Washington Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

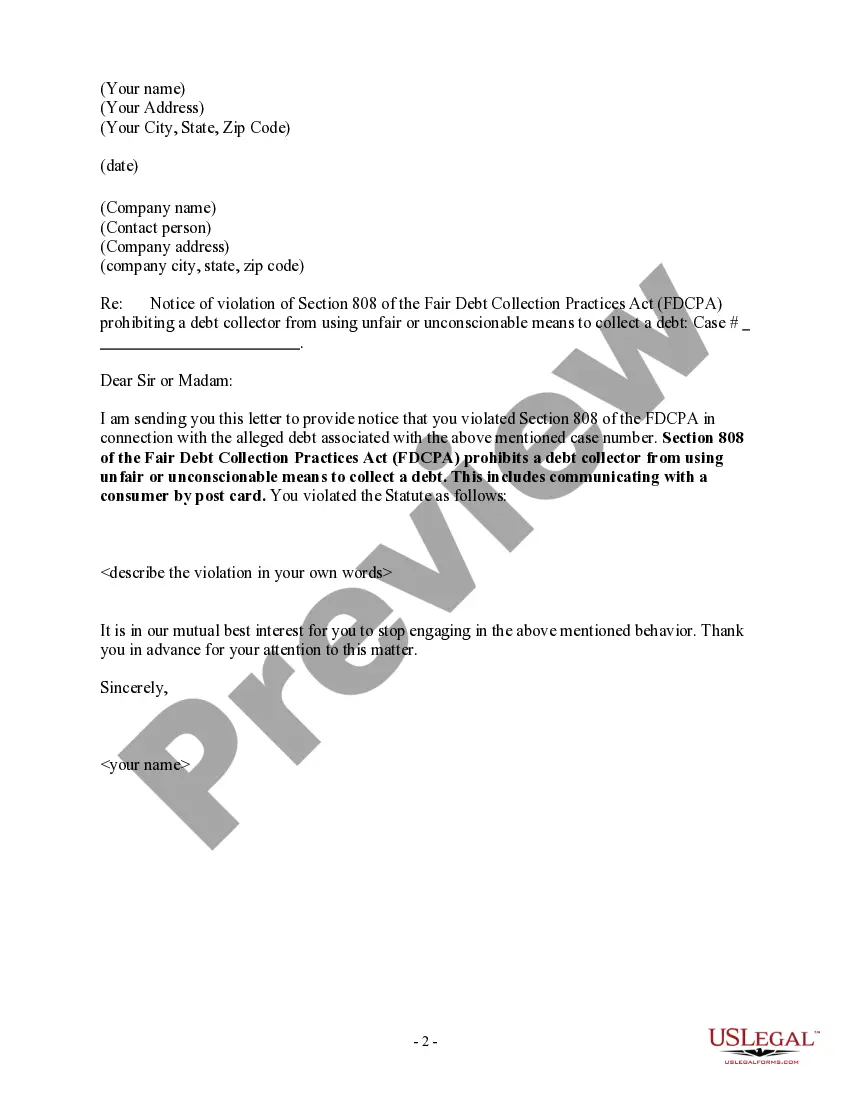

How to fill out Washington Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

US Legal Forms - among the greatest libraries of legitimate types in the United States - delivers a variety of legitimate document themes you are able to down load or produce. Using the web site, you can get 1000s of types for business and person functions, sorted by groups, says, or keywords.You can get the most recent variations of types much like the Washington Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard in seconds.

If you already possess a membership, log in and down load Washington Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard through the US Legal Forms local library. The Down load option can look on each kind you see. You gain access to all formerly delivered electronically types from the My Forms tab of your own profile.

If you want to use US Legal Forms initially, listed here are easy instructions to get you began:

- Be sure to have picked out the right kind for your personal city/county. Click the Preview option to review the form`s information. See the kind outline to ensure that you have selected the appropriate kind.

- In the event the kind does not match your specifications, take advantage of the Research area on top of the screen to discover the one that does.

- Should you be happy with the form, validate your decision by clicking on the Get now option. Then, select the rates program you favor and give your references to sign up to have an profile.

- Process the financial transaction. Make use of charge card or PayPal profile to finish the financial transaction.

- Select the formatting and down load the form on your system.

- Make changes. Fill up, change and produce and indication the delivered electronically Washington Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Every template you included in your bank account does not have an expiry time and is also your own property for a long time. So, if you would like down load or produce yet another copy, just proceed to the My Forms area and click in the kind you want.

Obtain access to the Washington Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard with US Legal Forms, the most extensive local library of legitimate document themes. Use 1000s of expert and condition-particular themes that satisfy your small business or person demands and specifications.

Form popularity

FAQ

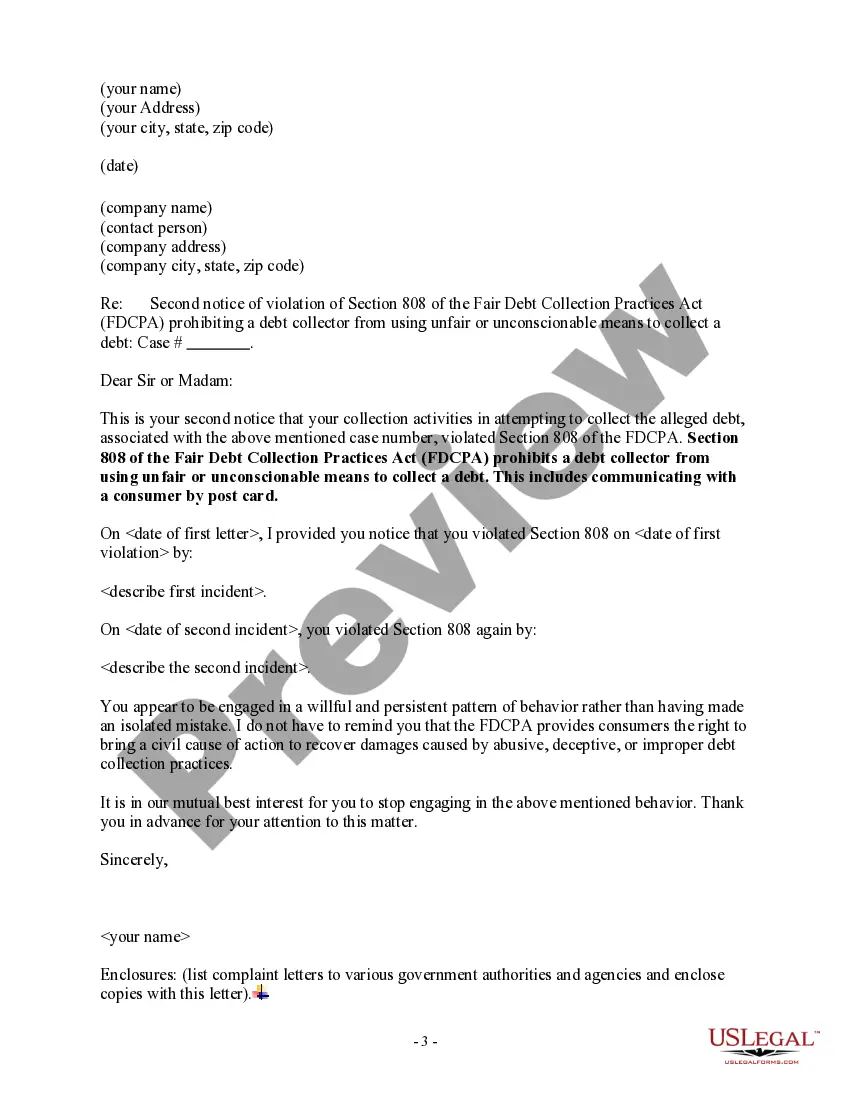

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Debt collectors are not permitted to try to publicly shame you into paying money that you may or may not owe. In fact, they're not even allowed to contact you by postcard. They cannot publish the names of people who owe money. They can't even discuss the matter with anyone other than you, your spouse, or your attorney.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.