Washington Authorization to purchase corporation's outstanding common stock

Description

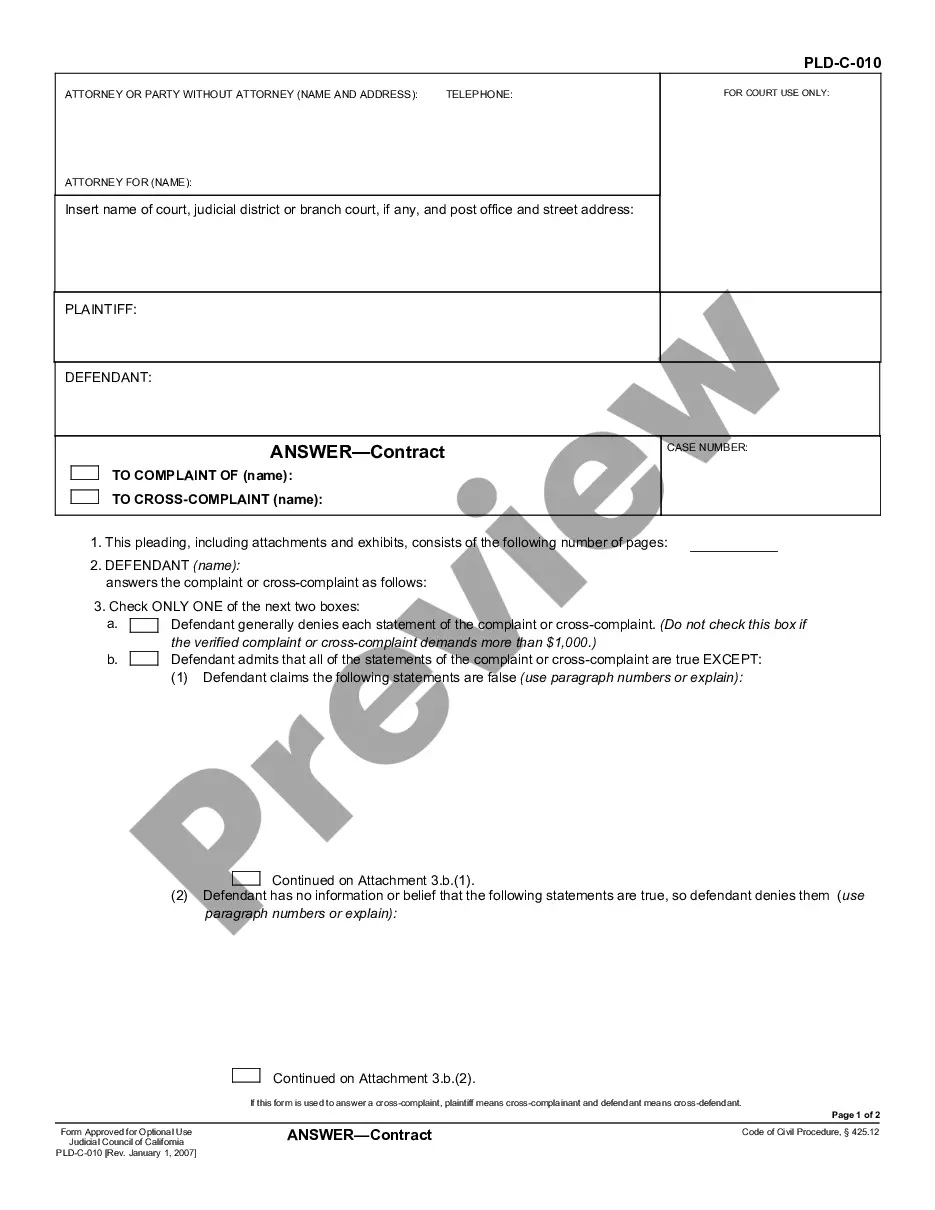

How to fill out Authorization To Purchase Corporation's Outstanding Common Stock?

Are you in a position the place you will need documents for either enterprise or personal uses just about every working day? There are plenty of legitimate papers web templates available on the Internet, but discovering types you can rely on isn`t easy. US Legal Forms offers a large number of develop web templates, much like the Washington Authorization to purchase corporation's outstanding common stock, that happen to be created to meet federal and state demands.

If you are already knowledgeable about US Legal Forms website and get an account, basically log in. Following that, you are able to obtain the Washington Authorization to purchase corporation's outstanding common stock design.

If you do not offer an profile and need to start using US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for the correct area/region.

- Use the Review option to examine the shape.

- See the explanation to actually have selected the proper develop.

- When the develop isn`t what you are seeking, take advantage of the Look for industry to get the develop that meets your needs and demands.

- If you obtain the correct develop, simply click Get now.

- Select the costs prepare you need, complete the specified information to create your account, and pay for the order utilizing your PayPal or bank card.

- Pick a practical paper formatting and obtain your copy.

Locate all of the papers web templates you may have purchased in the My Forms menus. You can get a extra copy of Washington Authorization to purchase corporation's outstanding common stock whenever, if needed. Just go through the necessary develop to obtain or produce the papers design.

Use US Legal Forms, probably the most extensive variety of legitimate types, to conserve some time and avoid mistakes. The assistance offers professionally created legitimate papers web templates which you can use for a range of uses. Make an account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

A commonly adopted starting point is to authorize 10 million shares. It provides flexibility for fundraising, hiring, and future growth. Typically, founders might initially issue themselves between 6 and 8 million shares, leaving the rest for future employees, advisors, and investors.

Authorized share capital is the number of stock units a company can issue as stated in its memorandum of association or articles of incorporation. Capital stock is the number of common and preferred shares that a company is authorized to issue, and is recorded in shareholders' equity.

There is no requirement regarding how many shares can be authorized. Enterprises use authorized shares when they go public by offering a company's equity, for instance, through an initial public offering (IPO).

A shareholder receives a share certificate as a receipt of his or her purchase and to reflect ownership of a specified number of shares of the company. In today's financial world, physical share certificates are issued only rarely, with digital records replacing them in most cases.

The number of authorized shares per company is assessed at the company's creation and can only be increased or decreased through a vote by the shareholders. If at the time of incorporation the documents state that 100 shares are authorized, then only 100 shares can be issued.

A corporation can't be a corporation without at least one share of stock. So you must have at least one shareholder, and one share of stock. You can have (authorize) as many shares of stock as you want, however, this may increase your filing fees in some cases.

The company secretary is responsible for issuing stock certificates, but the certificate has to be signed by two directors. In some cases, one director signs along with the company secretary. Companies having only one director will have to invite a witness to attest the signature.

????? Stock: An equity security that represents the purchase of a share of ownership in a corporation by a shareholder.