Washington Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

Description

How to fill out Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

US Legal Forms - one of many biggest libraries of legitimate varieties in America - gives an array of legitimate record themes it is possible to down load or produce. Utilizing the website, you can find a huge number of varieties for enterprise and personal purposes, categorized by classes, suggests, or key phrases.You will find the most up-to-date types of varieties like the Washington Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. in seconds.

If you currently have a monthly subscription, log in and down load Washington Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. through the US Legal Forms catalogue. The Down load button can look on each type you view. You get access to all formerly delivered electronically varieties from the My Forms tab of your accounts.

If you want to use US Legal Forms the very first time, listed here are straightforward directions to help you started out:

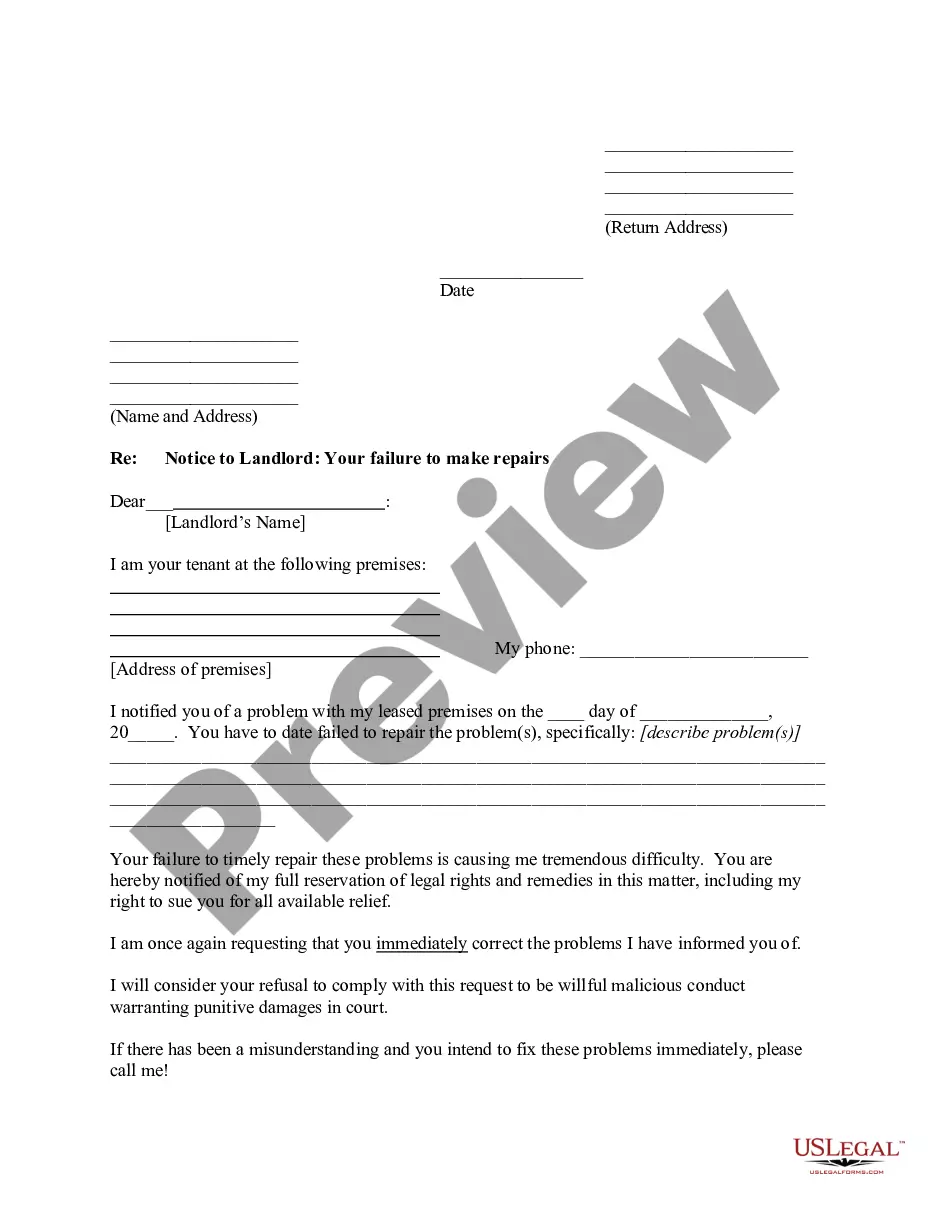

- Make sure you have chosen the right type for the metropolis/county. Click on the Review button to analyze the form`s articles. Read the type explanation to actually have chosen the right type.

- In case the type does not fit your demands, make use of the Search field near the top of the screen to obtain the one that does.

- If you are pleased with the shape, affirm your option by visiting the Get now button. Then, choose the costs plan you like and give your credentials to register for an accounts.

- Process the financial transaction. Make use of bank card or PayPal accounts to finish the financial transaction.

- Choose the format and down load the shape on your product.

- Make adjustments. Fill up, edit and produce and signal the delivered electronically Washington Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc..

Every format you added to your bank account lacks an expiry date and is your own property eternally. So, if you want to down load or produce yet another backup, just go to the My Forms area and then click in the type you want.

Obtain access to the Washington Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. with US Legal Forms, probably the most considerable catalogue of legitimate record themes. Use a huge number of professional and condition-distinct themes that meet your company or personal needs and demands.

Form popularity

FAQ

Canadian Investment advisors have earned a college degree in business, finance, economics, or a related field such as accounting. Post secondary education is a vital component to success in this industry, as even being considered for employment requires a strong educational background.

This is called the 15(c) process, named after the section of the Investment Company Act of 1940 (1940 Act) that requires a majority of a fund's independent directors to annually approve the fund's advisory contract at an in-person meeting called for that purpose.

Advisers to business development companies, when the adviser has at least $25 million of RAUM, must register with the SEC. Certain internet advisers who provide advice through an interactive website may register with the SEC.

This agreement is meant to be a blueprint of sorts for you as the client because it spells out both what the financial advisor will do you for you, such as provide general advice or recommend specific investment moves for your portfolio, as well as what your responsibilities are.

They provide clear guidelines of what is expected of each party in order for your needs to be met. Investment advisory agreements typically include terms related to the advisors fee structure, investment methodology, level of risk a client is willing to take, and more.

Ing to the U.S. Investment Advisers Act of 1940, an investment advisor is a person or firm that provides advice to others or issues securities reports or analyses for compensation. U.S. Securities and Exchange Commission.

To become a Registered Investment Advisor you must at a minimum pass the Series 65 exam administered by the Financial Industry Regulatory Authority (FINRA). Once you've passed the series 65 you must register with the Securities and Exchange Commission (SEC) or with state regulatory agencies.

The SEBI (Investment Advisers) Regulations, 2013 (?IA Regulations?) have been notified on January 21, 2013. The IA Regulations came into effect from April 21, 2013.