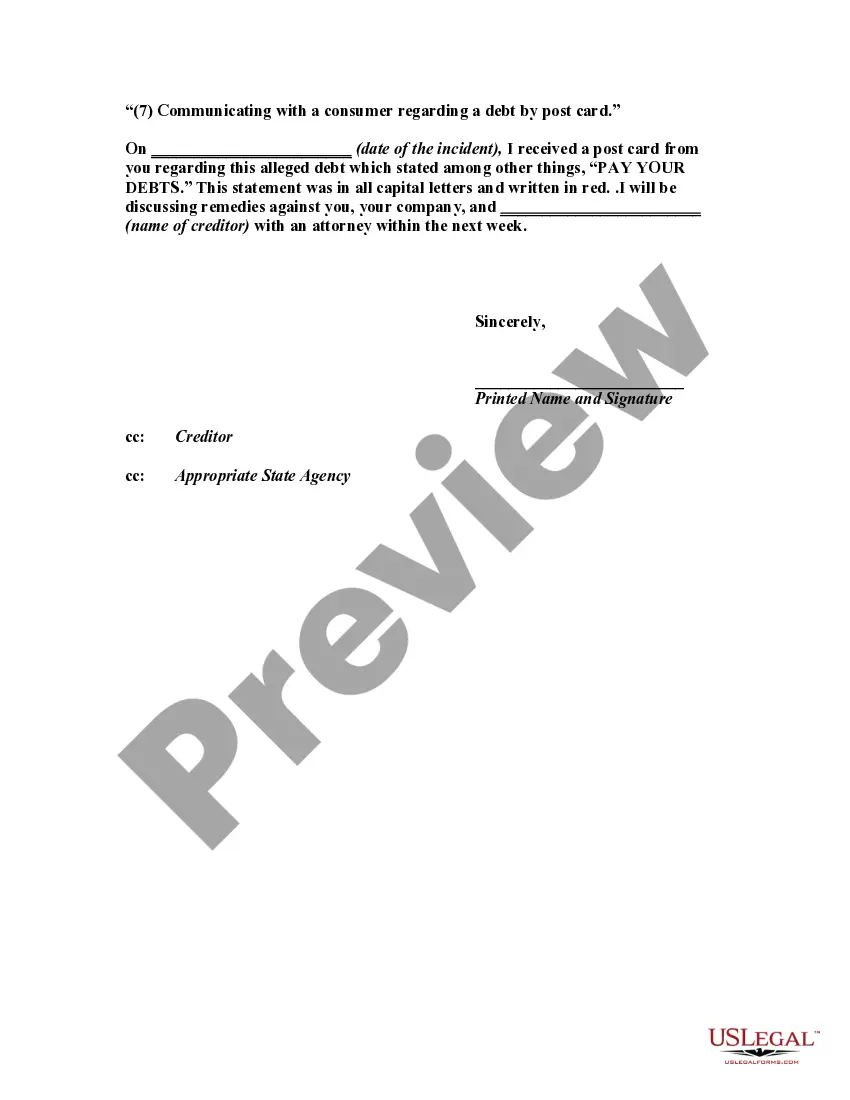

Choosing the right legal papers design might be a struggle. Naturally, there are plenty of web templates accessible on the Internet, but how would you discover the legal kind you want? Utilize the US Legal Forms web site. The support gives thousands of web templates, including the Washington Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card, that can be used for organization and personal demands. Every one of the varieties are inspected by experts and fulfill federal and state demands.

In case you are currently listed, log in for your profile and click the Download button to find the Washington Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card. Utilize your profile to search from the legal varieties you may have ordered in the past. Visit the My Forms tab of your respective profile and obtain one more duplicate from the papers you want.

In case you are a fresh end user of US Legal Forms, listed below are simple instructions so that you can comply with:

- Initially, make sure you have selected the appropriate kind for your personal metropolis/area. It is possible to look over the form using the Review button and look at the form outline to make sure this is the best for you.

- In case the kind does not fulfill your expectations, utilize the Seach field to obtain the proper kind.

- Once you are certain the form is acceptable, click the Buy now button to find the kind.

- Opt for the rates program you want and type in the needed information. Design your profile and purchase your order making use of your PayPal profile or Visa or Mastercard.

- Select the submit formatting and obtain the legal papers design for your device.

- Full, edit and produce and indication the acquired Washington Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card.

US Legal Forms is the biggest catalogue of legal varieties that you can find various papers web templates. Utilize the company to obtain skillfully-made files that comply with express demands.

Credit card debt comprises a large majority of the debt that debt buyerscommunicating with a consumer regarding a debt by postcard; ... Learn about common debt problems, including filing for bankruptcy. On This Page. Credit Counseling Services; Debt Collection; Personal ...Handling Debt Collection Phone Calls · The caller's name. · The name of the collection agency that the collector is calling on behalf of. · An address at which you ... The Fair Debt Collection Practices Act (FDCPA),. 15 U.S.C. 1692 et seq., imposes various requirements on ?a debt collector in ... The Federal Fair Debt Collection Practices Act (FDCPA)personal consumer debt, such as medical bills, auto loans, and credit card debt. The proposal focuses on debt collection communications and disclosures andcommunicating with a consumer regarding a debt by postcard; ... (1) Communicate with a consumer regarding a debt by postcard. (2) Use any language or symbol, other than the debt collector's address, on any envelope when ... Debt claims grew to dominate state civil court dockets in recent decades. From 1993 to 2013, the number of debt collection suits more than ... The Consumer Financial Protection Bureau released the first part of final rules on permissible communications in connection with the ... Learn about the Fair Debt Collection Practices Act (FDCPA). Our Chicago FDCPA lawyers may be able to help defend the claims against you & assert your ...