Washington Software Sales Agreement

Description

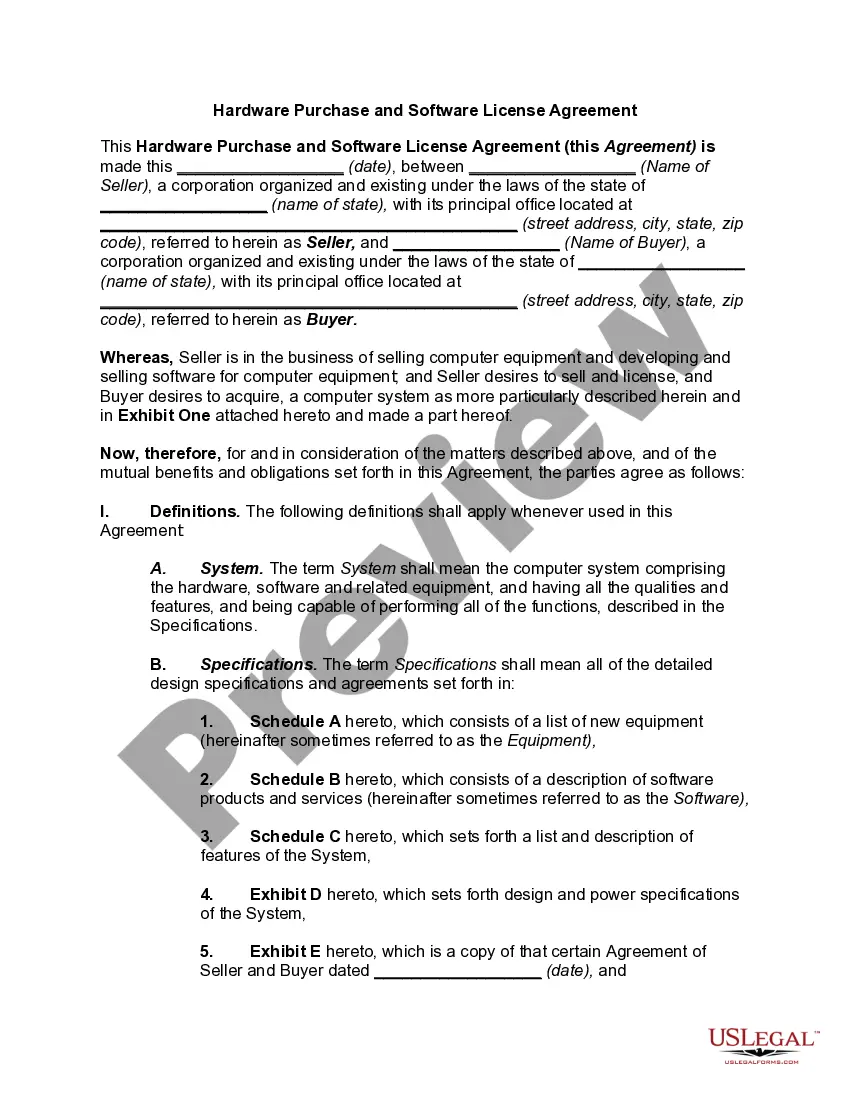

How to fill out Software Sales Agreement?

Are you within a place the place you need to have paperwork for both enterprise or individual uses almost every day time? There are plenty of lawful record themes available on the net, but locating kinds you can rely on is not straightforward. US Legal Forms gives a large number of type themes, such as the Washington Software Sales Agreement, which are created in order to meet federal and state requirements.

Should you be currently acquainted with US Legal Forms site and also have a free account, simply log in. Afterward, you may down load the Washington Software Sales Agreement design.

Unless you come with an profile and wish to begin to use US Legal Forms, abide by these steps:

- Get the type you will need and ensure it is for the correct area/region.

- Use the Review option to review the shape.

- Browse the outline to ensure that you have selected the appropriate type.

- When the type is not what you are seeking, take advantage of the Research area to get the type that fits your needs and requirements.

- If you find the correct type, click on Purchase now.

- Pick the pricing plan you want, fill in the desired details to produce your account, and buy the transaction making use of your PayPal or charge card.

- Decide on a convenient file file format and down load your version.

Discover each of the record themes you possess bought in the My Forms menus. You can obtain a further version of Washington Software Sales Agreement anytime, if needed. Just click the needed type to down load or printing the record design.

Use US Legal Forms, one of the most considerable assortment of lawful forms, in order to save some time and avoid mistakes. The services gives professionally made lawful record themes that you can use for a selection of uses. Produce a free account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

If a business purchases a digital good (only digital goods, NOT digital automated services or remote access software) for business purposes, then the purchase is exempt from sales tax.

Washington law exempts most grocery type food from retail sales tax. However, the law does not exempt ?prepared food,? ?soft drinks,? or ?dietary supplements.? Businesses that sell these ?foods? must collect sales tax. In addition, all alcoholic items are subject to retail sales tax.

SST CAS Allowance credit (Credit ID 603) The law allows certain businesses using Certified Automated System (CAS) software a credit against the sales/use tax they collect and report on their excise tax return.

Sales tax is charged on the entire package including both hardware and software and on charges for any subsequent modifications or enhancements made to the software program after the initial installation.

The State of Washington imposes a 6.5% sales tax on all retail sales as defined by statute (RCW 82.08. 020). Cities, towns, counties, transit districts, and public facilities districts may impose additional local sales taxes as described below.

Which States Do Not Levy an Internet Sales Tax? Only five states in the U.S. do not collect sales tax from internet purchases as of 2022. These include: Alaska, Delaware, New Hampshire, Montana, and Oregon.

You must collect retail sales tax from all of your nonresident customers, unless the customer or sale qualifies for another exemption. See our list of common nonresident exemptions for more information and related documentation requirements.

Washington is a destination-based sales tax state. So if you sell an item to a customer through your online store, collect sales tax at the tax rate where your product is delivered. (I.e. the Buyer's ship to address.) The state sales tax rate for Washington is 6.5%.