Washington Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company

Description

How to fill out Distribution Agreement Between First American Insurance Portfolios, Inc. And SEI Financial Services Company?

Finding the right authorized papers web template can be quite a have difficulties. Naturally, there are tons of layouts available on the Internet, but how will you find the authorized develop you need? Make use of the US Legal Forms internet site. The services gives a large number of layouts, including the Washington Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company, which you can use for business and private requirements. Each of the kinds are examined by experts and meet up with federal and state demands.

If you are already signed up, log in to the profile and click on the Download switch to get the Washington Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company. Make use of your profile to check throughout the authorized kinds you may have ordered in the past. Proceed to the My Forms tab of your own profile and acquire one more copy of the papers you need.

If you are a new end user of US Legal Forms, here are basic recommendations so that you can comply with:

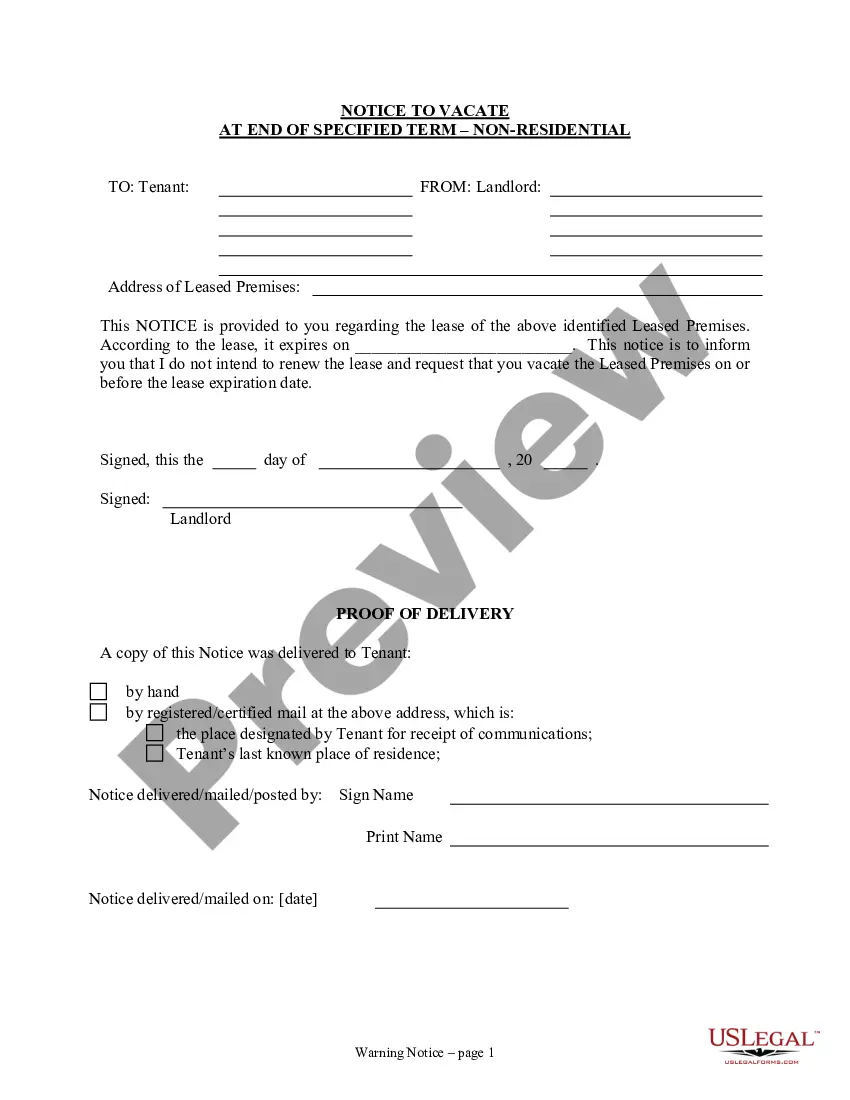

- First, make certain you have chosen the proper develop to your town/county. You may look through the shape making use of the Preview switch and read the shape explanation to ensure this is the right one for you.

- When the develop fails to meet up with your preferences, make use of the Seach area to discover the appropriate develop.

- Once you are certain the shape is acceptable, click on the Purchase now switch to get the develop.

- Opt for the prices strategy you want and enter the needed information and facts. Build your profile and pay for an order using your PayPal profile or Visa or Mastercard.

- Choose the file structure and download the authorized papers web template to the device.

- Total, change and printing and sign the received Washington Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company.

US Legal Forms is the greatest library of authorized kinds where you can discover a variety of papers layouts. Make use of the company to download skillfully-produced files that comply with condition demands.