Title: Understanding the Washington Underwriting Agreement: Advance Equipment Receivable Series LLC and Advance Bank Corporation Keywords: Washington Underwriting Agreement, Advance Equipment Receivable Series LLC, Advance Bank Corporation, types, detailed description Introduction: The Washington Underwriting Agreement plays a crucial role in ensuring a secure and transparent transaction between Advance Equipment Receivable Series LLC (AER) and Advance Bank Corporation (ABC). This comprehensive agreement establishes the terms and conditions under which ABC, as the underwriter, will purchase equipment receivables originated by AER. Let's explore the key aspects of this agreement and shed light on potential variations in its types. 1. Purpose of the Washington Underwriting Agreement: The primary objective of the Washington Underwriting Agreement is to solidify the relationship between AER and ABC, ensuring smooth financing operations. It sets forth the terms, rights, responsibilities, and obligations of both parties involved in the purchase and sale of equipment receivables. 2. Key Elements of the Agreement: a. Terms and Conditions: The agreement outlines the rights and obligations of both AER and ABC, including purchase price, risk allocation, warranties, representations, and indemnification provisions. b. Payment Provisions: It defines the payment terms, including the timing and manner of payment, penalties for late payments, and potential events of default. c. Equipment Receivables: The agreement specifies the types of equipment receivables eligible for purchase by ABC, along with any exclusions or limitations. d. Representations and Warranties: Both parties provide assurances regarding the accuracy of information, compliance with laws and regulations, and the absence of undisclosed liabilities or adverse events. e. Indemnification: The agreement outlines the indemnification process, wherein parties compensate each other for any losses, damages, or liabilities arising from breaches of the agreement. 3. Types of Washington Underwriting Agreement: While there might be variations based on specific circumstances, two notable types of Washington Underwriting Agreements can exist between AER and ABC: a. Uncommitted Underwriting Agreement: In this type, ABC has discretion over purchasing equipment receivables from AER. The agreement does not guarantee ABC's obligation to purchase any specific receivables and provides flexibility for ABC to select on a case-by-case basis. b. Committed Underwriting Agreement: Unlike the uncommitted type, this agreement obligates ABC to purchase a predetermined amount or volume of equipment receivables from AER over a specified term. This type provides greater certainty for AER but imposes a stronger commitment on ABC's part. Conclusion: The Washington Underwriting Agreement between Advance Equipment Receivable Series LLC and Advance Bank Corporation serves as a vital framework for their financing operations. By accurately defining the terms, obligations, and rights of both parties, this agreement ensures a transparent and secure transaction process. While two primary types, uncommitted and committed, exist, each agreement may have specific variations depending on the circumstances and needs of AER and ABC.

Washington Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation

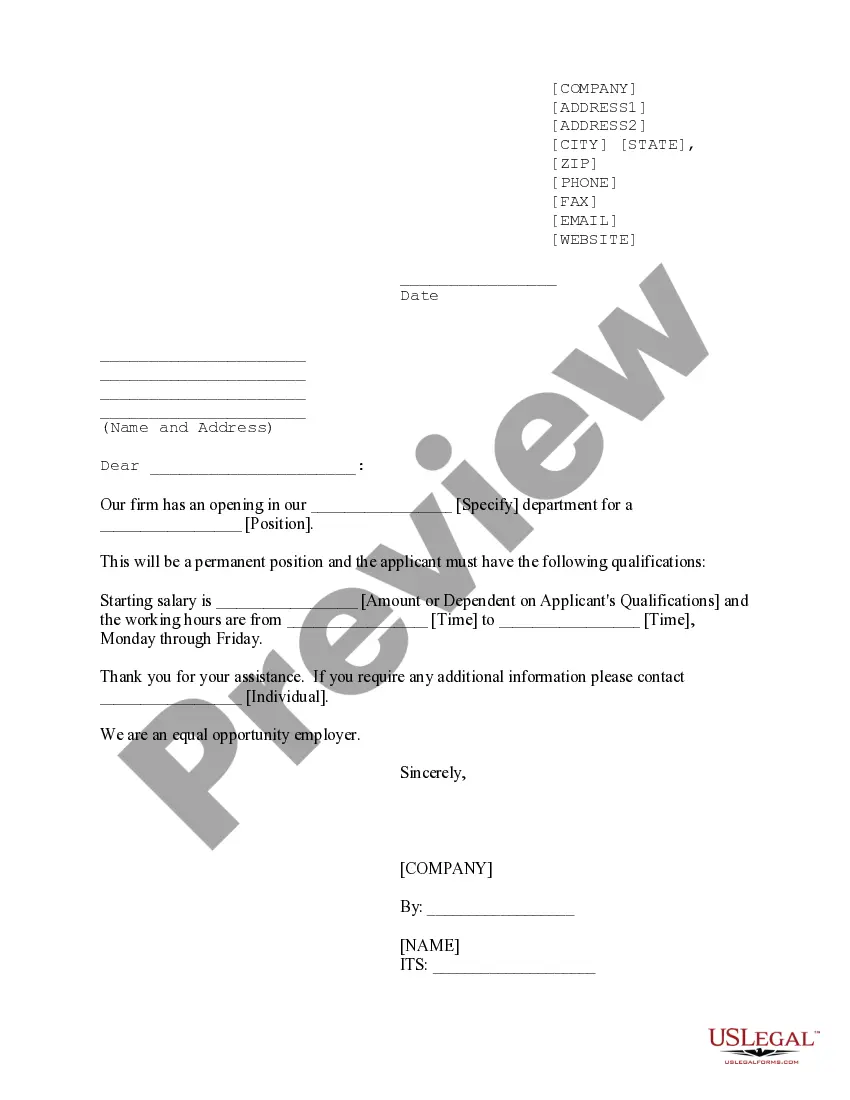

Description

How to fill out Washington Underwriting Agreement Between Advanta Equipment Receivable Series LLC And Advanta Bank Corporation?

Are you presently inside a place in which you will need documents for either enterprise or individual functions almost every day time? There are tons of legitimate papers layouts available online, but getting kinds you can depend on isn`t simple. US Legal Forms gives a huge number of kind layouts, such as the Washington Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation, which can be created to meet state and federal needs.

When you are presently familiar with US Legal Forms site and also have a merchant account, basically log in. Next, it is possible to download the Washington Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation format.

If you do not provide an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is for your appropriate city/state.

- Take advantage of the Review button to check the shape.

- See the information to actually have chosen the appropriate kind.

- When the kind isn`t what you`re trying to find, use the Search area to discover the kind that meets your needs and needs.

- Once you discover the appropriate kind, click on Acquire now.

- Opt for the rates plan you need, fill in the desired information and facts to produce your bank account, and buy an order making use of your PayPal or Visa or Mastercard.

- Choose a convenient file formatting and download your copy.

Get each of the papers layouts you might have bought in the My Forms food selection. You can aquire a more copy of Washington Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation any time, if needed. Just click the required kind to download or print the papers format.

Use US Legal Forms, by far the most extensive variety of legitimate types, to save some time and avoid faults. The assistance gives skillfully produced legitimate papers layouts that you can use for an array of functions. Produce a merchant account on US Legal Forms and start making your daily life easier.