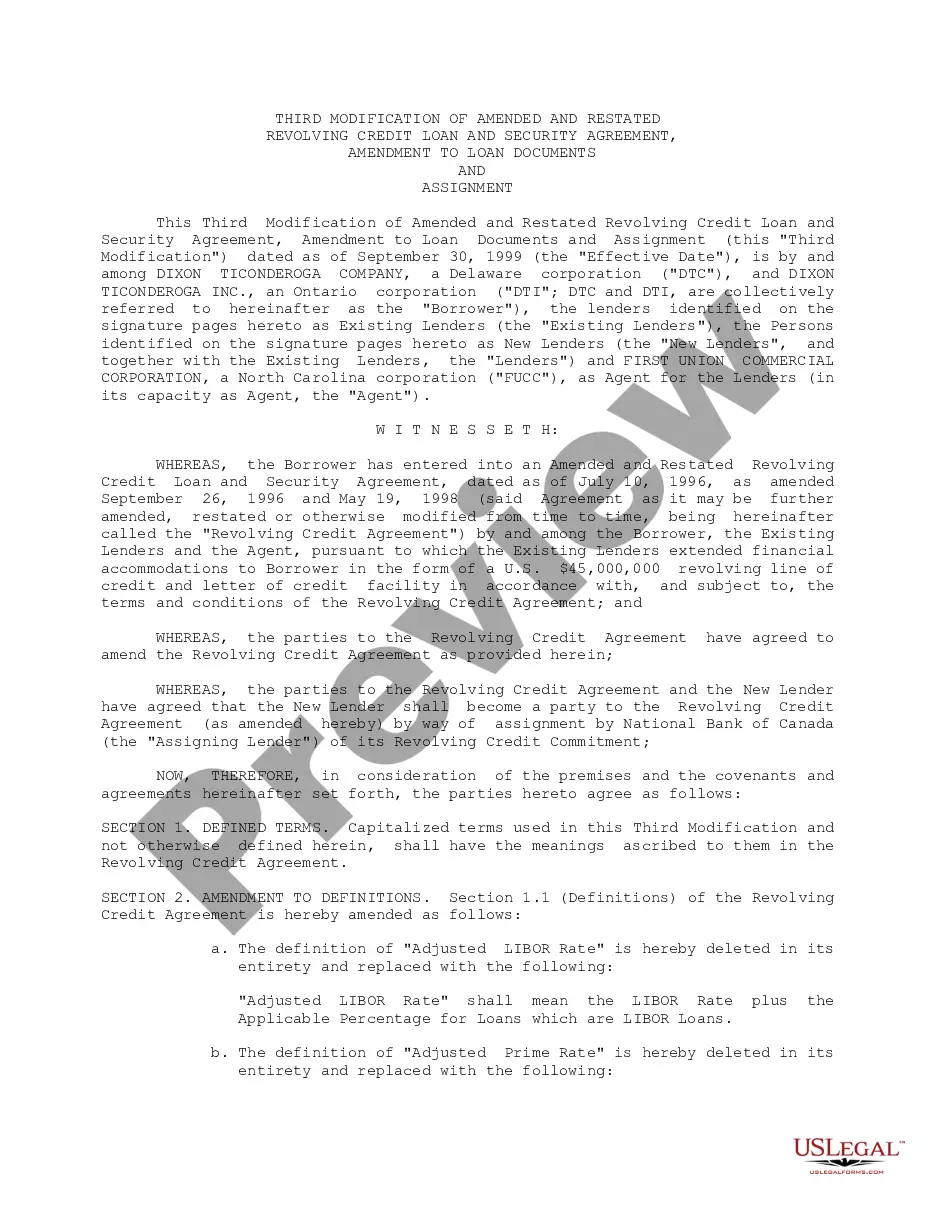

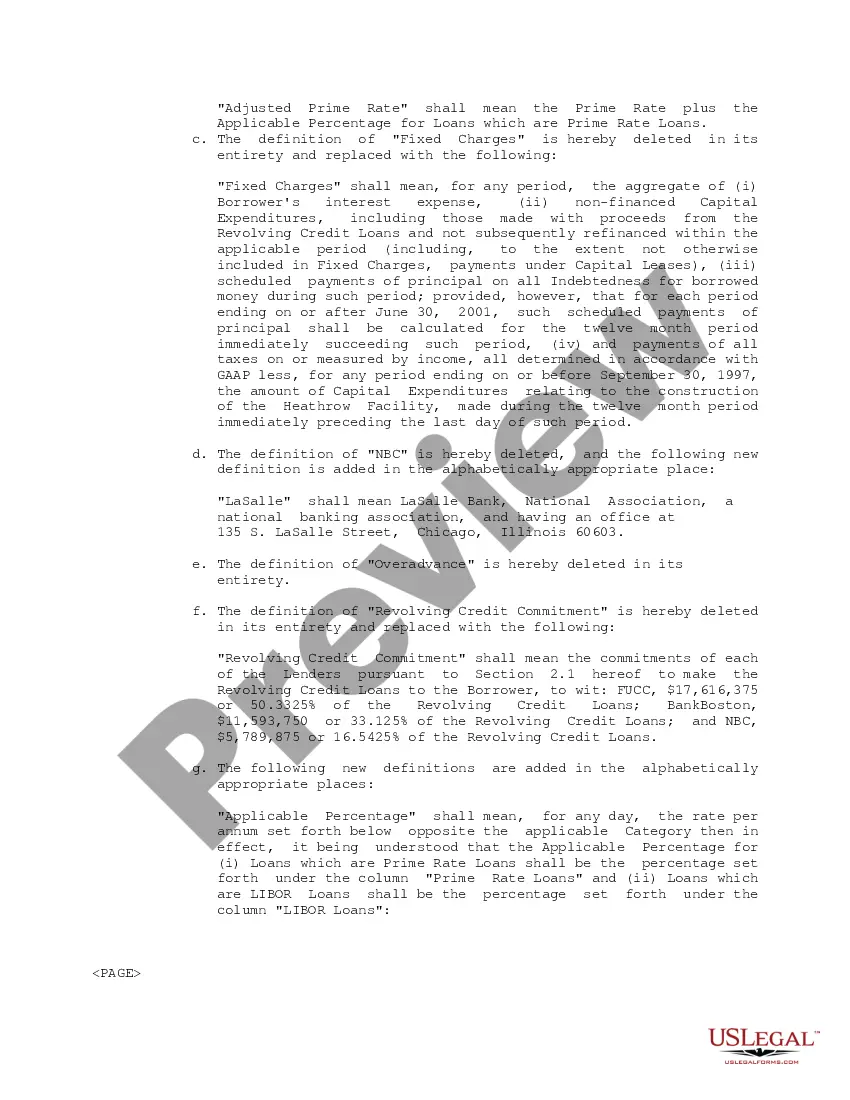

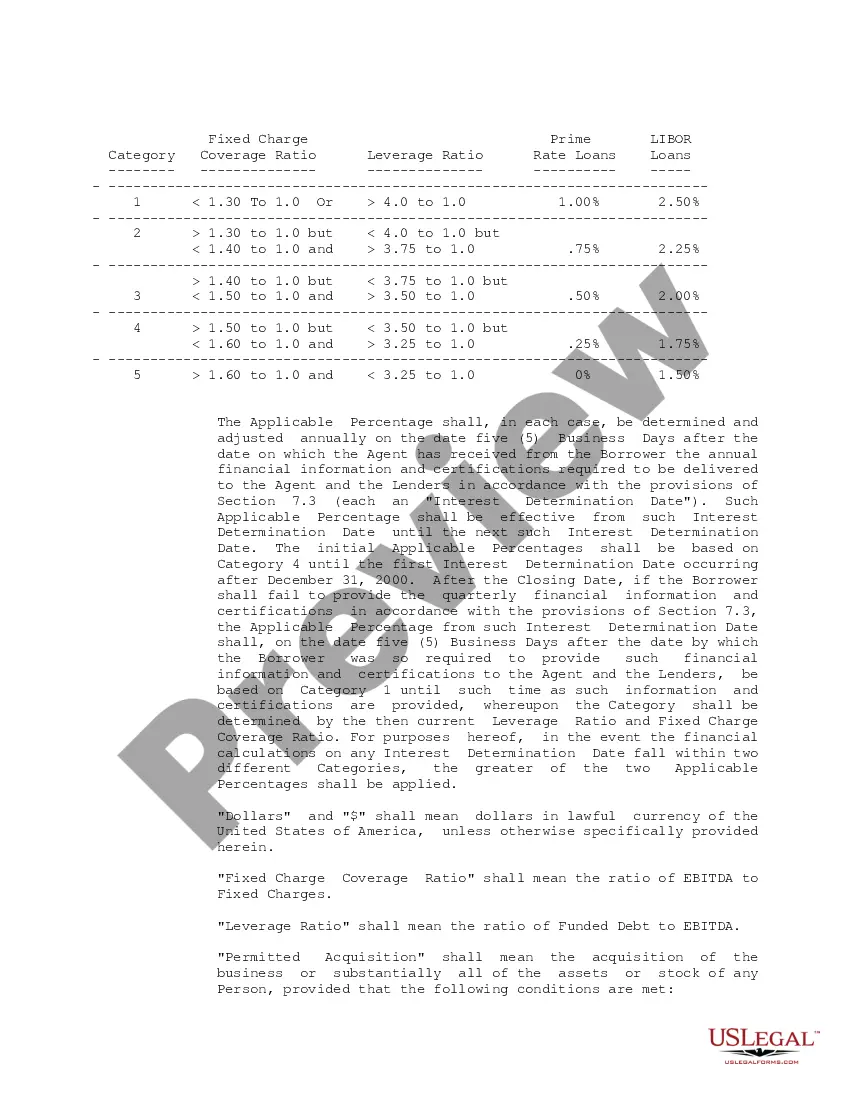

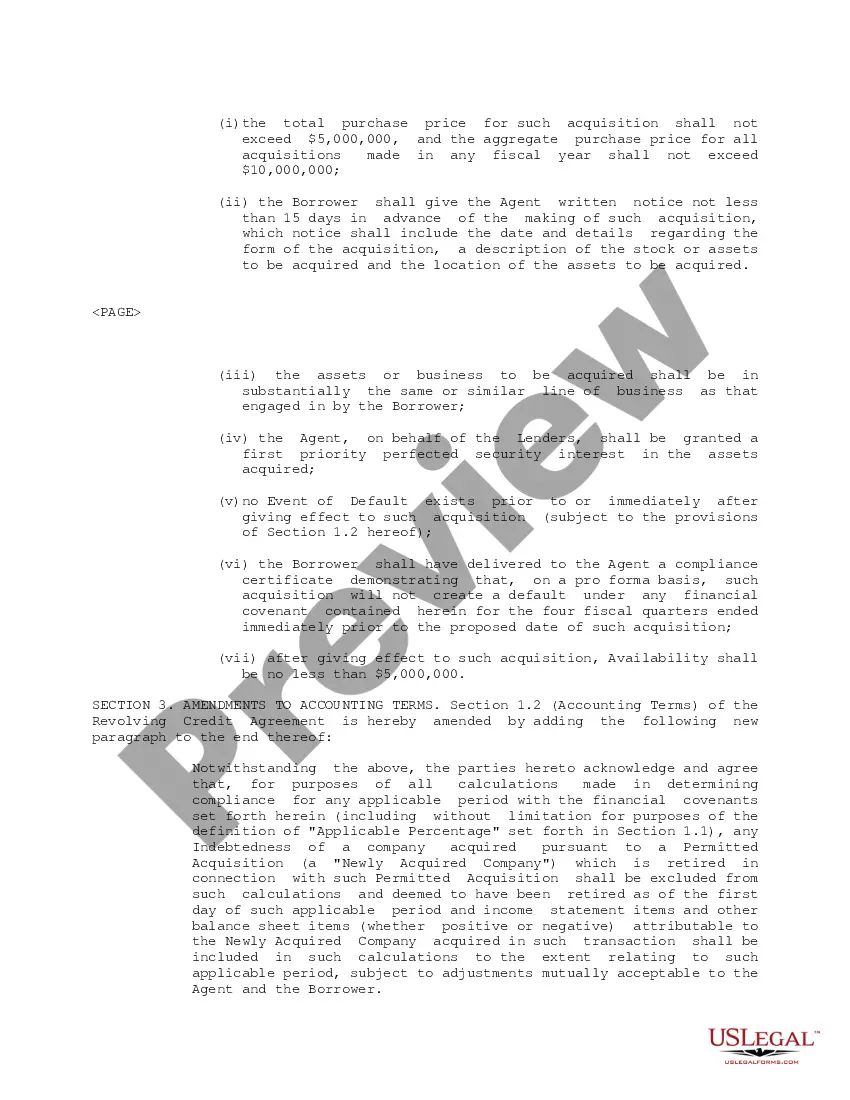

The Washington Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. is a legally binding document that outlines the terms and conditions associated with a revolving credit loan arrangement and the security provided by the parties involved. The main purpose of this agreement is to establish a revolving credit facility, allowing Dixon Ticonderoga, Inc. to borrow funds from Dixon Ticonderoga Co. on an ongoing basis, up to a specified limit. This type of loan is commonly used by businesses to manage their working capital needs, as it provides them with access to funds whenever necessary. The agreement specifies the terms of the loan, including the interest rate, repayment schedule, and any associated fees or charges. It also outlines the conditions under which the loan can be borrowed, such as the purpose for which the funds can be used and any limitations or restrictions imposed by the lender. To secure the loan, Dixon Ticonderoga Co. may require Dixon Ticonderoga, Inc. to provide collateral or guarantees. This collateral could include assets such as inventory, accounts receivable, or even real estate owned by the company. By providing security, Dixon Ticonderoga Co. can mitigate the risk of lending money and ensure that there are assets available to recover the loan in case of default. There may be different types or variations of the Washington Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc., depending on the specific requirements and circumstances of the parties involved. Some possible variations could include: 1. Traditional Revolving Credit Agreement: This is the standard form of revolving credit loan agreement, where Dixon Ticonderoga, Inc. can borrow funds up to a preset limit and repay them as per the agreed terms. 2. Asset-Based Revolving Credit Agreement: In this type of agreement, the collateral provided by Dixon Ticonderoga, Inc. is primarily based on its assets, such as accounts receivable or inventory. The borrowing capacity may be determined by the value of these assets. 3. Non-Recourse Revolving Credit Agreement: In certain cases, the lender may agree not to hold Dixon Ticonderoga, Inc. personally liable for the repayment of the loan but instead limits their recourse to the specified collateral. This provides an extra layer of protection for the borrower. 4. Revolving Credit Agreement with Over-Advance Option: This type of agreement may allow Dixon Ticonderoga, Inc. to borrow even beyond the specified credit limit, subject to certain conditions and additional fees. This provides flexibility to the borrower in case of unexpected or temporary cash flow needs. Each of these variations may have its own specific terms and conditions, which would be detailed within the agreement. It is crucial for both parties involved to carefully review and understand the terms before entering into such an agreement. Additionally, legal advice may be sought to ensure compliance with Washington state laws and regulations.

Washington Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.

Description

How to fill out Washington Revolving Credit Loan And Security Agreement Between Dixon Ticonderoga Co. And Dixon Ticonderoga, Inc.?

It is possible to spend time on the Internet looking for the legitimate record format that fits the state and federal specifications you will need. US Legal Forms provides 1000s of legitimate forms that happen to be reviewed by experts. You can actually obtain or produce the Washington Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. from our support.

If you already have a US Legal Forms bank account, you are able to log in and then click the Acquire switch. Afterward, you are able to complete, edit, produce, or indication the Washington Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.. Each legitimate record format you purchase is yours permanently. To acquire another copy associated with a bought type, check out the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site the very first time, keep to the straightforward instructions listed below:

- First, ensure that you have selected the proper record format for that region/area that you pick. Look at the type information to make sure you have selected the appropriate type. If offered, make use of the Preview switch to check from the record format also.

- If you wish to find another version of your type, make use of the Search area to get the format that meets your needs and specifications.

- Upon having found the format you would like, simply click Buy now to continue.

- Select the costs plan you would like, type your references, and register for an account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal bank account to cover the legitimate type.

- Select the formatting of your record and obtain it to the gadget.

- Make alterations to the record if necessary. It is possible to complete, edit and indication and produce Washington Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc..

Acquire and produce 1000s of record layouts utilizing the US Legal Forms web site, which offers the largest collection of legitimate forms. Use specialist and state-certain layouts to take on your small business or personal requirements.