Washington Terms of advisory agreement

Description

How to fill out Terms Of Advisory Agreement?

US Legal Forms - one of several greatest libraries of legitimate forms in the States - offers a wide array of legitimate file templates you are able to acquire or printing. Utilizing the website, you will get thousands of forms for business and specific functions, categorized by classes, claims, or keywords.You can find the newest models of forms just like the Washington Terms of advisory agreement in seconds.

If you already possess a subscription, log in and acquire Washington Terms of advisory agreement from your US Legal Forms collection. The Download switch can look on every develop you see. You have access to all earlier downloaded forms inside the My Forms tab of your respective accounts.

If you want to use US Legal Forms for the first time, here are simple instructions to help you get started:

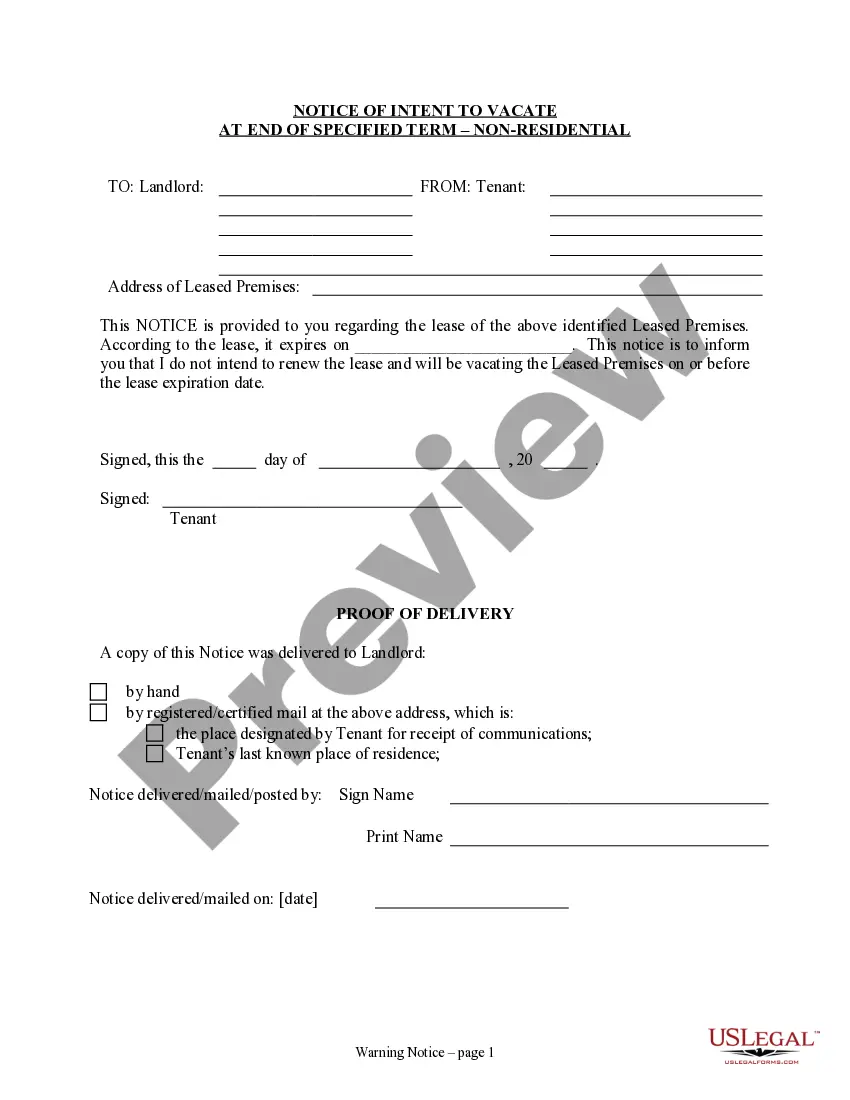

- Make sure you have picked out the proper develop for your area/region. Select the Review switch to check the form`s articles. See the develop outline to ensure that you have chosen the correct develop.

- When the develop doesn`t match your requirements, take advantage of the Search field on top of the screen to obtain the one which does.

- If you are happy with the shape, validate your decision by clicking the Buy now switch. Then, select the prices program you prefer and provide your qualifications to register on an accounts.

- Process the deal. Use your credit card or PayPal accounts to perform the deal.

- Find the formatting and acquire the shape on your product.

- Make modifications. Fill up, edit and printing and signal the downloaded Washington Terms of advisory agreement.

Each format you included in your bank account does not have an expiration date and is also your own property eternally. So, if you want to acquire or printing yet another copy, just visit the My Forms section and click on about the develop you need.

Obtain access to the Washington Terms of advisory agreement with US Legal Forms, one of the most substantial collection of legitimate file templates. Use thousands of skilled and condition-specific templates that fulfill your small business or specific requires and requirements.

Form popularity

FAQ

(2) It is unlawful for an investment adviser, acting as principal for his or her own account, knowingly to sell any security to or purchase any security from a client, or act as a broker for a person other than such client, knowingly to effect any sale or purchase of any security for the account of such client, without ...

The director, by rule or order, may waive the examination as to a person or class of persons if the administrator determines that the examination is not necessary or appropriate in the public interest or for the protection of investors.

Rule 204-3 under the Advisers Act, commonly referred to as the "brochure rule," generally requires every SEC-registered investment adviser to deliver to each client or prospective client a Form ADV Part 2A (brochure) and Part 2B (brochure supplement) describing the adviser's business practices, conflicts of interest ...

Unlawful to offer or sell unregistered securities?Exceptions. It is unlawful for any person to offer or sell any security in this state unless: (1) The security is registered by coordination or qualification under this chapter; (2) the security or transaction is exempted under RCW 21.20.

(1) In recommending to a customer the purchase, sale, or exchange of a security, a broker-dealer, salesperson, investment adviser, or investment adviser representative must have reasonable grounds for believing that the recommendation is suitable for the customer upon the basis of the facts, if any, disclosed by the ...