The Washington Letter to limited partners is an important communication document in the financial industry, specifically in investment partnerships. This letter serves as a comprehensive update on the performance, strategy, and overall outlook of the partnership to its limited partners. It is usually written by the general partner or management team of the partnership and aims to keep limited partners well-informed about the status of their investments. Containing valuable information, the Washington Letter discusses a range of topics pertinent to the partnership's activities and interests. It often begins with a concise introduction, followed by an overview of the partnership's performance during the reporting period, analyzing key financial metrics, such as net asset value (NAV), returns on investments, and any changes in the investment portfolio. In addition to performance updates, the letter may touch upon the partnership's investment strategy, discussing the rationale behind investment decisions, asset allocation, risk management, and market analysis. It often highlights notable events or trends affecting the portfolio and may discuss the impact of macroeconomic factors like interest rates, inflation, or regulatory changes. The Washington Letter also provides insights into the partnership's operational aspects, such as expenses, fee structure, and any changes in the partnership agreement. It may detail any carried interest or management fees, clarify the taxation landscape relevant to limited partners, and outline any upcoming fund distributions or capital calls. Moreover, the letter might address any legal or compliance matters, ensuring transparency and adherence to regulations. It may introduce updates on regulatory changes that could impact the partnership's activities or mention any ongoing litigation or compliance issues if applicable. Depending on the partnership type and its specific nature, there might be various types of Washington Letters to limited partners. Some examples include: 1. Quarterly Washington Letter: Issued on a quarterly basis, providing an overview of the partnership's performance during the past three months. It highlights factors influencing investment decisions, changes in asset allocation, and addresses any issues or opportunities that arose during the period. 2. Annual Washington Letter: Produced at the end of each fiscal year, summarizing the partnership's performance over the year. This letter often includes a comprehensive review of the investments made, significant achievements, as well as a more detailed discussion on the partnership's strategy for the upcoming year. 3. Ad-hoc Washington Letter: Occasionally, a partnership might issue ad-hoc letters to limited partners when there are significant developments or events impacting the partnership. These letters may focus on a specific topic, such as changes in law or regulation, updates on specific investments, or other critical matters requiring immediate attention. Overall, the Washington Letter to limited partners is a crucial tool for investment partnerships, ensuring effective communication and transparency between the general partner and limited partners. Its comprehensive content provides stakeholders with valuable insights into the partnership's performance, strategy, operational aspects, and compliance matters.

Washington Letter to limited partners

Description

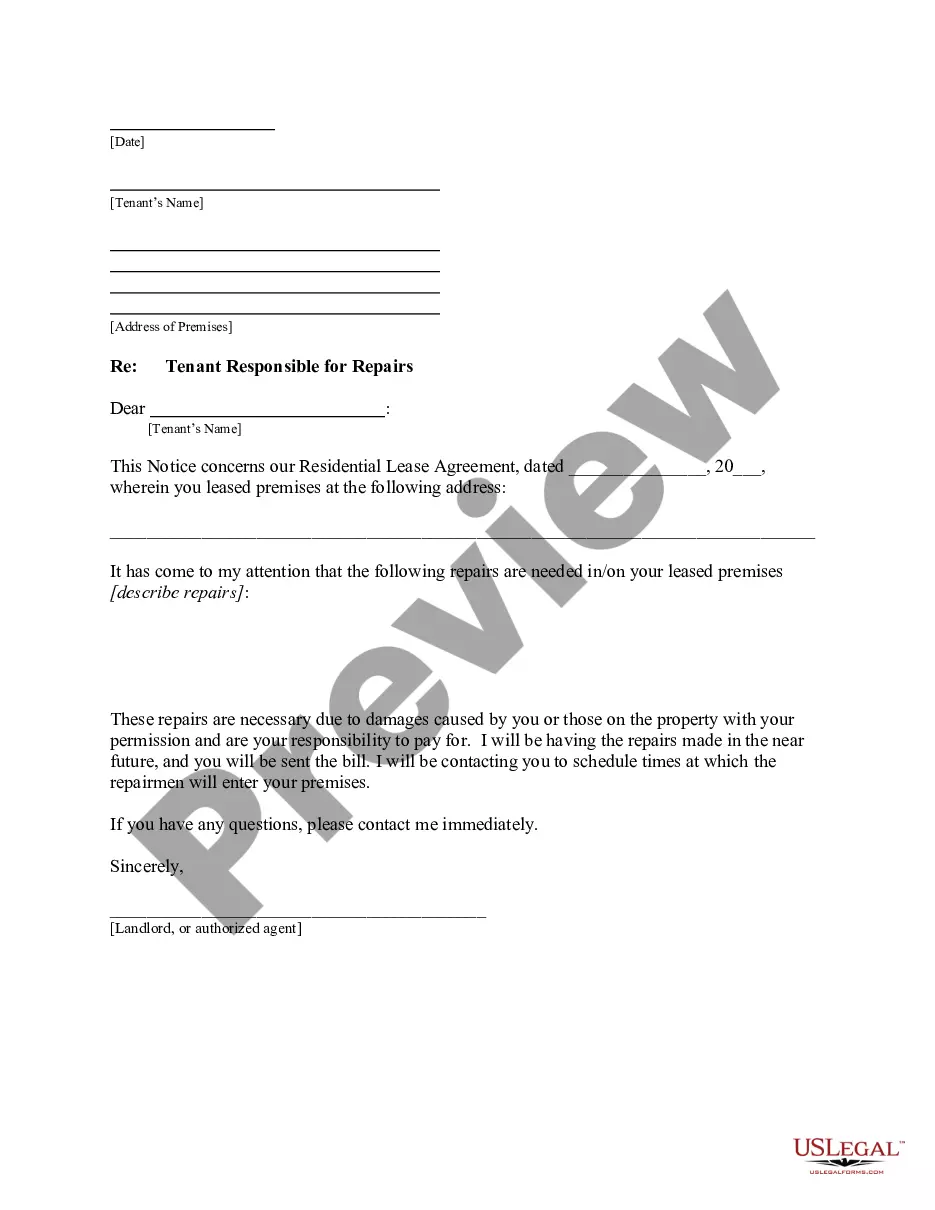

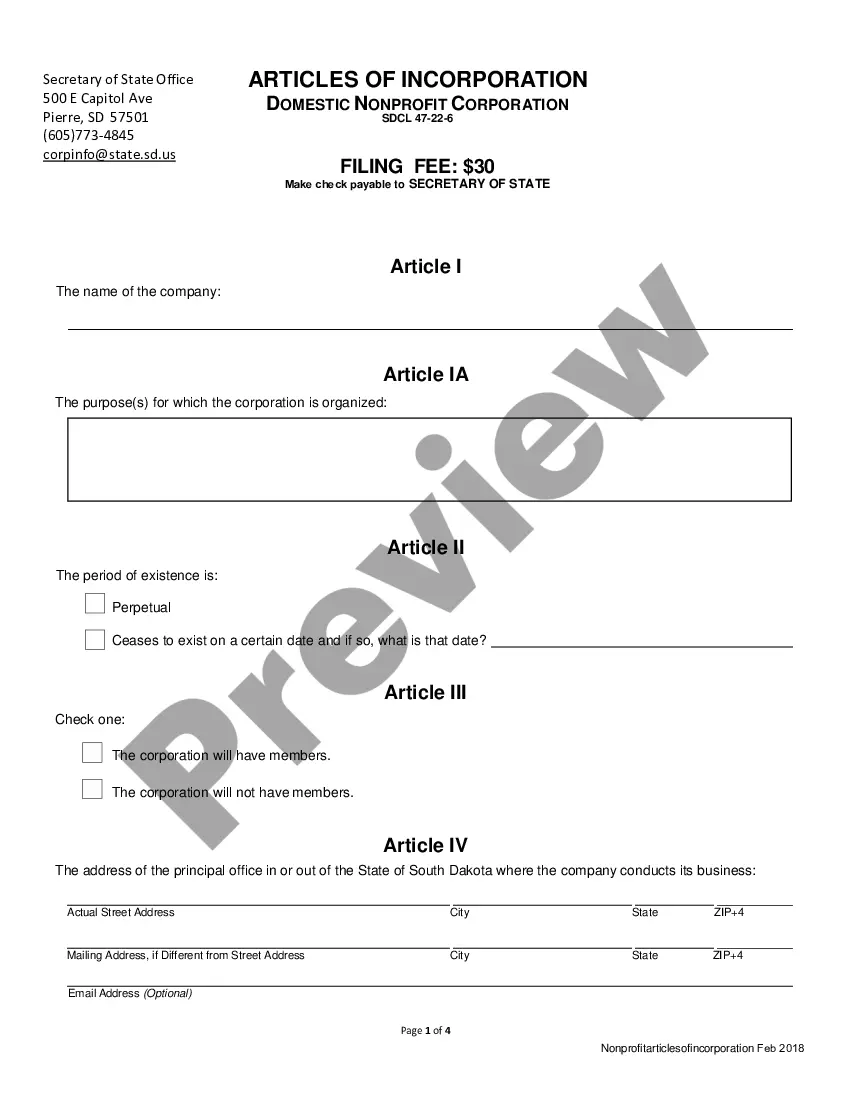

How to fill out Washington Letter To Limited Partners?

Have you been in the place the place you require papers for possibly enterprise or individual functions just about every day time? There are a lot of legal papers templates available on the Internet, but locating types you can rely on is not simple. US Legal Forms delivers a large number of kind templates, such as the Washington Letter to limited partners, that are created to satisfy state and federal needs.

Should you be previously informed about US Legal Forms web site and have a merchant account, merely log in. Next, you can acquire the Washington Letter to limited partners web template.

Unless you offer an account and need to begin to use US Legal Forms, follow these steps:

- Obtain the kind you want and ensure it is for that correct metropolis/state.

- Make use of the Review option to check the form.

- Look at the information to ensure that you have chosen the appropriate kind.

- When the kind is not what you are seeking, take advantage of the Look for field to discover the kind that suits you and needs.

- When you discover the correct kind, click on Get now.

- Pick the pricing program you desire, fill in the specified info to make your money, and purchase an order using your PayPal or charge card.

- Choose a hassle-free file format and acquire your backup.

Discover all of the papers templates you might have purchased in the My Forms food selection. You can aquire a more backup of Washington Letter to limited partners whenever, if needed. Just click on the essential kind to acquire or print the papers web template.

Use US Legal Forms, one of the most comprehensive assortment of legal types, to conserve some time and stay away from blunders. The service delivers appropriately made legal papers templates which you can use for a range of functions. Make a merchant account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

Paris,July 30th, 1796, AS censure is but awkwardly softened by apology, I shall offer you no apology for this letter. The eventful crisis to which your double politics have con?ducted the affairs of your country requires an investi?gation uncramped by ceremony.

Using rhetoric, the art of persuasive speaking or writing, Washington does his best to put the readers (members of the Congress) at ease and gain their initial support for the new Constitution. Rhetoric can be broken down into three basic tactics: using authority, logic, and emotion.

Further, Washington initially refused to attend because he suspected that he would be made the Convention's leader, and probably be proposed as the nation's first chief executive.

Crawford by then was the colonel of Virginia's 7th Regiment and joined Washington at the Battle of Long Island. Crawford went on to fight under Washington's command at Trenton, Princeton, Brandywine, and Germantown.

?We are either a United people, or we are not. If the former, let us, in all matters of general concern act as a nation, which have national objects to promote, and a National character to support?If we are not, let us no longer act a farce by pretending to it??

Letter of George Washington to William Crawford, September 21, 1767. This letter describes George Washington's contempt for Britain's attempt to limit settlement west of the Appalachian Mountains. Washington held extensive landholdings in the region and hoped to sell the land for a profit.

Crawford was one of the well-known frontiersmen. He was a surveyor and assisted Washington to select the bounty lands on the Kanawha and Ohio Rivers for the Virginia officers and soldiers, for their services in the French and Indian War.