The Washington Stockholders' Rights Plan of Data scope Corp., also referred to as a "poison pill" or "shareholders' rights plan," is a defensive strategy implemented by the company to protect its shareholders against hostile takeovers or other potential threats. This detailed description will explore the purpose and working mechanism of the Washington Stockholders' Rights Plan, highlighting its benefits and different types. The Washington Stockholders' Rights Plan is designed to deter and resist unsolicited attempts by acquiring entities to take over or control Data scope Corp. without proper consent from the existing shareholders. It provides shareholders with certain rights and privileges to defend their interests and ensure equitable treatment during any change in control or ownership. At its core, the Washington Stockholders' Rights Plan issues rights or "poison pills" to the existing shareholders of Data scope Corp. Each right enables the shareholder to purchase additional shares of the company's stock at a significant discount, typically exercised when an acquiring entity crosses a specified threshold of ownership (e.g., acquiring a certain percentage of outstanding shares). This triggers dilution, making it more costly or complicated for the acquiring entity to gain control and reducing the financial attractiveness of the takeover. The Washington Stockholders' Rights Plan consists of two main types: 1. Flip-in Rights: These rights grant existing shareholders (except the acquiring entity) the option to purchase additional Data scope Corp. shares at a discount. When a potential acquirer crosses the predetermined threshold specified in the plan, these rights become exercisable by shareholders, encouraging them to increase their stake in the company, thus diluting the acquiring entity's ownership. 2. Flip-over Rights: Flip-over rights come into effect when an acquisition or merger occurs. In this scenario, shareholders (excluding the acquiring entity) are entitled to acquire shares of the acquiring entity at a discounted price. This provision incentivizes existing shareholders to support a merger or acquisition that maximizes shareholder value, ensuring they receive fair consideration in the event of a change in control. The Washington Stockholders' Rights Plan serves several purposes, including: 1. Protecting shareholder value: By providing a defense against hostile takeover attempts, the plan aims to preserve the long-term value of Data scope Corp. and prevent undervaluation or inadequate control transfer. 2. Negotiating leverage: The plan gives the board of directors and existing shareholders negotiating leverage with potential acquirers, fostering fairer terms and conditions for any change in control transaction. 3. Time for evaluation: By diluting the acquiring entity's ownership, the plan buys time for the board of directors and shareholders to assess the potential impact of a takeover and evaluate alternative strategies or offers. In summary, the Washington Stockholders' Rights Plan of Data scope Corp. is a vital defensive measure designed to safeguard shareholder interests and deter hostile takeovers. The plan comprises flip-in and flip-over rights, empowering shareholders to purchase additional shares at discounted prices when specific thresholds are met. By implementing this plan, Data scope Corp. seeks to protect long-term shareholder value, negotiate more favorable outcomes, and gain time for thorough evaluation in the face of potential takeovers.

Washington Stockholders' Rights Plan of Datascope Corp.

Description

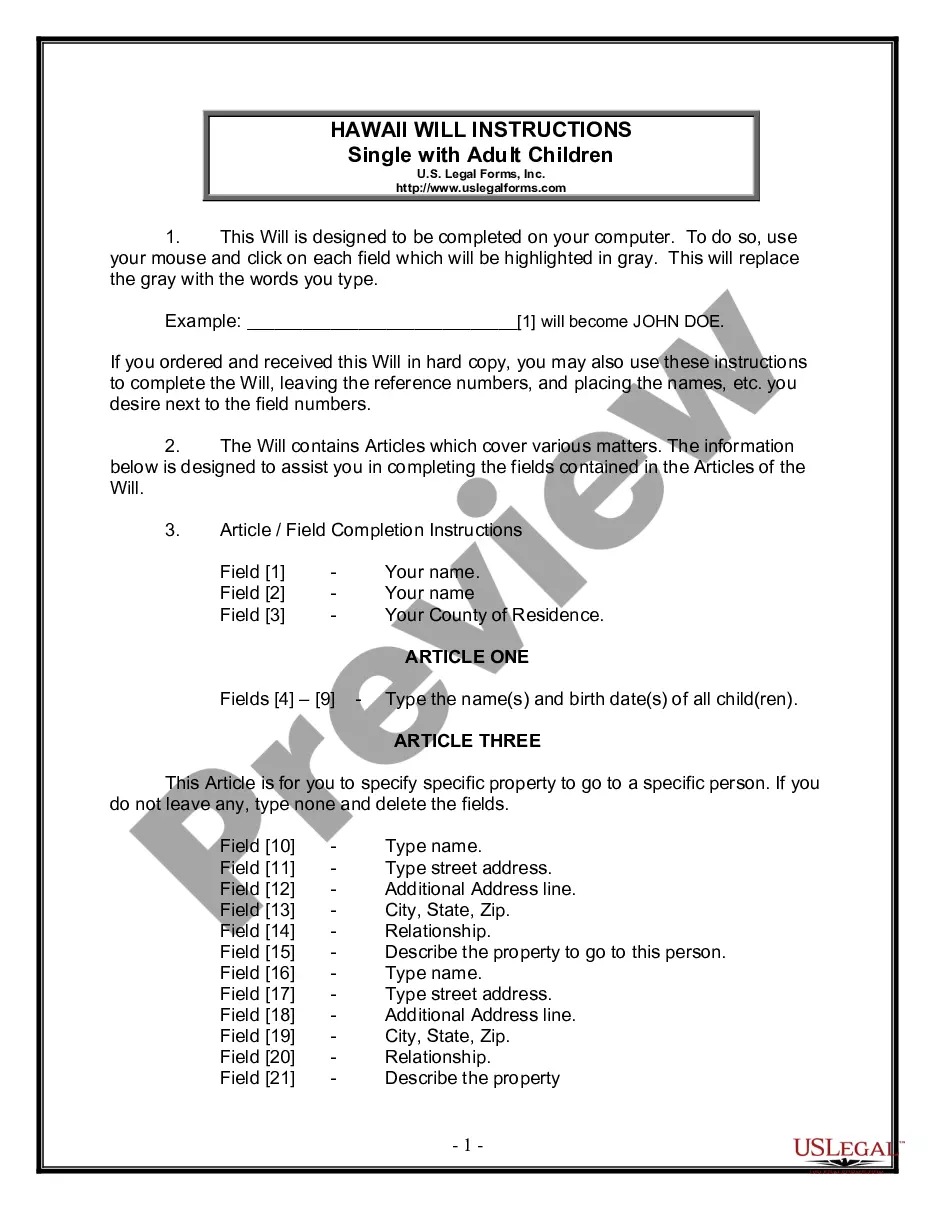

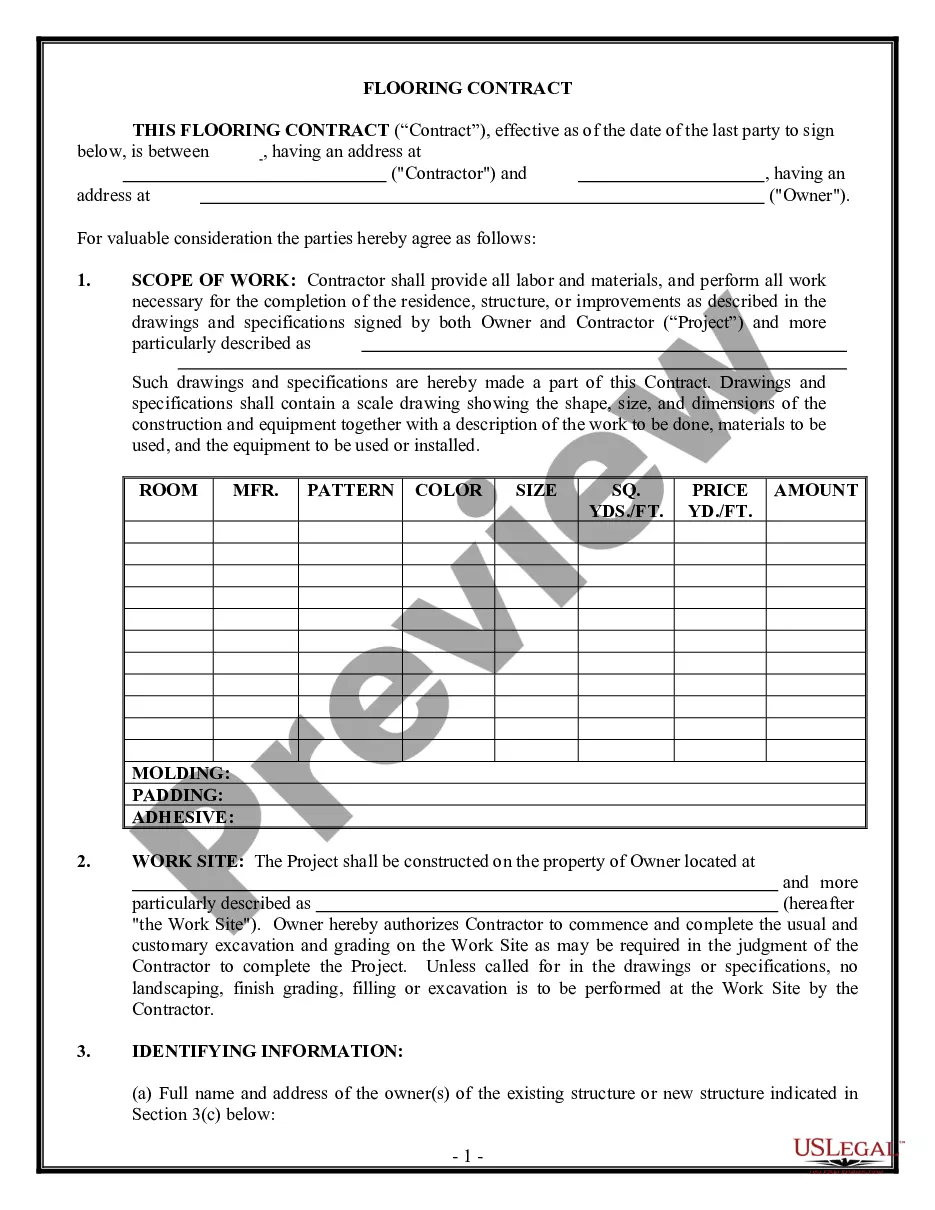

How to fill out Washington Stockholders' Rights Plan Of Datascope Corp.?

If you have to comprehensive, down load, or printing authorized record layouts, use US Legal Forms, the greatest selection of authorized forms, that can be found on the Internet. Make use of the site`s basic and practical look for to discover the paperwork you require. Various layouts for company and individual functions are categorized by groups and claims, or key phrases. Use US Legal Forms to discover the Washington Stockholders' Rights Plan of Datascope Corp. in a number of click throughs.

In case you are currently a US Legal Forms buyer, log in to the accounts and click the Obtain button to find the Washington Stockholders' Rights Plan of Datascope Corp.. You can also accessibility forms you earlier delivered electronically within the My Forms tab of your accounts.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that proper city/country.

- Step 2. Make use of the Review option to look through the form`s content material. Don`t forget about to see the outline.

- Step 3. In case you are unsatisfied with all the type, make use of the Search field towards the top of the display to locate other variations in the authorized type template.

- Step 4. After you have located the shape you require, click the Buy now button. Pick the pricing plan you like and add your qualifications to sign up to have an accounts.

- Step 5. Method the transaction. You may use your credit card or PayPal accounts to perform the transaction.

- Step 6. Select the formatting in the authorized type and down load it on your product.

- Step 7. Complete, modify and printing or signal the Washington Stockholders' Rights Plan of Datascope Corp..

Each authorized record template you purchase is your own permanently. You have acces to each and every type you delivered electronically inside your acccount. Select the My Forms area and decide on a type to printing or down load yet again.

Compete and down load, and printing the Washington Stockholders' Rights Plan of Datascope Corp. with US Legal Forms. There are many skilled and state-certain forms you may use to your company or individual requires.