Washington Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment

Description

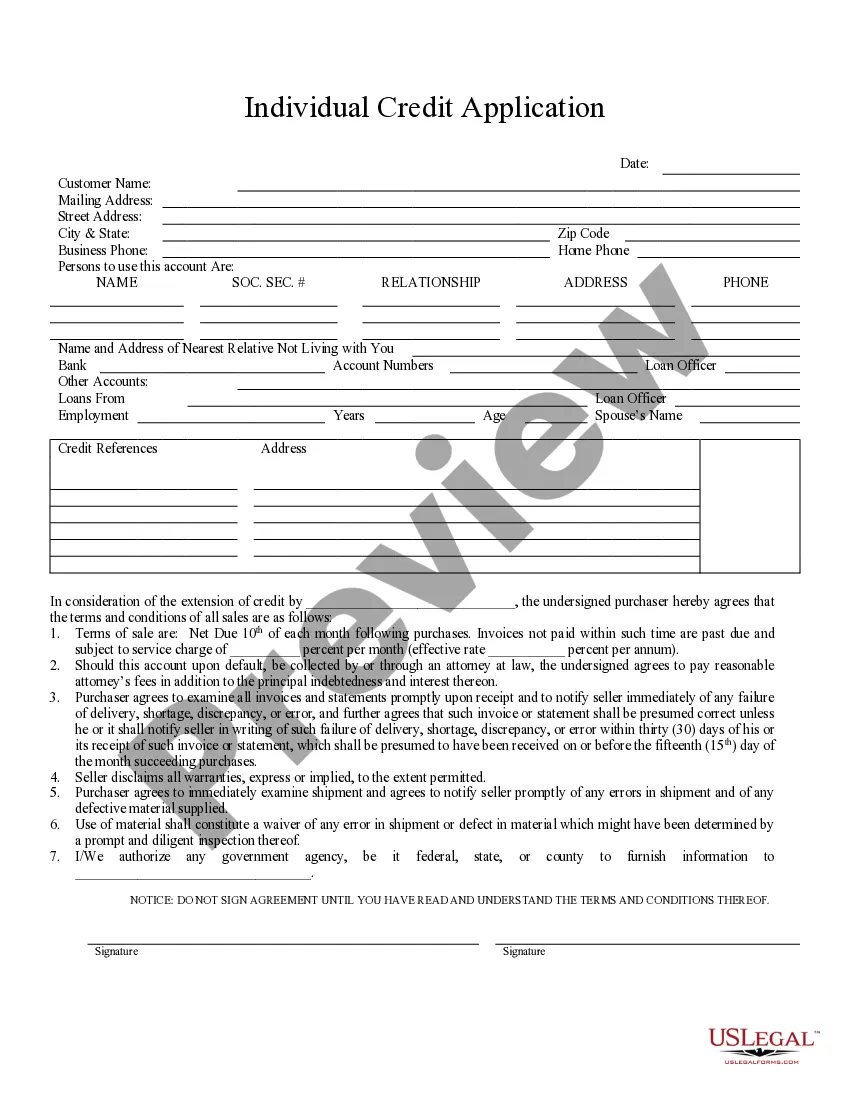

How to fill out Proposal To Amend The Articles Of Incorporation To Increase Authorized Common Stock And Eliminate Par Value With Amendment?

If you need to complete, down load, or print out legal file templates, use US Legal Forms, the biggest collection of legal varieties, that can be found on the web. Utilize the site`s basic and convenient lookup to find the files you require. Various templates for business and person purposes are categorized by types and suggests, or search phrases. Use US Legal Forms to find the Washington Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment with a couple of clicks.

When you are previously a US Legal Forms consumer, log in to the account and then click the Obtain key to have the Washington Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment. You may also entry varieties you in the past delivered electronically within the My Forms tab of your own account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your right city/nation.

- Step 2. Make use of the Review method to examine the form`s information. Don`t forget about to see the outline.

- Step 3. When you are not happy with the kind, use the Lookup field on top of the screen to discover other models of your legal kind design.

- Step 4. After you have identified the shape you require, click the Get now key. Opt for the rates prepare you like and include your qualifications to sign up for the account.

- Step 5. Method the transaction. You can use your credit card or PayPal account to accomplish the transaction.

- Step 6. Choose the format of your legal kind and down load it in your gadget.

- Step 7. Comprehensive, revise and print out or signal the Washington Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment.

Each and every legal file design you purchase is your own permanently. You might have acces to each and every kind you delivered electronically with your acccount. Go through the My Forms portion and decide on a kind to print out or down load once again.

Remain competitive and down load, and print out the Washington Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment with US Legal Forms. There are millions of professional and express-distinct varieties you can use for your business or person needs.

Form popularity

FAQ

Conduct the extraordinary general meeting and obtain the approval of the shareholders to increase the authorized share capital on the time, date, and place that is mentioned on the notice. The approval of the shareholders to increase the authorized capital must be in the form of an ordinary resolution.

Articles of Incorporation must be amended to alert the state to major changes. Changes that qualify for state notification include changes to: address. company name.

Definition of Corporation It is an artificial being, created operation of law, having the right of succession and the powers, attributes, and properties expressly authorized by law or incident to its existence.

Either the directors or shareholders of a company may increase or decrease the number of authorised shares for a particular share class by amending the Memorandum of Incorporation (?MOI?) and filing a COR15. 2 with the CIPC.

To make amendments to your Washington State Corporation, you must provide the completed Articles of Amendment form and provide them to the Secretary of State by mail, by fax or in person, along with the filing fee.

The number of shares represents the authorized shares. The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

Because a corporation's Articles of Incorporation include the number of authorized shares and par value of those shares, a share amendment must be filed with the state in order to change this information.

HOWEVER, it's important to know the consequences of authorizing more stock shares before you do. In brief, increased stock means increased capital?yay! At the same time, creating more stock means all existing shareholders suddenly own a smaller percentage of your company, which can decrease shareholder value.