Washington Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage

Description

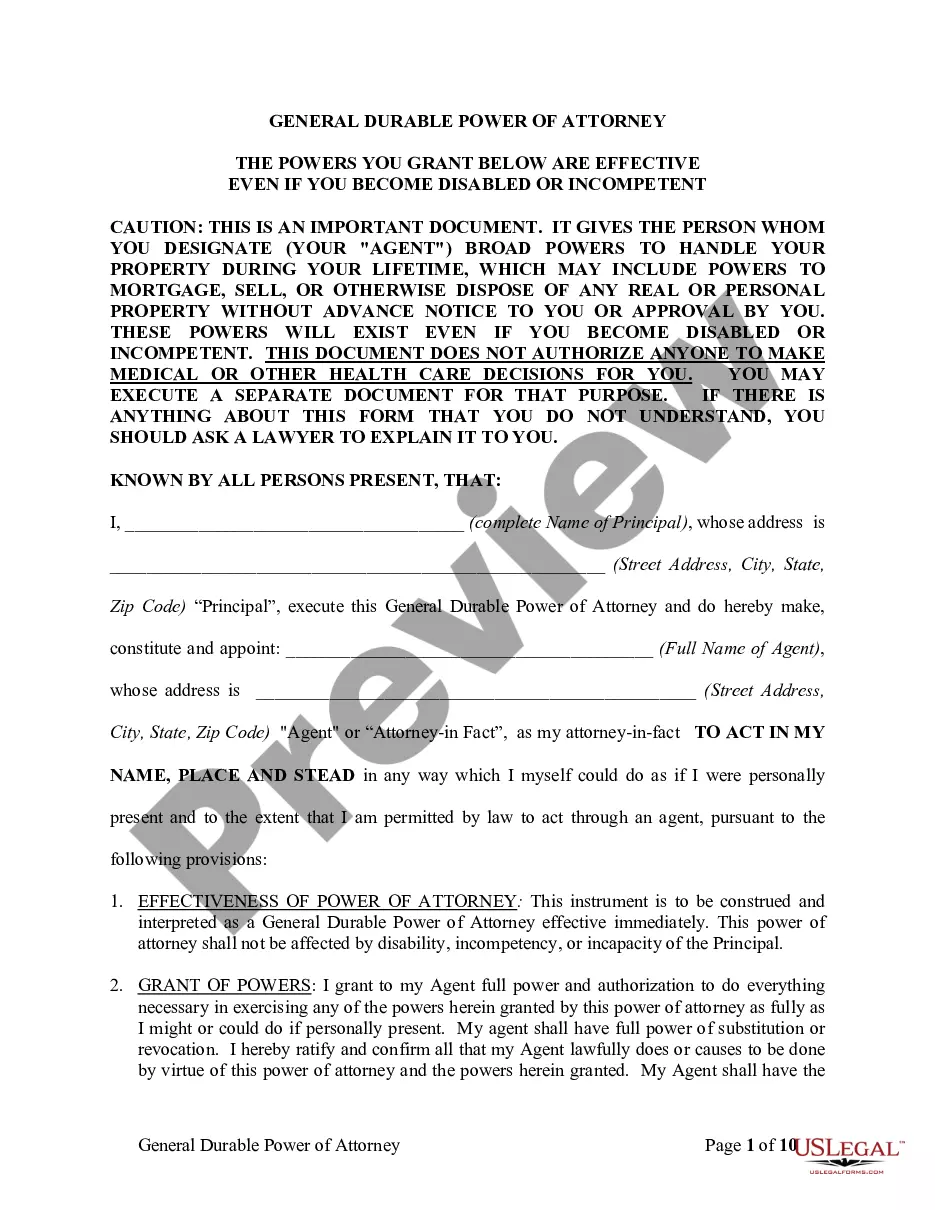

How to fill out Sample Subsequent Mortgage Loan Purchase Agreement Of Ameriquest Mortgage?

US Legal Forms - one of several largest libraries of legal kinds in the United States - offers a wide array of legal file web templates you are able to obtain or print. While using website, you can get a large number of kinds for business and person reasons, categorized by groups, says, or keywords and phrases.You will discover the newest variations of kinds like the Washington Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage within minutes.

If you currently have a membership, log in and obtain Washington Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage from the US Legal Forms catalogue. The Down load button will show up on every kind you perspective. You have accessibility to all formerly delivered electronically kinds within the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed here are easy instructions to help you began:

- Be sure you have picked out the correct kind for the area/county. Click the Preview button to check the form`s content. Browse the kind outline to actually have chosen the proper kind.

- When the kind does not satisfy your needs, take advantage of the Search area towards the top of the monitor to find the one that does.

- If you are happy with the shape, affirm your choice by visiting the Get now button. Then, pick the costs prepare you prefer and provide your accreditations to register to have an bank account.

- Procedure the deal. Use your bank card or PayPal bank account to finish the deal.

- Select the formatting and obtain the shape on your own system.

- Make modifications. Fill up, modify and print and indication the delivered electronically Washington Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage.

Every template you included with your money does not have an expiry particular date and is also the one you have forever. So, if you wish to obtain or print an additional backup, just check out the My Forms area and click on around the kind you will need.

Obtain access to the Washington Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage with US Legal Forms, probably the most substantial catalogue of legal file web templates. Use a large number of skilled and status-distinct web templates that fulfill your business or person needs and needs.

Form popularity

FAQ

On September 9, 2007, Argent Mortgage was sold to Citi for an undisclosed amount. Argent was renamed Citi Residential Lending. Citi Residential Lending operated for several months before it was shut down. On September 10, 2007, Ameriquest stopped accepting loan applications.

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

The "lender" is the financial institution that loaned you the money. The lender owns the loan and is also called the "note holder" or "holder." Sometime later, the lender might sell the mortgage debt to another entity, which then becomes the new loan owner (holder).

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.

A loan purchase agreement is an agreement between a lender and borrower that states how a secured financial asset, such as real estate or equipment, will be purchased. The buyer of this type of security agrees to buy the asset at some point for an agreed-upon price.