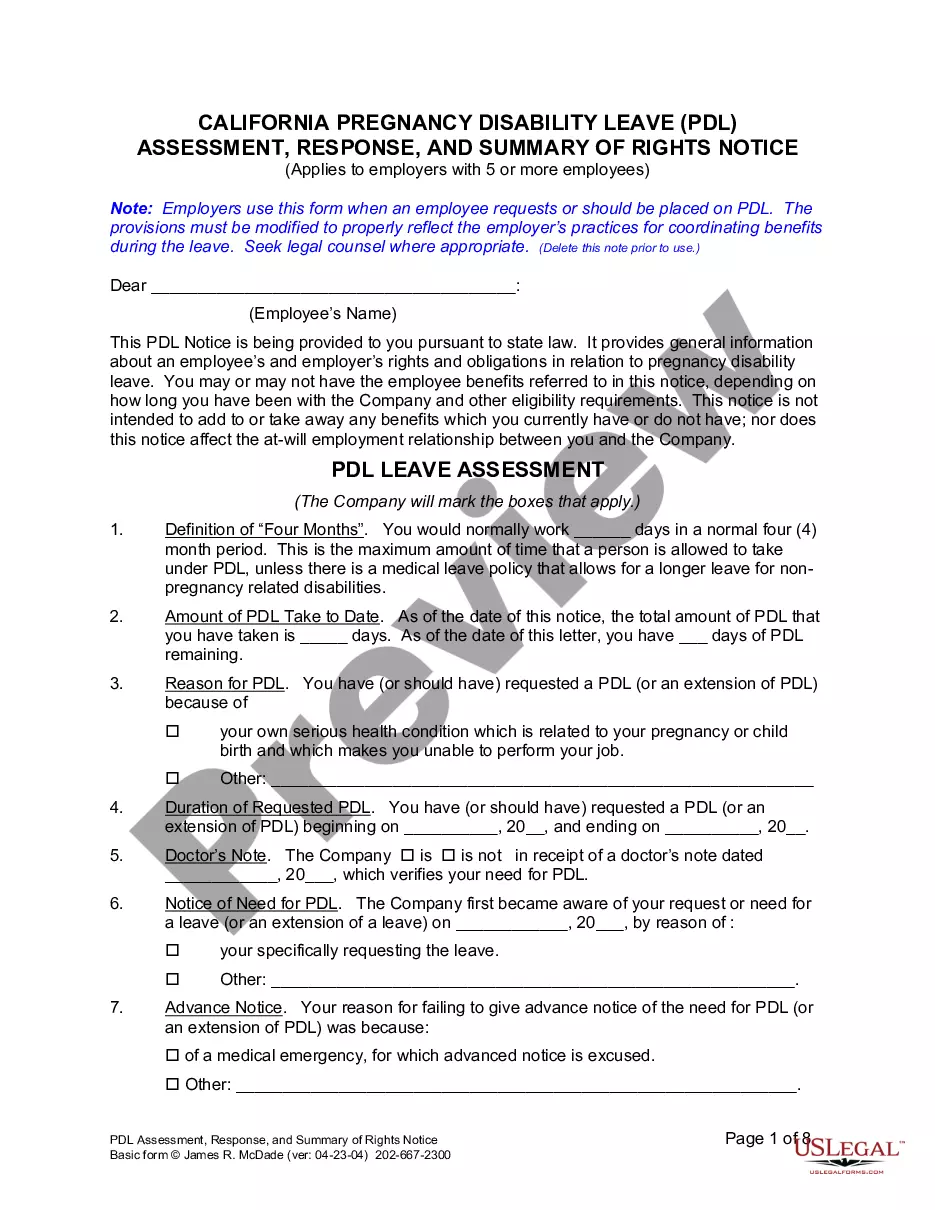

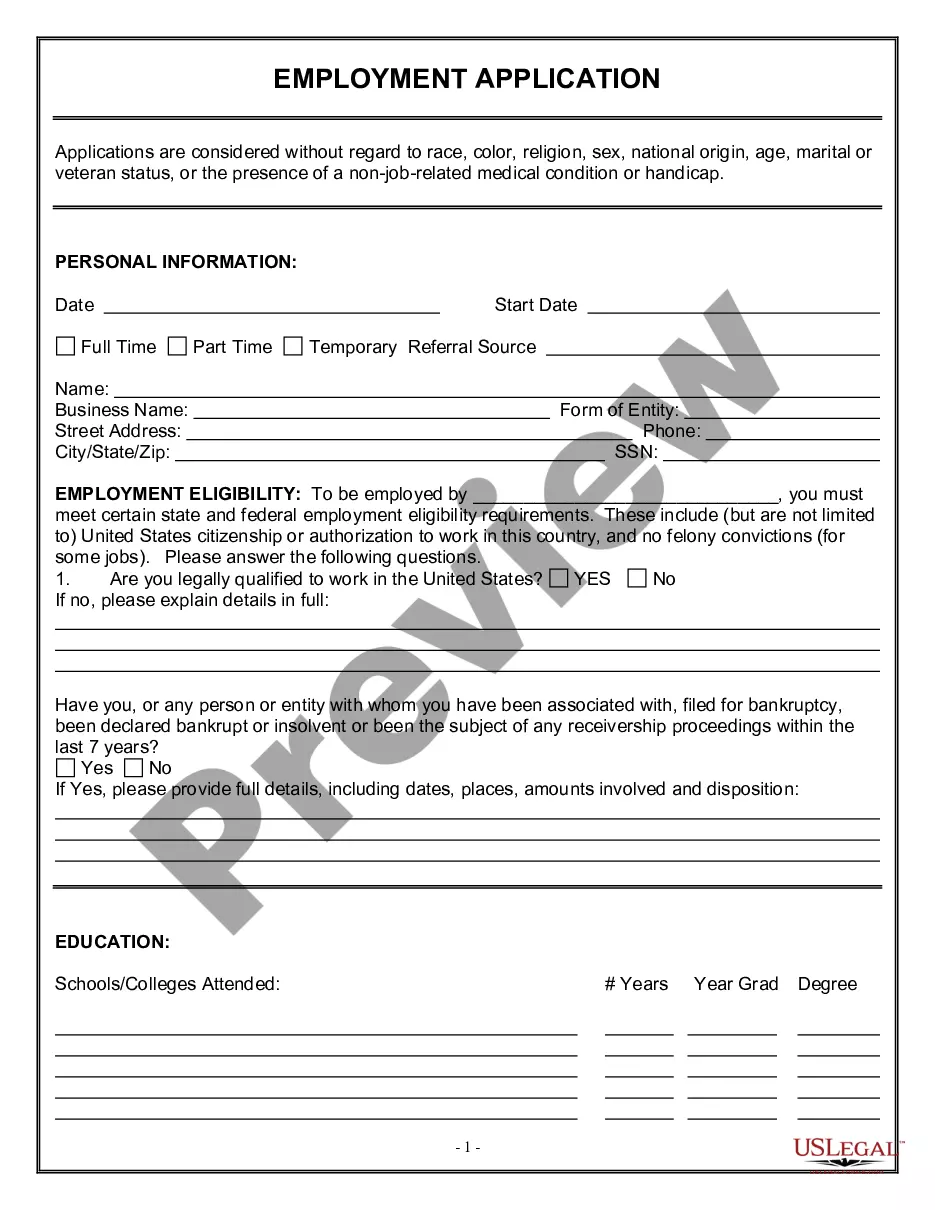

- Take advantage of the Review switch to analyze the shape.

- Look at the information to actually have selected the right develop.

- In the event the develop isn`t what you are trying to find, make use of the Search field to find the develop that fits your needs and specifications.

- When you get the proper develop, click on Purchase now.

- Choose the pricing program you would like, complete the desired information and facts to create your account, and purchase the order making use of your PayPal or charge card.

- Decide on a convenient document formatting and acquire your backup.

Find all of the document web templates you may have bought in the My Forms food list. You can aquire a additional backup of Washington Stock Option Grants and Exercises and Fiscal Year-End Values any time, if necessary. Just select the required develop to acquire or print out the document format.

Use US Legal Forms, the most substantial collection of lawful varieties, in order to save time as well as avoid blunders. The services delivers expertly created lawful document web templates which you can use for an array of functions. Create an account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

Both call and put options have an exercise price. Investors also refer to the exercise price as the strike price. The difference between the exercise price and the underlying security's price determines if an option is ?in the money? or ?out of the money."

You can calculate the aggregate exercise price by taking the strike price of the option and multiplying it by its contract size. In the case of a bond option, the exercise price is multiplied by the face value of the underlying bond.

An incentive stock option (ISO) gives employees?usually company executives?the opportunity to buy company stock at a discounted price. Employees do not owe federal income taxes when the option is granted or when they exercise the option. Instead, they pay taxes when they sell the stock.

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option.

Exercise Price ? Also known as the strike price, the grant price is the price at which you can buy the shares of stock. Regardless of the future value of that particular stock, the option holder will have the right to buy the shares at the grant price rather than the current, actual price.

FMV influences the price employees, contractors, and other common stock option recipients must pay to purchase their stock options (also known as the strike price). The strike price must be greater than or equal to the FMV stated in the 409A valuation.

Every stock option has an exercise price, also called the strike price, which is the price at which a share can be bought. In the US, the exercise price is typically set at the fair market value of the underlying stock as of the date the option is granted, in order to comply with certain requirements under US tax law.

A strike price, also known as a grant price or exercise price, is the fixed cost that you'll pay per share in order to exercise your stock options so you can own them.