The Washington Master Agreement between Credit Suisse Financial Products and Bank One National Association is a legally binding contract that outlines the terms and conditions governing their financial relationship. This agreement serves as a framework for various transactions and sets forth the rights and responsibilities of both parties. The Washington Master Agreement is specifically designed to facilitate transactions such as derivatives, swaps, options, and other financial instruments. It ensures that both Credit Suisse Financial Products and Bank One National Association are operating within a secure and mutually beneficial environment. This agreement consists of several key sections that cover various aspects of the parties' relationship. These sections include: 1. Definitions: This section establishes the meanings of key terms used throughout the agreement, ensuring clarity and consistency in its interpretation. 2. Transaction Confirmations: The Washington Master Agreement allows for the execution of multiple transactions between the parties. Each transaction is confirmed and recorded separately, highlighting the specifics of the financial instrument, pricing, settlement terms, and other relevant details. 3. Payments and Deliveries: This section outlines the process and deadlines for making payments and delivering underlying assets related to the transactions. It includes provisions for calculating interest, penalties for late payments, and the respective responsibilities of both parties. 4. Representations and Warranties: Both Credit Suisse Financial Products and Bank One National Association must provide accurate and truthful representations of their financial standing and legal capacity to enter into the agreement effectively. 5. Rights and Obligations: This section determines the rights and obligations of both parties throughout the term of the agreement. It covers issues such as performance obligations, confidentiality, and dispute resolution. 6. Termination: The Washington Master Agreement allows for termination under specific circumstances, such as insolvency or breach of contract. It sets forth the procedure for termination and any associated consequences. 7. Governing Law and Jurisdiction: This section establishes that the agreement will be governed by the laws of the state of Washington. It also specifies the jurisdiction and venue for resolving any disputes that may arise. Different types of Washington Master Agreement between Credit Suisse Financial Products and Bank One National Association may exist to accommodate specific types of transactions or financial products. For example, there could be agreements tailored for interest rate swaps, credit default swaps, commodity derivatives, or currency options. These variations would include specific terms, definitions, and provisions relevant to the particular type of transaction. In summary, the Washington Master Agreement between Credit Suisse Financial Products and Bank One National Association is a comprehensive contract that ensures a secure and defined framework for their financial dealings. It covers various aspects of their relationship, including transaction confirmations, payments and deliveries, representations and warranties, rights and obligations, termination, and the governing law. Different types of this agreement may exist to address specific financial instruments or transactions.

Washington Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

How to fill out Washington Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

Discovering the right legal file format can be quite a have difficulties. Of course, there are plenty of layouts available online, but how do you discover the legal form you will need? Make use of the US Legal Forms web site. The assistance offers a large number of layouts, like the Washington Master Agreement between Credit Suisse Financial Products and Bank One National Association, that can be used for enterprise and personal needs. Every one of the types are examined by pros and meet state and federal needs.

When you are presently signed up, log in to your accounts and then click the Obtain switch to get the Washington Master Agreement between Credit Suisse Financial Products and Bank One National Association. Use your accounts to search throughout the legal types you possess ordered earlier. Check out the My Forms tab of your respective accounts and have one more version of the file you will need.

When you are a fresh user of US Legal Forms, allow me to share basic guidelines for you to comply with:

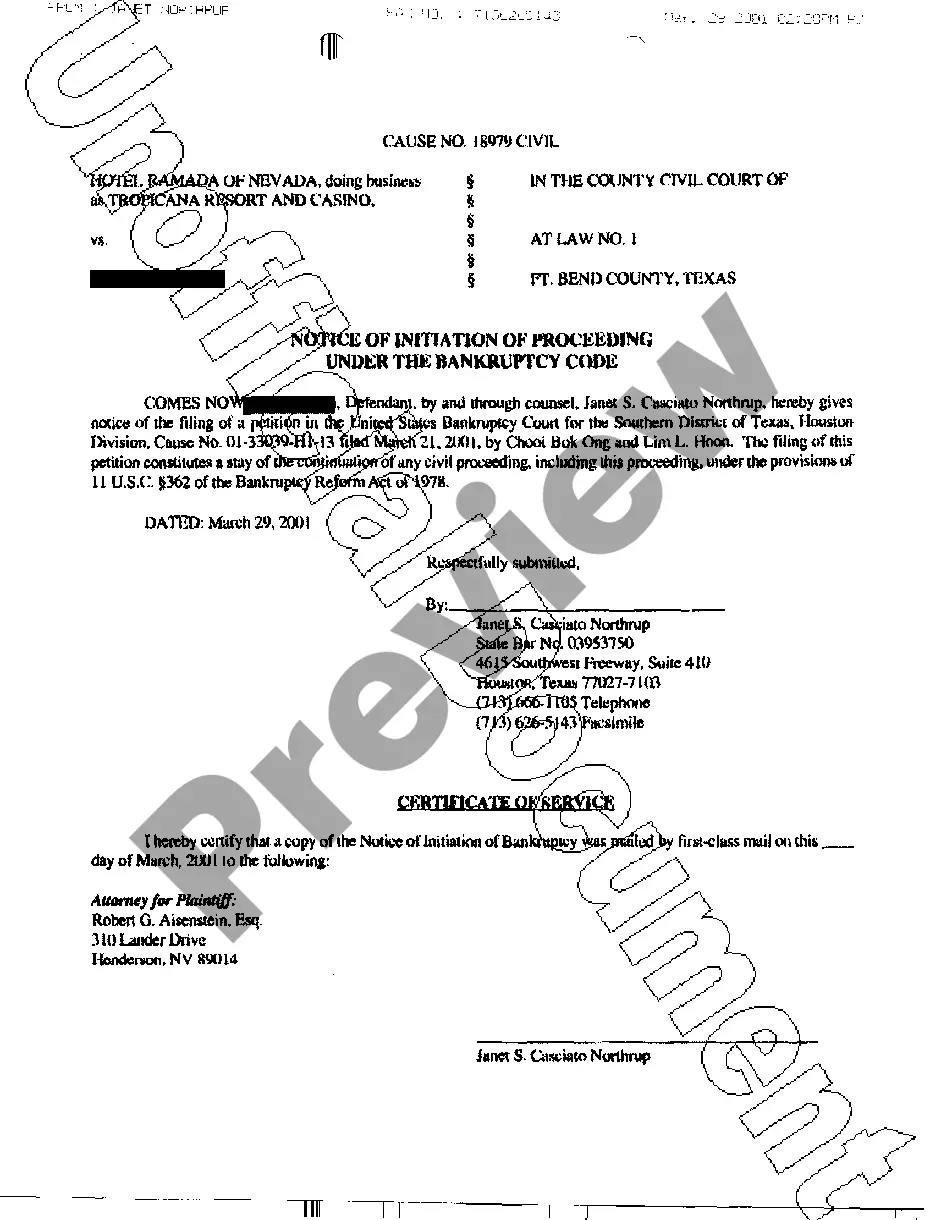

- First, make certain you have selected the correct form for your personal metropolis/region. You are able to examine the form making use of the Review switch and look at the form explanation to make certain it will be the right one for you.

- In case the form is not going to meet your preferences, utilize the Seach industry to discover the appropriate form.

- When you are certain the form would work, select the Buy now switch to get the form.

- Select the costs strategy you want and type in the necessary details. Design your accounts and pay money for the order using your PayPal accounts or bank card.

- Opt for the file format and acquire the legal file format to your system.

- Total, revise and printing and sign the obtained Washington Master Agreement between Credit Suisse Financial Products and Bank One National Association.

US Legal Forms is the greatest collection of legal types for which you can discover various file layouts. Make use of the service to acquire expertly-produced documents that comply with status needs.